Estimated reading time: 7 minutes

Target Date index funds and ETFs are incredibly popular, with billions of dollars in total assets. The appeal of these products is probably obvious – the level of simplicity is tough to beat. The drawbacks of these products aren’t obvious, but they’re potentially significant.

In this article:

Benefits Of Target Date Funds

Target Date funds are the ultimate “one stop shop” for retirement planning. The premise is pretty straightforward: you pick a fund with a “target date” that matches the year you want to retire.

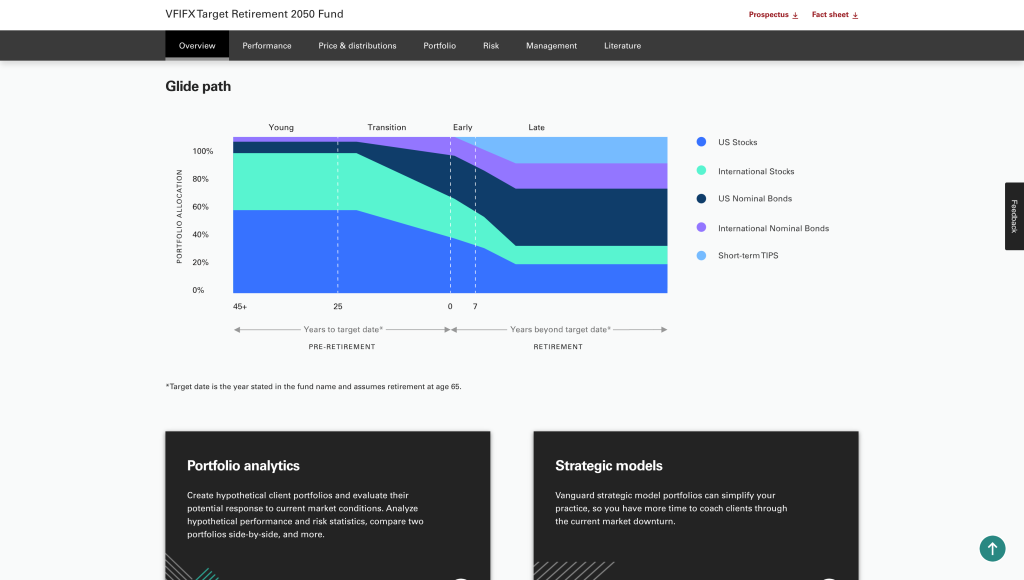

That fund then invests in a diversified portfolio of stocks and bonds, and over time it gradually shifts the asset allocation towards bonds and away from stocks. The idea is that as you approach retirement, your risk tolerance declines and your portfolio should reflect that.

So these target date funds will often follow a “glide path” that looks something like this.

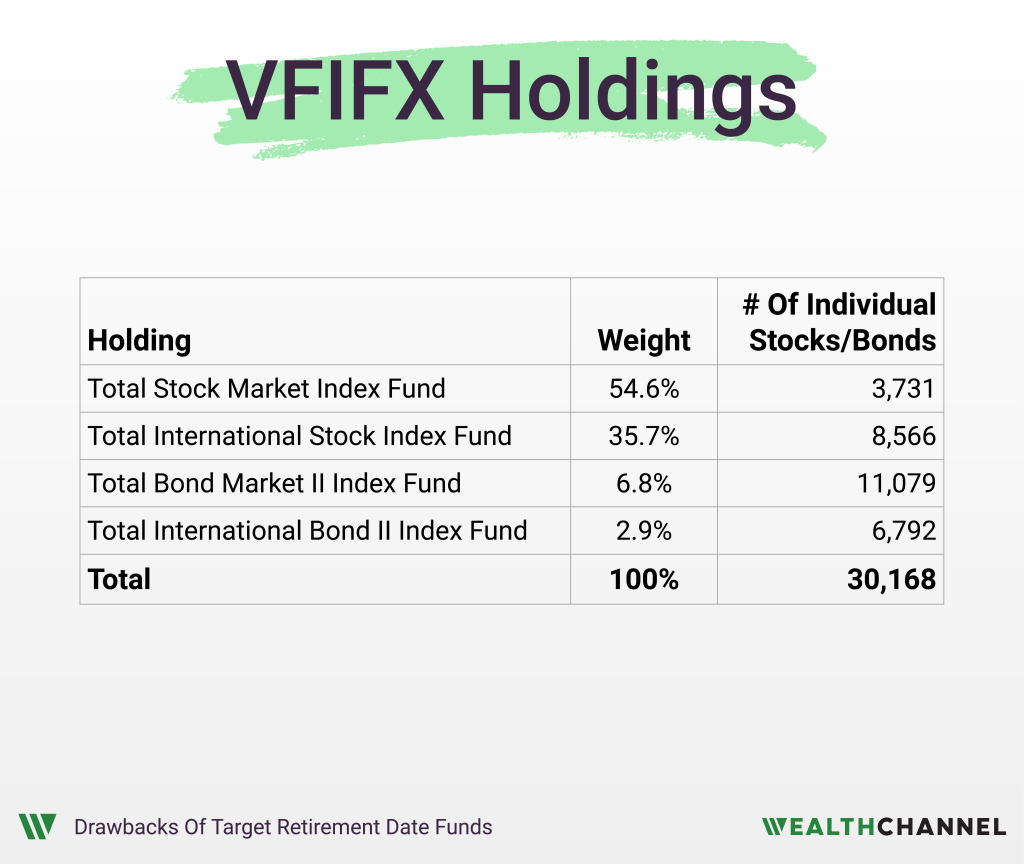

So there’s a lot to like about these funds. Let’s use the Vanguard Target Retirement 2050 Fund, ticker VFIFX, as an example. You buy one fund, but you get exposure to more than 12,000 global stocks and 17,000 of individual bonds as well. That includes dozens of countries and every sector.

That’s pretty incredible diversification. And you can, in theory, buy just one fund and then never worry about rebalancing again.

The Drawbacks

But there are a few drawbacks to these target date retirement funds.

The Fees

First off, is the fees. Now, most Target Retirement Date funds are structured as what I call funds of funds. They don’t buy individual stocks and bonds. Instead, they buy other index funds or ETFs.

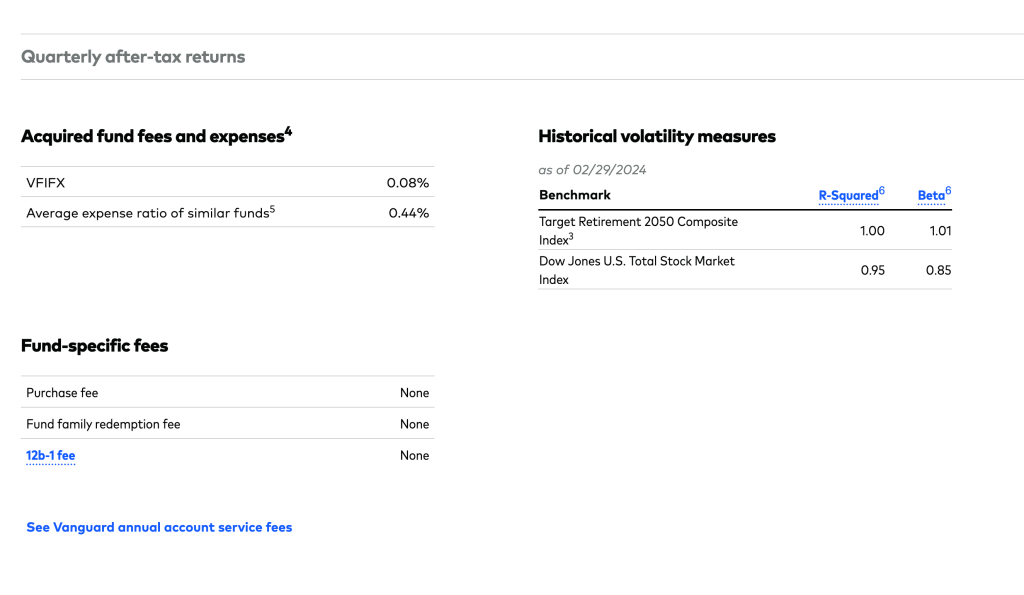

That means that there can be two layers of fees. For example, if you buy Vanguard’s 2050 Target Retirement Date Fund, VFIFX, you’ll be paying both the expense ratio charged by VFIFX, as well as the expenses charged by the funds that this fund holds.

Now, in this specific example this isn’t an issue. That’s because the expense ratio for VFIFX is zero – kudos to Vanguard for being investor friendly here.

This is the case for some other target retirement date funds as well – but not all of them. So be careful! Make sure you look to see if there are multiple layers of fees.

Asset Location

The second drawback relates to the optimal location of assets within your portfolio. This gets a little bit complicated, but it can be pretty important.

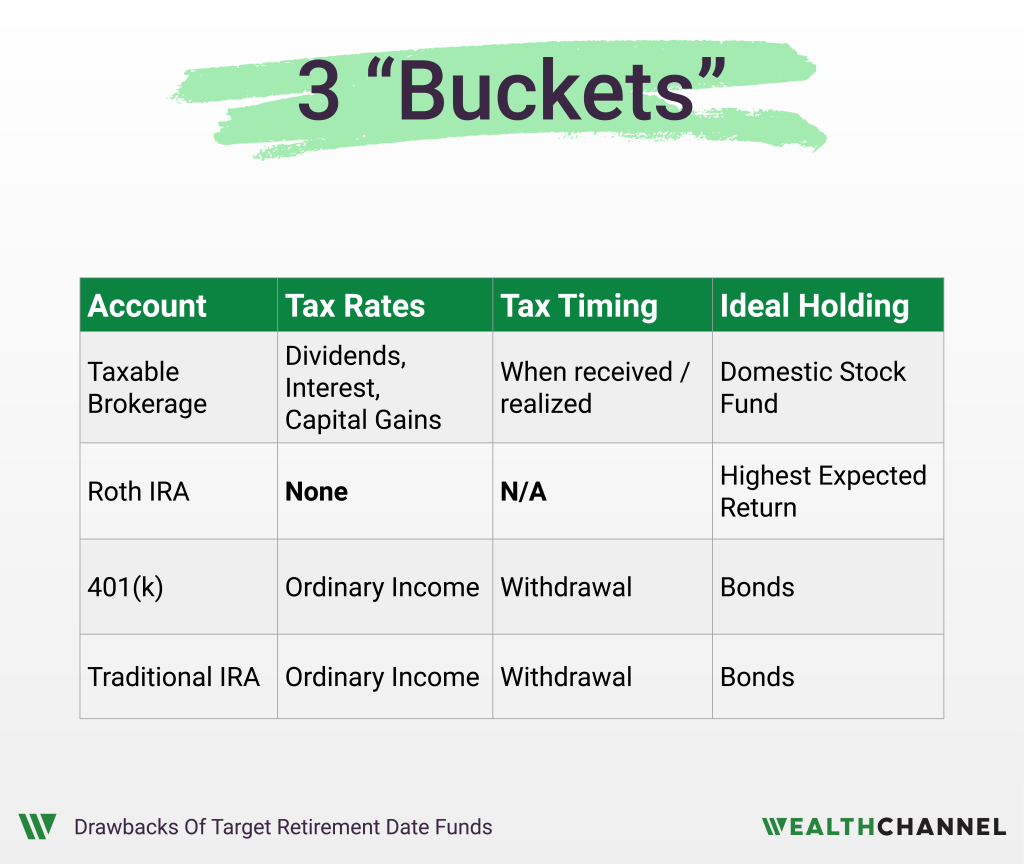

Most investors have three “buckets” in which they accumulate assets. They have a taxable brokerage account. They might also have a tax-free account, such as a Roth IRA. And finally they may have a tax-deferred account like a 401(k) or a Traditional IRA.

Essentially, different asset classes are better suited to different buckets. It is suboptimal to simply have a mirrored portfolio. In other words, simply holding a 2050 Target Retirement Date fund in all three buckets isn’t an ideal strategy. It will result in a greater tax drag, and lower bottom line returns.

Specifically, buying a target date retirement fund within a tax-advantaged account like a 401(k) isn’t optimal from a tax perspective. You’re much better off holding bonds – which pay distributions taxed at unfavorable rates – in your tax advantaged accounts.

Depending on your time horizon and your tax brackets, the impact of this “asset location” can end up making a big difference on your bottom line returns.

Again, this gets a little complicated and the ideal strategy will depend on a lot of factors, including how big each of your buckets is. Determining the optimal asset location is one of the services that a good financial advisor will provide.

Capital Gains Taxes

The third drawback of target date funds also relates to tax efficiency. These products have the potential to be pretty tax inefficient. That’s because, by design, they will sell stocks and buy bonds over time to stay on the target glide path.

Again, that’s suboptimal for a lot of investors because it can trigger a taxable event that translates into lower bottom line returns.

Investors who construct their own portfolio may be able to more efficiently transition their asset allocation by, for example, reinvesting dividends paid from stock funds into bond funds over time.

Additionally, if they do need to realize a capital gain as part of a rebalancing, they will have more control over where that gain is realized. For example, they can realize the capital gain within an account like a 401(k) or a Traditional IRA that avoids capital gains taxes.

Again, this is pretty nuanced and it might seem like a minor thing. But depending on your time horizon and your marginal tax rates, being able to efficiently rebalance your portfolio can be a big deal. And target retirement dates have limited flexibility in this regard.

The Alternative

So if Target Retirement Date Funds aren’t optimal, what are the alternatives?

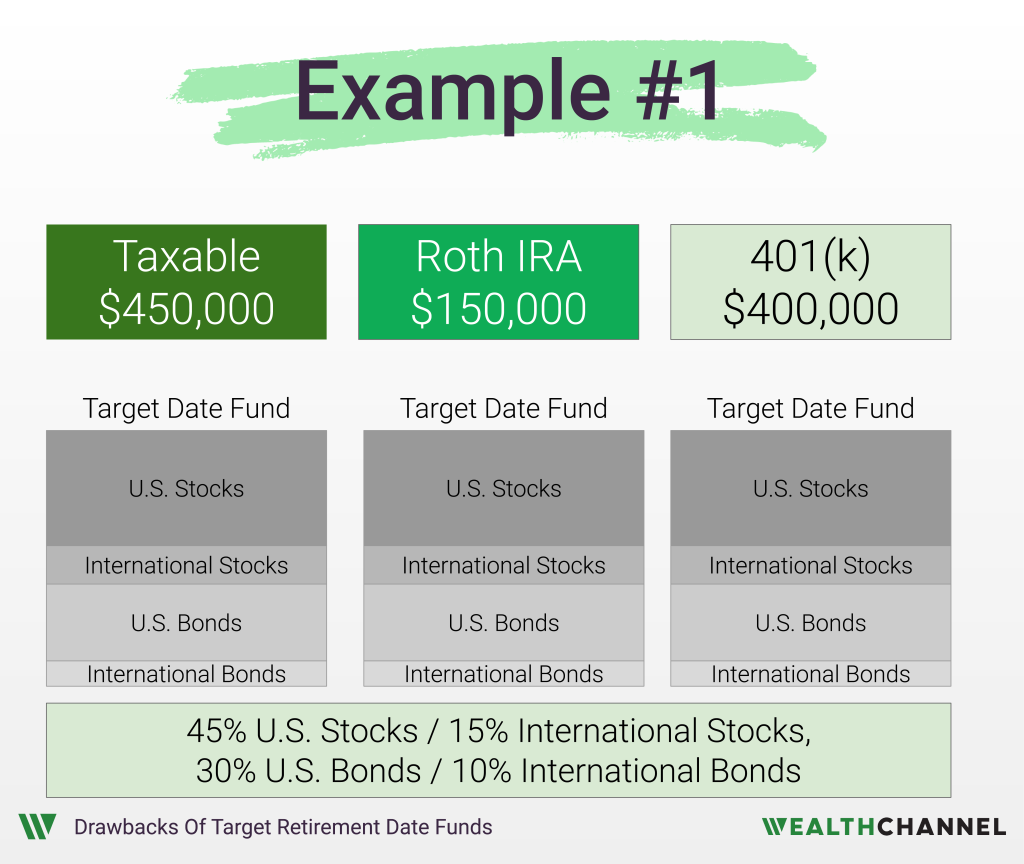

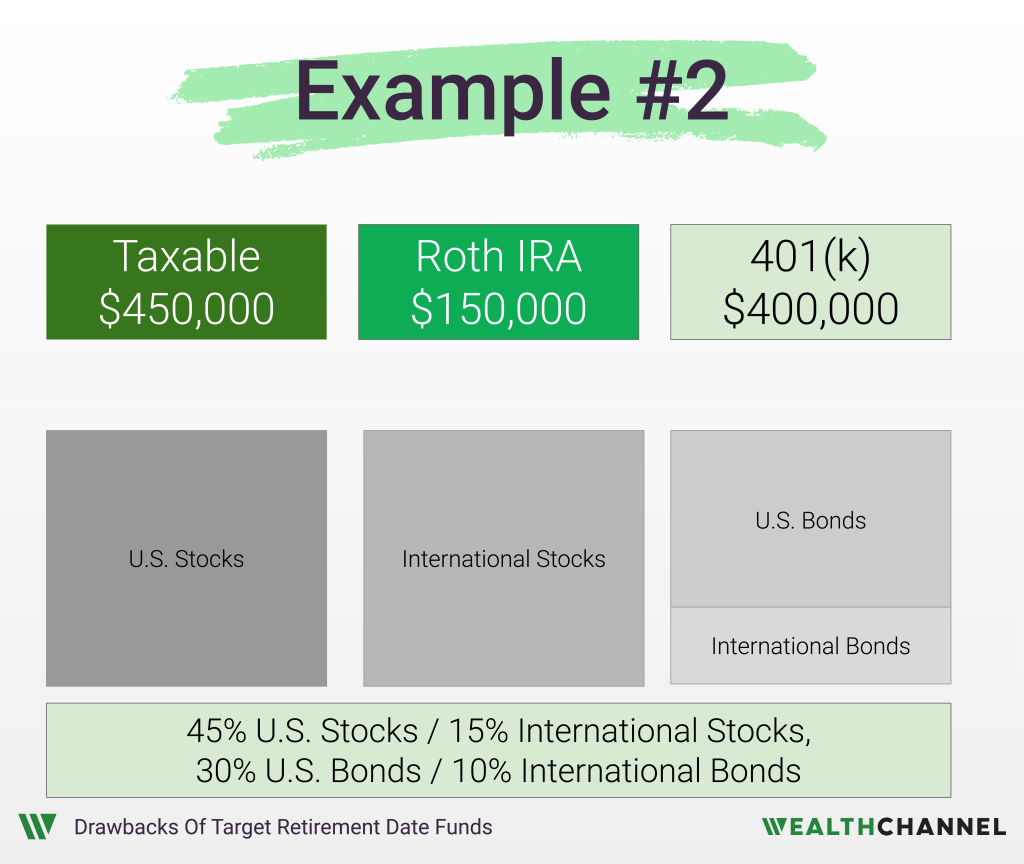

I’ll give you a hypothetical example here. Let’s say that you have a $1 million portfolio, including $450,000 in a taxable account, $150,000 in a Roth IRA, and $400,000 in a 401(k).

Let’s say there’s a Target Retirement Date Fund that has a 60% allocation to stocks – 45% domestic and 15% international – and a 40% allocation to bond, with 30% in domestic bonds and 10% in international securities.

The easy option is to just buy the Target Retirement Date fund in all these accounts. I call this a “mirrored” approach because all these accounts look the same.

Alternatively, you could use the 401(k) to purchase bond funds. That would avoid having interest income – which is subject to unfavorable tax rates – in your taxable account.

Let’s say you thought that international stocks will have the highest expected return. You could hold that asset in your Roth IRA, which means that you won’t owe taxes on any of the future appreciation. And then you could hold a domestic stock fund in your taxable account.

You get to the exact same place – the same asset allocation as the Target Retirement Date Fund – but you are more optimized from a tax perspective and avoid any possibility of double fees.

Bottom Line On Target Date Funds

There’s a lot to like about Target Date funds, including incredible simplicity. But there are some drawbacks as well that can result in you paying more and fees and taxes than you should. Depending on your time horizon and the size of your portfolio, this can end up being a big deal.

How An Advisor Can Help

When it comes to getting the most out of your retirement accounts, an experienced advisor can help in a few different ways:

- Determining the optimal asset location strategy;

- Executing annual tax loss harvesting (and potentially “tax gain harvesting” as well) to minimize your lifetime tax bill; and

- Identifying the lowest cost investment options.

About WealthChannel Academy

This article is part of WealthChannel Academy, the ultimate guide to planning a worry-free retirement.

WealthChannel Academy has a simple premise: to build a $1 million portfolio and enjoy a worry-free retirement, you need to understand just 7 basic concepts. WealthChannel Academy is your guide to simple and effective retirement planning, without the hype.