The system is broken.

Over the last 20 years, investing has become a “solved problem.” It is cheaper and easier than ever before to create a diversified portfolio and implement proven wealth building strategies. Yet many Americans are in worse shape financially than the previous generation.

This feels impossible. But it’s true – and can be proven by data.

Less than a third of Americans feel that they are on track to retire, and that number has declined sharply over the last several years.

The median retirement savings for an American household is just $87,000 – while the median home price is nearly $400,000.

25% of Americans have no retirement savings at all. Nearly half of non-retirees don’t have a 401(k).

This can only be described as a failure.

And the reason for this failure is perhaps hard to swallow: we are a financially illiterate country.

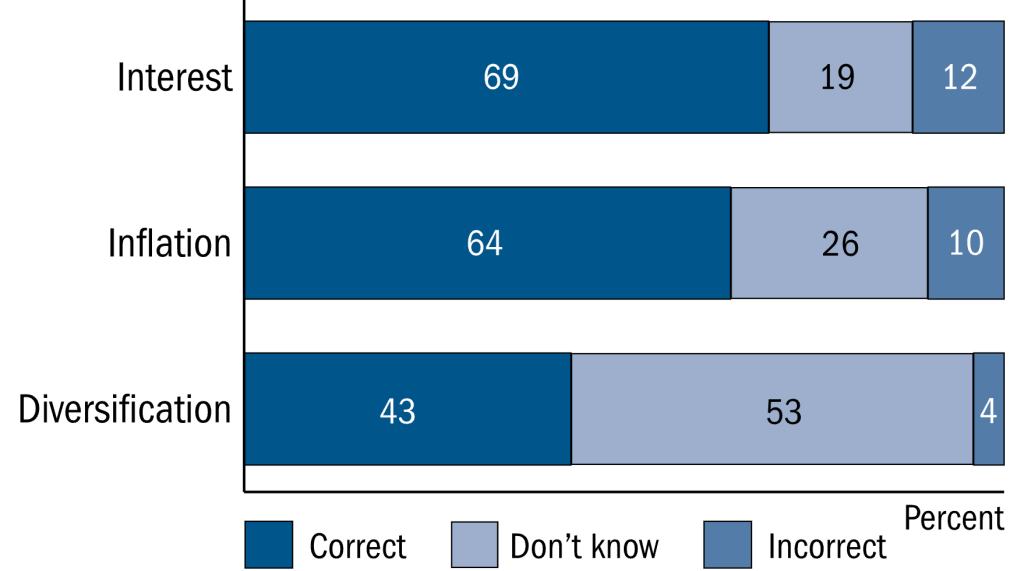

Technically, we get a D- in financial literacy. That’s according to an annual survey of Americans that asks three basic questions about interest, inflation, and diversification. The average response is 1.8 correct answers out of three – a grade of 60%. Just 34% of Americans get all three questions right.

Again, this feels like it should be impossible.

We put a man on the moon 50 years ago, but less than 50% of Americans can correctly answer this True/False question: “Buying a single company’s stock usually provides a safer return than a stock market mutual fund.”

Information is more widely available than ever before thanks to technological advancements that previous generations could never have imagined.

We have AI that can pass the CPA exam, but many Americans lack even a basic understanding of inflation.

Declaring A Crisis

This lack of financial literacy meets the two criteria that define a crisis: it is widespread, and it is devastating.

While the widespread nature of financial illiteracy is easy to quantify – as shown above – the devastating nature of this problem is best discerned through a qualitative lens… and a “big question.”

How many of our societal problems would be alleviated if we were to bring our financial literacy grade up from a D-… even to just a C+?

If you assume that greater financial literacy translates into higher levels of wealth…

Wouldn’t it also translate into better health? (The link between poor finances and poor physical health is hard to debate)

Wouldn’t it also translate into more stable families? (Again, the link between financial stability and divorce rates is well documented)

Research – and reason – indicate that financial struggles are tied to drug use, mental illness, and just about every other problem in our society today.

Considering all of this, it seems reasonable to at least ask: could improved financial literacy fundamentally change the trajectory of our society?