Estimated reading time: 6 minutes

I like to call the Roth IRA the “Holy Grail” of retirement planning, because in many ways this is the absolute best place for your retirement savings to live.

In this article:

Why It Matters

My goal with this episode is pretty simple: I’m going to show you why the Roth IRA is so powerful, and why you’re making a huge mistake if you aren’t using it to shelter your assets from taxes.

Side Note: I’m going to assume that you’re able to make contributions to a Roth IRA. Not every investor can – there are income limits in place.

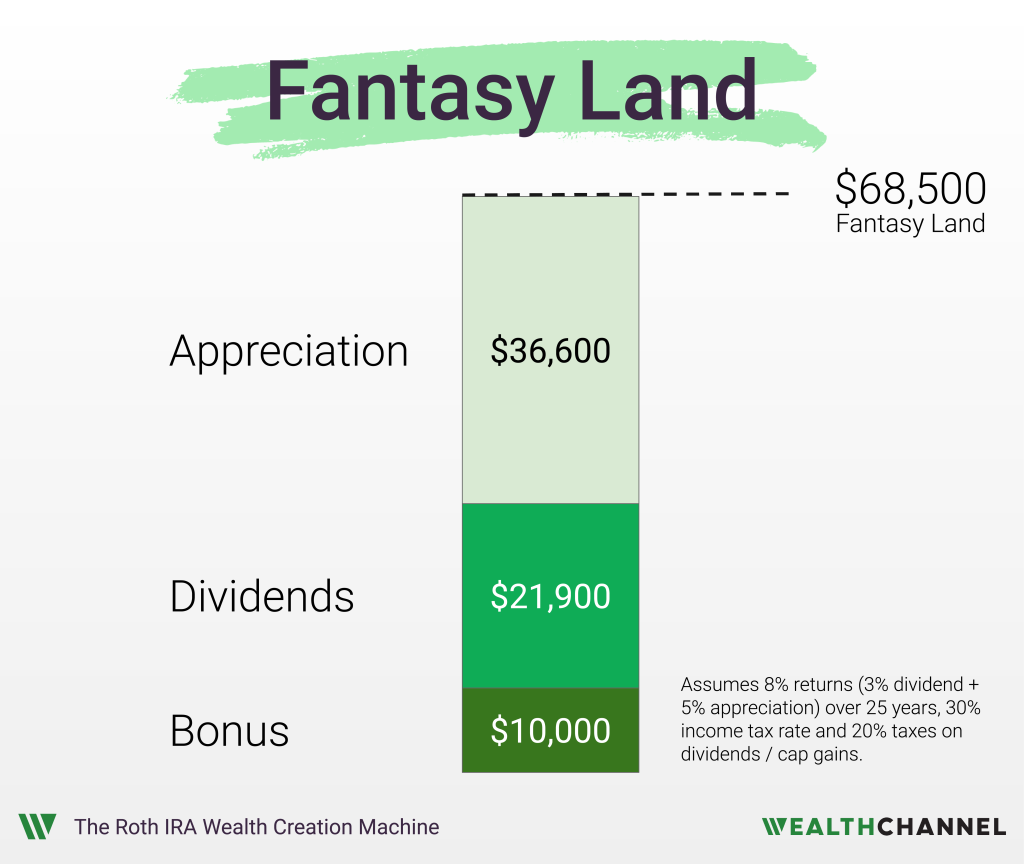

Fantasy Land

I want to start in a Fantasy Land of make believe – where there are no taxes. Let’s say that in this Fantasy Land, you get a bonus of $10,000, and you invest it in a portfolio of stocks and bonds.

That portfolio returns 8% – consisting of 3% annual dividends and 5% in capital appreciation. And let’s say you invest for 25 years. Let’s look at how your initial $10,000 would grow.

- You’ll collect about $22,000 in dividend payments over that time period;

- You’ll experience another $36,000 in capital appreciation.

- That means that after 25 years, your $10,000 investment has grown to more than $68,000 – it’s grown by 6x.

Reality Check

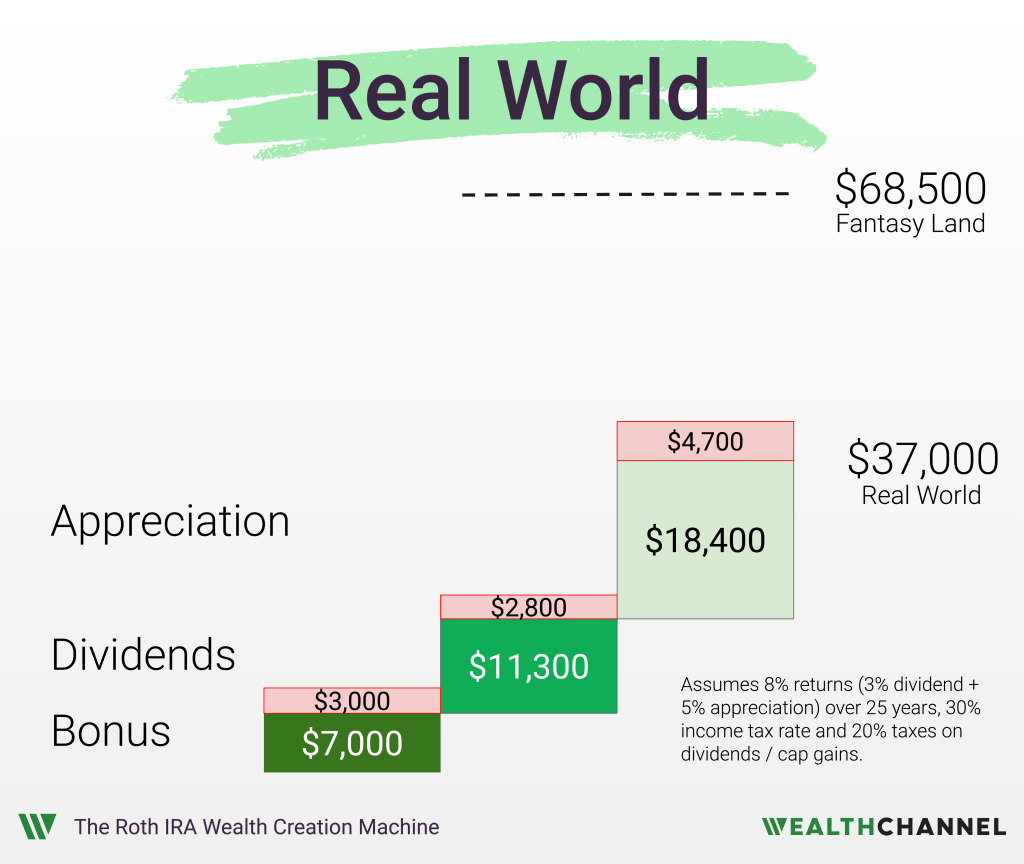

Unfortunately, we don’t live in this Fantasy Land. We live in a Real World where we have income taxes, dividend taxes, capital gains taxes – we have taxes on almost everything imaginable – but that’s a rant for another time.

So let’s see how this scenario plays out in the real world, if we assume a 30% income tax rate and a 20% tax on dividends and capital gains.

- You get your $10,000 bonus, but you can’t invest that entire amount. You owe $3,000 in income taxes, leaving you with $7,000 to invest.

- On that investment, you’ll collect about $14,000 in dividends over 25 years. But you have to pay 20% of that – about $2,800 – in taxes. Your investments appreciate by about $23,000, but you owe 20% of that – nearly $5,000 – in capital gains taxes.

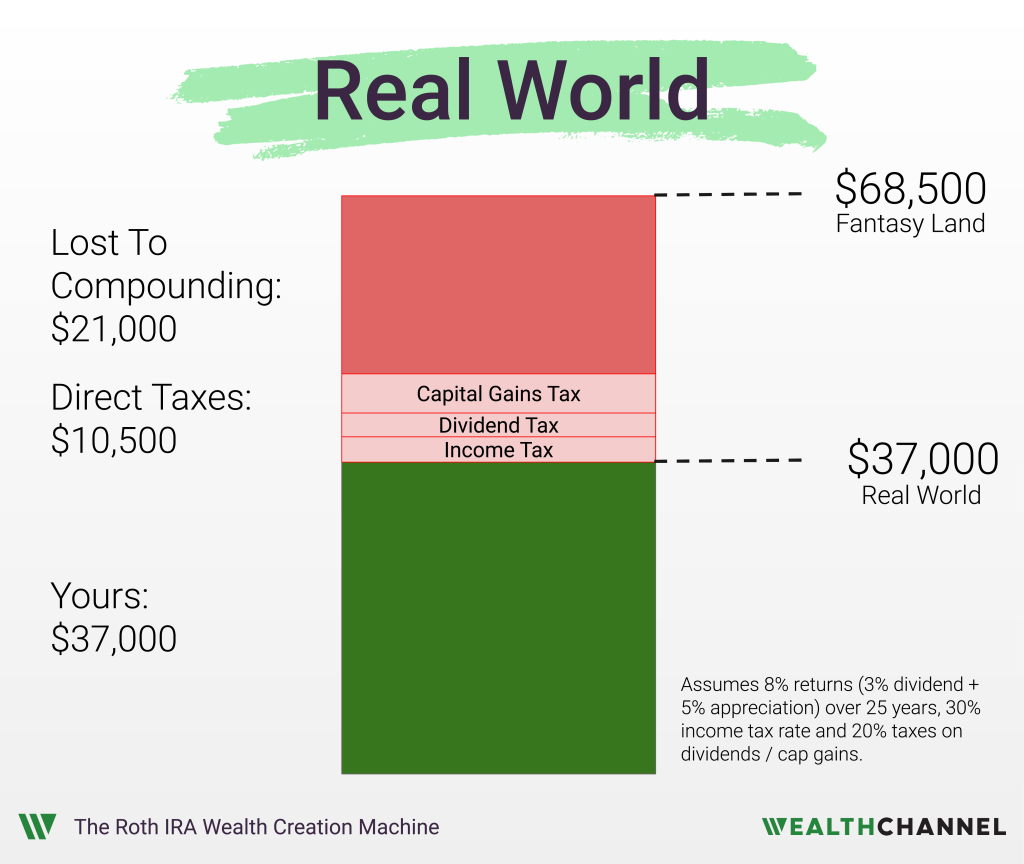

- You still do pretty well on this investment; your $10,000 bonus becomes about $37,000 after 25 years later. That’s impressive growth. But it’s about $31,000 less than what you had in the alternate reality without taxes.

In this real world, you’ve paid about $10,000 directly in taxes. And you’ve also lost quite a bit of money due to lost compounding. Because you only invest $7,000 up front and not $10,000, you miss out on significant dividends and appreciation over those 25 years.

There’s a similar effect on your dividends; because you owe taxes on these each year, you can’t reinvest the full amount. That means less in dividends and appreciation each year going forward.

So you really have four drags on your portfolio: income taxes, dividend taxes, capital gains taxes, and the indirect costs of compounding.

And here’s why the Roth IRA is so incredible: it eliminates two of these entirely. Goodbye dividend taxes and goodbye capital gains taxes. And then it also lowers the cost of compounding – this is really the hidden benefit of the Roth IRA that nobody appreciates.

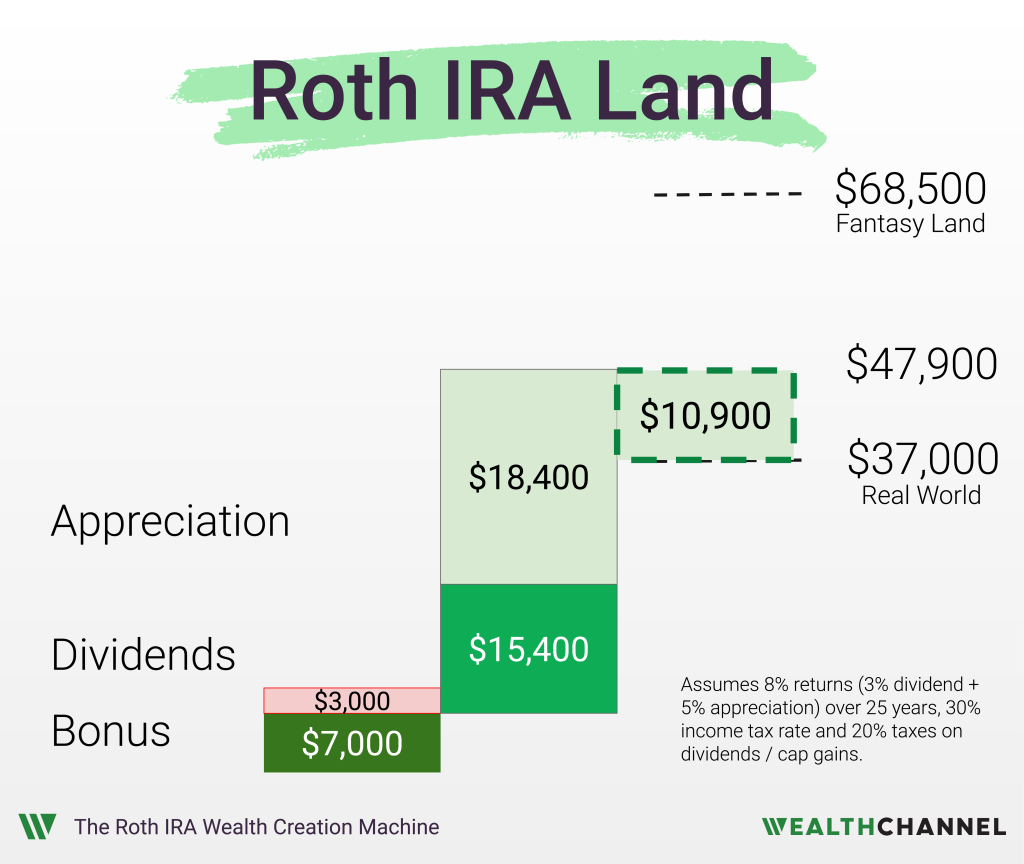

Enter The Roth IRA

Let me show you how this works, in a world where you have access to a Roth IRA.

- You get a $10,000 bonus. And, unfortunately, the magic of the Roth IRA doesn’t kick in yet. Because you still owe income taxes. So you still have to pay that $3,000 in taxes, and you have only $7,000 left over to invest.

- So you get more than $15,000 in dividends over 25 years, and you don’t owe any taxes on those either. That means you can reinvest the entire amount. So in addition to eliminating those dividend taxes completely, you reduce that cost of compounding.

- You get about $26,000 in capital appreciation, and don’t owe any capital gains taxes on those. This is a huge win. If this money was in a taxable brokerage account, you’d owe capital gains taxes when you liquidated.

- If it was in a 401(k) or a Traditional IRA, any withdrawals would be taxed as ordinary income – and those rates are likely to be even higher than the rates on capital gains.

So, your $10,000 has grown to about $48,000. That means that you’re almost $11,000 ahead of where you’d be if you hadn’t used the Roth IRA. You created almost $11,000 in after-tax wealth.

It Gets Better…

But it’s actually way better than this, for three reasons. Number one is that the Roth IRA is a renewable tax incentive. You’re limited in the amount that you’re able to contribute, but that amount resets each year. That essentially means that you can do this same wealth creation alchemy year after year.

Second, the Roth IRA is an individual account. IRA actually stands for Individual Retirement Arrangement. That means that if you’re married, both you and your spouse can contribute – and you effectively double all the numbers in this video. Instead of creating about $11,000 in incremental wealth, you’re creating $22,000.

Finally, the Roth IRA actually makes your other retirement accounts more valuable. This gets a little complicated, but because withdrawals from your Roth IRA are not taxable, using this account to fund your living expenses allows you to more efficiently withdraw from other accounts that are taxable, like a 401(k) or a Traditional IRA.

You see, we have a progressive income tax system in the U.S. When most retirees liquidate taxable or tax deferred accounts in retirement, they fill up these lower tax brackets – the 10% and 12% brackets – and start to push their income into the higher tax brackets.

Withdrawals from a Roth IRA aren’t taxable, so they don’t fill up any of these buckets. That means that more of your other accounts are eligible for a lower tax rate. That means that your Roth IRA actually helps you keep more of what you withdraw from your 401(k) or from your taxable brokerage account. Pretty cool, right?

OK, there you have it: the math behind why the Roth IRA is such an incredible wealth creation opportunity. If you’re surprised by the magnitude of these numbers, I hope that this will be good motivation to use your Roth IRA to its absolute maximum.

Bottom Line On Roth IRAs

The Roth IRA is one of the greatest tax incentives out there — much better even than most investors realize. Maximizing contributions to this account is critical, especially for younger investors with a long term time horizon.

How An Advisor Can Help

When it comes to maximizing the value of your Roth IRA, an experienced advisor can help in a few different ways:

- Determine your eligibility for contributing to a Roth IRA, including potential for “backdoor” contributions;

- Planning for an optimal withdrawal strategy in retirement that maximizes the post-tax value of all accounts; and

- Avoiding any early withdrawal taxes or penalties.

About WealthChannel Academy

This article is part of WealthChannel Academy, the ultimate guide to planning a worry-free retirement.

WealthChannel Academy has a simple premise: to build a $1 million portfolio and enjoy a worry-free retirement, you need to understand just 7 basic concepts. WealthChannel Academy is your guide to simple and effective retirement planning, without the hype.