Executive Summary

- The 401(k) — or similar account such as a 403(b) — does much of the “heavy lifting” for most retirement accounts. This is because it has relatively high limits, widespread availability, and the potential for “free money” in the form of employer matches.

- The tax advantages of the 401(k) are significant, and include the deferral of income taxes as well as the avoidance of taxes on dividends and interest.

- For most investors, the 401(k) strategy is pretty straightforward. But there are some advanced strategies that may be applicable to certain investors.

For most investors, the 401(k) account will be the most important tax advantaged vehicle they have. It is the workhorse of your retirement account, and it will be responsible for creating a significant portion of your net worth.

In this chapter, I’m going to show you how to get every possible mile out of this workhorse.

Before I dive into the basic and advanced 401(k) investing strategies, however, I want to start with some illustrations that quantify the massive wealth creation potential of the 401(k).

Download This Guide As a PDF

Get the full PDF version of this Ultimate Guide To Tax Free Investing.

Your free instant download includes special bonus content.

The Frog And The Well

To understand the magic of the 401(k), it helps to start with a story about a frog climbing out of a well.

You’ve probably heard the saying “two steps forward, one step” back.

This saying comes from an old story about a frog trying to climb out of a well. For every two steps the frog took forward, it slipped back one step. The result was an arduous and time consuming – though ultimately successful – climb to the top.

“Two steps forward…” is an apt description for climbing a mountain, starting a business, raising children… and investing.

In this analogy, taxes are the steps back.

The goal of tax efficient investing is to minimize the size of those steps in the wrong direction (and sometimes eliminate them altogether).

Nowhere is this better illustrated than with a 401(k).

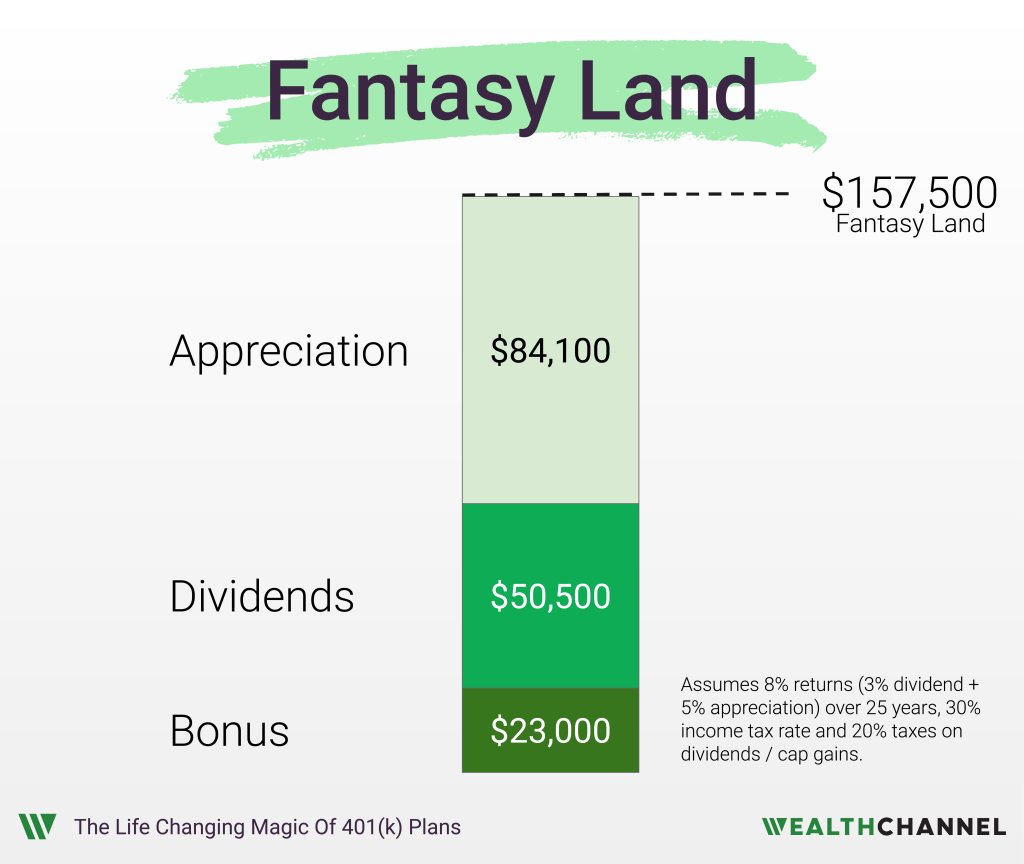

Fantasy Land

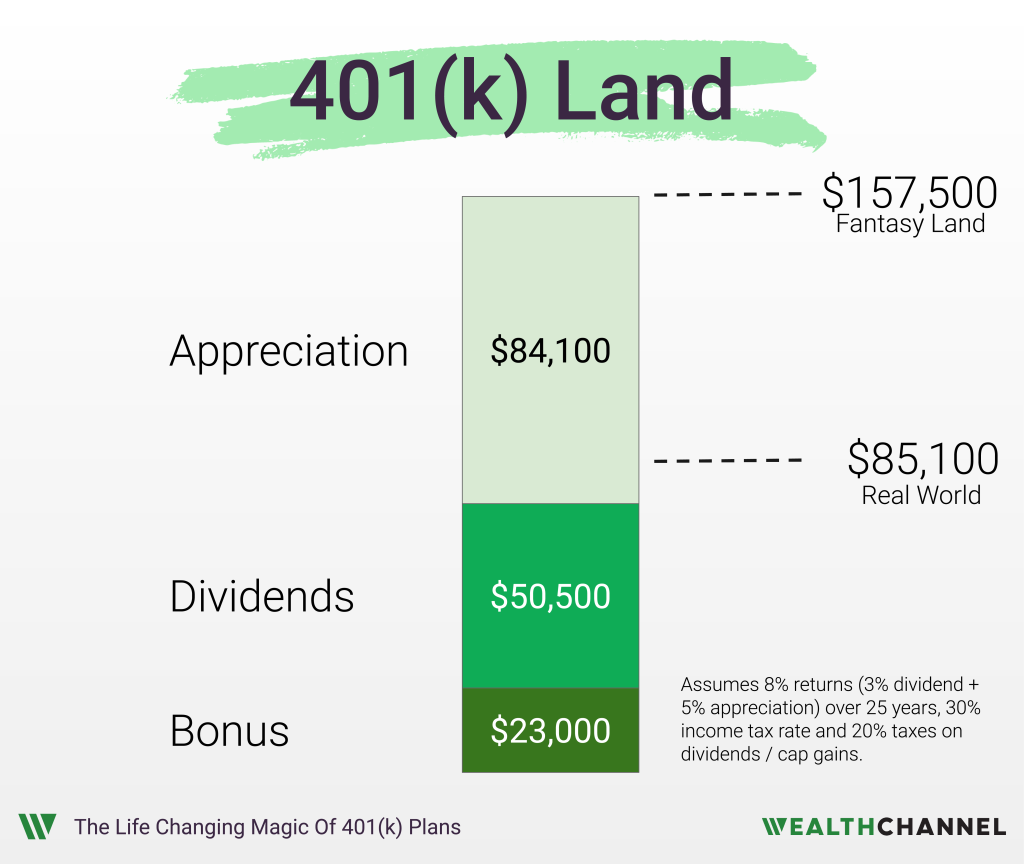

I want to start in a Fantasy Land of make believe – where there are no taxes. Let’s say that in this Fantasy Land, you get a bonus of $23,000, and you invest it in a portfolio of stocks and bonds.

That portfolio returns 8% – consisting of 3% annual dividends and 5% in capital appreciation. And let’s say you invest for 25 years. Let’s look at how your initial $23,000 would grow.

You’ll collect more than $50,000 in dividend payments over that time period, and experience another $84,000 in capital appreciation.

That means that after 25 years, your $23,000 investment has grown to more than $157,000 – it’s grown by 6x.

Reality Check

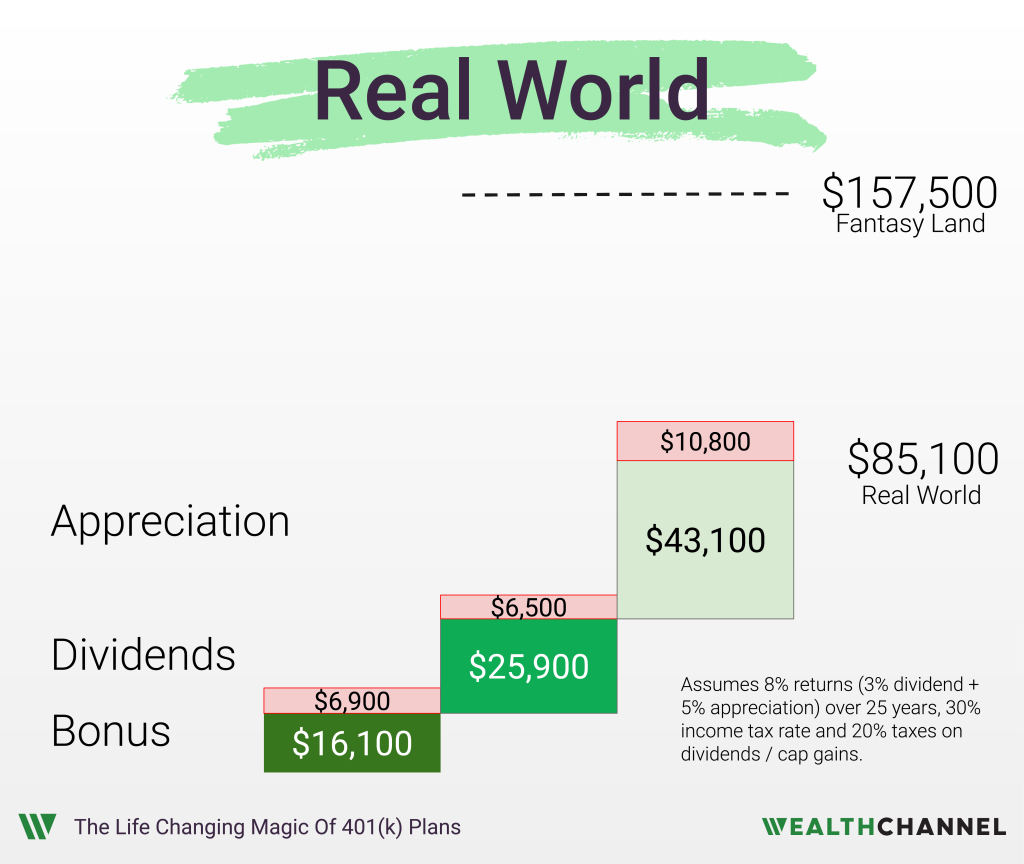

Unfortunately, we don’t live in this Fantasy Land. We live in a Real World where we have income taxes, dividend taxes, and capital gains taxes – just to name a few.

Without a tax efficient strategy, investing becomes a game of “Six Steps Forward, Three Steps Back.”

So let’s see how this scenario plays out in the Real World, if we assume a 30% income tax rate and a 20% tax on dividends and capital gains:

You get your $23,000 bonus, but you can’t invest that entire amount. You owe nearly $7,000 in income taxes, leaving you with about $16,000 to invest.

That’s one big step back.

Now on that investment, you’ll collect about $32,000 in dividends over 25 years. But you have to pay 20% of that – about $6,500 – in taxes.

That’s another step back.

Your investments appreciate by about $54,000, but you owe 20% of that – about $11,000 – in capital gains taxes.

Yep, another step back.

Now, you still do pretty well on this investment; your $23,000 bonus becomes about $85,000 after 25 years later. That’s impressive growth.

But it’s about $72,000 less than in the Fantasy Land without taxes.

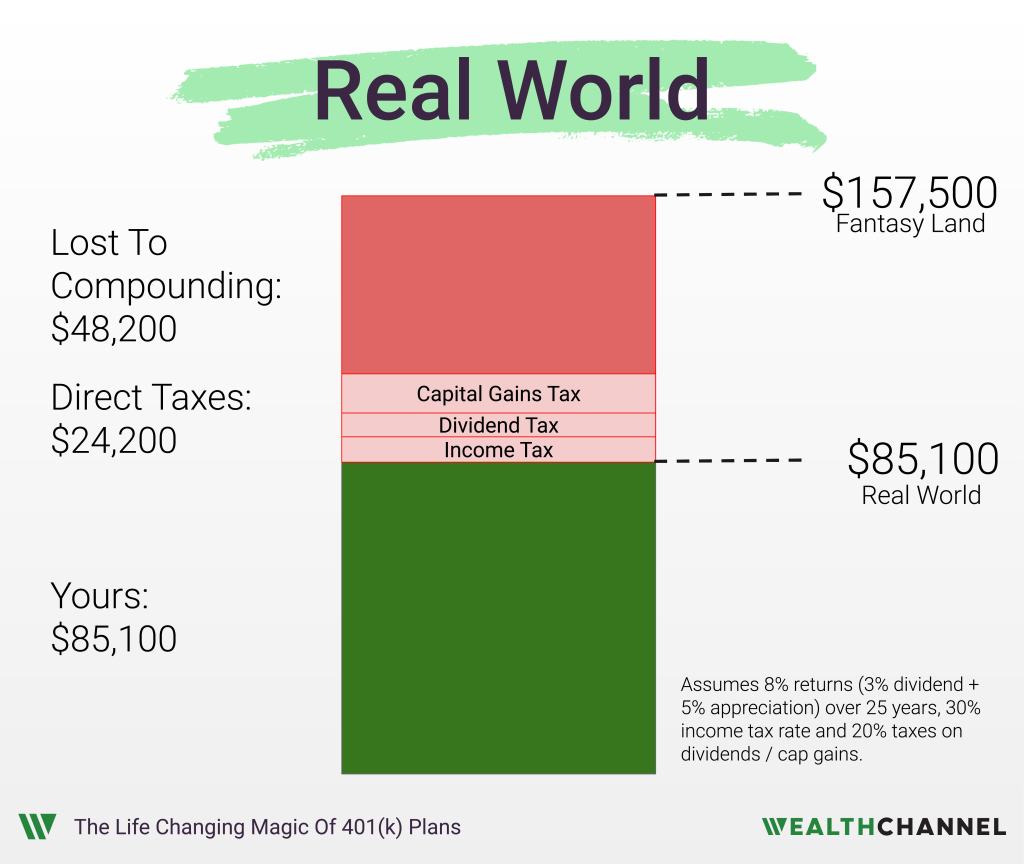

At this point, you’ve paid taxes three times: income tax when the money was initially earned, dividend and interest tax when the investments generated cash flow, and capital gains tax when you sold the investments.

In this Real World, you’ve paid about $24,000 directly in taxes.

But the real whammy comes from the dollars that you lose to compounding. Because you only invest $16,000 up front and not $23,000, you miss out on significant dividends and appreciation over those 25 years.

There’s a similar effect on your dividends; because you owe taxes on these each year, you can’t reinvest the full amount. That means less in dividends and appreciation each year going forward.

So you really have four drags on your portfolio:

- Income taxes;

- Dividend taxes;

- Capital gains taxes; and

- The indirect costs of compounding.

And here’s why the 401(k) is so incredible: it eliminates three of these entirely. Goodbye dividend taxes, capital gains taxes, and goodbye to that brutal cost of compounding.

All you have to deal with is income taxes.

The Beauty Of The 401(k)

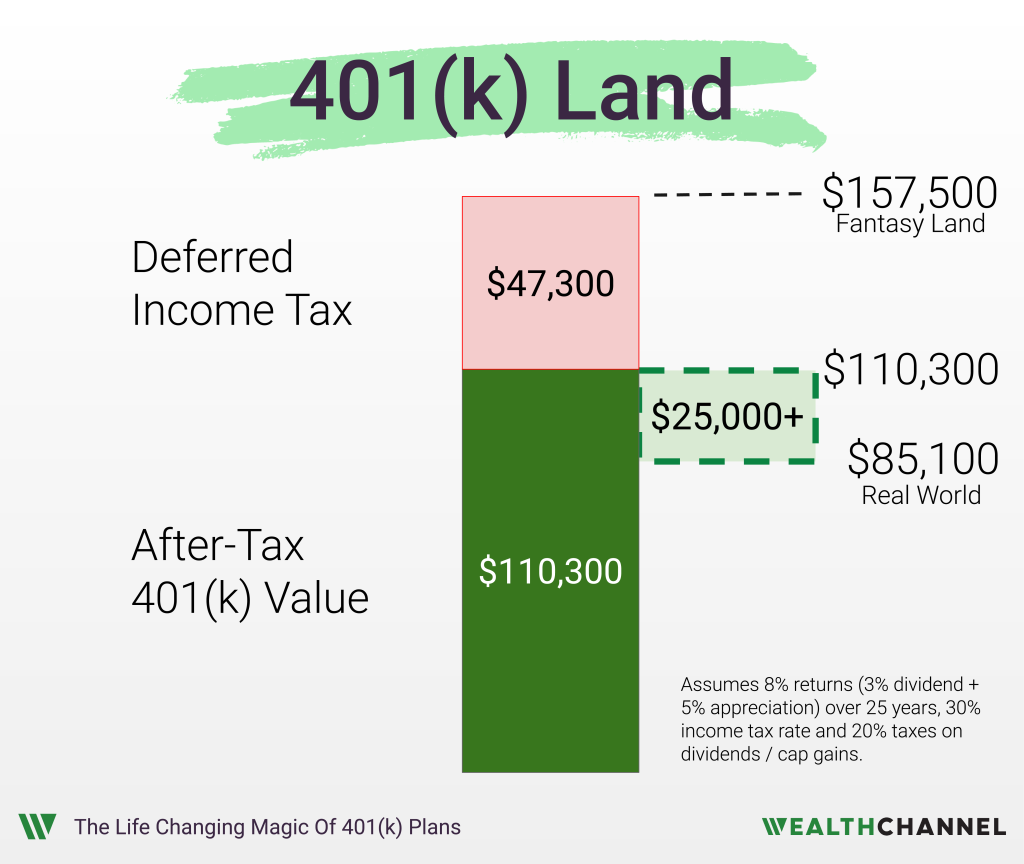

Let me show you how this works, in a world where you have access to a 401(k).

You get a $23,000 bonus. But you elect to use a tax deferred account like a 401(k), which means that you don’t owe any income taxes today. You get to invest the entire amount.

A 401(k) allows employees to defer some of their taxable income by making pre-tax deductions from their paychecks. Essentially, this means that a set amount of money is re-routed each payday: instead of hitting your checking account, it goes instead directly to your 401(k) account.

So you get your $50,000 in dividends over 25 years, and you don’t owe any taxes on those either. That means you can reinvest the entire amount. Awesome, right?

You get your $84,000 in capital appreciation, and don’t owe any capital gains taxes on those. Again, pretty awesome, right?

So, your $23,000 has grown to more than $157,000.

This is where that tax free magic runs out. Remember, a 401(k) is a tax-deferred account. You deferred your income when you received the bonus 25 years ago, and now it’s time to pay up.

Withdrawals from a 401(k) are taxed as Ordinary Income – that is, it’s taxed as if it is part of your salary.

Remember,

That translates to a pretty big step back; you owe about $47,000 in taxes. So that leaves you with $110,000.

That means that you’re more than $25,000 ahead of where you’d be if you hadn’t used the 401(k). You created $25,000 in after-tax wealth.

Dive into the data behind this example. Click here to open the underlying calculations in a Google Sheet. You can save as an Excel file or to your personal Google Drive.

Important Details

In the example above, using a 401(k) created about $25,000 of retirement wealth compared to the less desirable alternative.

There are three important notes about this number:

Detail #1: Annual Limits

First off, this represents the wealth created from making the maximum contribution to your 401(k) for the year.

Unfortunately, there are limits on the amount of your compensation that you are able to defer each year.

For 2024, the maximum that an employee is able to defer from their salary to their 401(k) is $23,000 if they are under 50 years old.

If you’re over 50, you’re allowed to make an additional $7,500 “catch up” contribution, for a total of $30,500.

One more piece of good news: these numbers are indexed to inflation, so they go up every year.

Detail #2: Renewable & Perishable Inventive

Secondly, it’s important to note that this contribution limit is an annual limit.

There are two ways to look at this.

On the upside, the 401(k) is a renewable tax incentive. You can take advantage of it each year, which is an incredible opportunity. If you start contributing the maximum to your 401(k) early in your career, the magic of compounding returns will do wonderful things for your retirement portfolio.

The downside is that the 401(k) is a perishable tax incentive. If you didn’t contribute to your 401(k) in 2022, for example, you’ve missed that opportunity forever.

Detail #3: Individual Account

Finally, the 401(k) is an individual account. If you’re married, it’s possible for both you and your spouse to have a 401(k) plan through your employer.

That means that the $25,000 in wealth creation from the example above can become $50,000 in wealth creation for a couple… for one year.

The Cherry On Top

For fortunate investors, there is a nice cherry on top of an already delicious 401(k) sundae.

Some employers will offer a 401(k) match, which essentially means that they will contribute to your 401(k) on your behalf, as long as you do too.

The 401(k) match typically includes two variables.

First of all, your employer will specify a match percentage. This is the percentage of your contribution that they will match.

Some companies will offer a 100% match; if you contribute $1,000 to your 401(k), they’ll contribute $1,000.

A company offering a 50% match would contribute $500 when you contribute $1,000.

The other variable is the contribution cap. Typically, this is a percentage of your total compensation.

For example, a company may cap their match contribution at 6% of your salary.

If you’re making $100,000 a year, that means that their maximum contribution would be $6,000 ($100,000 x 6%).

Below are a few examples to illustrate this concept under different scenarios:

Example #1: 100% Match, Up To 10% Of Salary

If you make $100,000 and contribute $5,000 to your 401(k), your employer would contribute $5,000:

$5,000 x 100% = $5,000 (which is less than 10% of your salary)

If you make $100,000 and contribute $10,000 to your 401(k), your employer would contribute $10,000:

$10,000 x 100% = $10,000 (which is equal to 10% of your salary)

If you make $100,000 and contribute the full $23,000 to your 401(k), your employer would contribute $10,000:

$23,000 x 100% = $23,000 (which is more than 10% of your salary, so the employer match is capped at 10%of your salary, or $10,000)

Example #2: 50% Match, Up To 6% Of Salary

If you make $100,000 and contribute $5,000 to your 401(k), your employer would contribute $2,500:

$5,000 x 50% = $2,500 (which is less than 6% of your salary)

If you make $100,000 and contribute $10,000 to your 401(k), your employer would contribute $5,000:

$10,000 x 50% = $5,000 (which is less than 6% of your salary)

If you make $100,000 and contribute the full $23,000 to your 401(k), your employer would contribute $6,000:

$23,000 x 50% = $11,500 (which is more than 6% of your salary, so the employer match is capped at 6% of your salary, or $6,000)

Downsides Of 401(k) Accounts

I believe it is important to always show the good, bad, and the ugly.

And the truth is that there are some drawbacks of 401(k) accounts that investors should consider.

Drawback #1: Illiquidity

The government created the 401(k) tax incentive because it wants people to save for retirement.

In addition to the carrot – the favorable tax treatment – there’s also a stick. Specifically, there’s a penalty on withdrawals from your 401(k) account made before age 59 ½.

The idea here is to incentivize people to save for retirement – and not liquidate their accounts early because they want to buy a new car.

There are some allowed early withdrawals, including for medical expenses not covered by insurance, to purchase your house (but not a vacation home), and to pay for college education.

But if you need to tap your 401(k) early for any other reason, you’ll end up paying a penalty that will likely outweigh the favorable tax treatments you received.

Drawback #2: Tax Rate Uncertainty

Remember that a 401(k) is a tax-deferred investment account. You are deferring the income tax on part of your earnings until the future.

There’s a major advantage associated with that deferral; it allows you to put more money to work now, and maximize the magic of compounded returns over a long period of time.

The downside is that you add uncertainty to the equation, because you have no idea what tax rates will be when it comes time to pay them.

If tax rates go down in the future, that’s an added bonus for you.

For example, instead of paying income taxes at a 32% marginal rate today you could end up paying those taxes at a 25% rate in 2060.

That would be a nice win!

Of course, it can move the other way too. If taxes go up, you could end up paying taxes at a higher rate in the future than you would have now.

In most cases you’ll still come out ahead in the future even if tax rates increase, because you were able to defer that tax bill and there is a time value of money.

This is an important concept, so let’s make sure it’s clear with a quick example.

We’ll assume the following:

| Current Ordinary Income Tax Rate: | 30% |

| Future Ordinary Income Tax Rate: | 40% |

| Future Capital Gains Tax Rate: | 20% |

| Expected Annual Returns (Tax Advantaged Account) | 8% |

| Expected Annual Returns (Taxable Account) | 7.5% |

| Time Horizon | 25 Years |

In the first scenario, you invest the $23,000 in a 401(k). Because you defer the taxes, that amount grows at 8% annually for 25 years to about $158,000.

Upon withdrawal, you owe taxes on that entire amount at 40%.

That’s a total tax bill of about $63,000, and leaves you with $94,500.

The alternative is to skip the 401(k), and pay taxes today when you know what tax rates will be.

You pay taxes on your $23,000 at a known 30% rate, leaving you with about $16,000 to invest.

That amount grows at 7.5% annually for 25 years (remember, you’ll owe taxes each year on dividends and interest, which creates a “tax drag” that can be avoided in a 401(k)) to about $98,000.

Now, you’ll still owe taxes at an unknown rate on the approximately $82,000 in capital gains ($98,000 less the initial investment of your $16,000).

Assuming a 20% rate (again, this is speculative as it involves predicting what taxes will be in the future), you’ll owe about $16,400 in capital gains and have a net after-tax amount of $82,000.

To recap: using these assumptions, the 401(k) route is still a better option. It produces $94,500 in after-tax wealth compared to $82,000 in the alternative scenario.

But other inputs may yield different results. The appendix to this book includes more calculations, and the companion website allows you to download the spreadsheet and enter your own assumptions.

Dive into the data behind this example. Click here to open the underlying calculations in a Google Sheet. You can save as an Excel file or to your personal Google Drive.

Drawback #3: RMDs

The final disadvantage of a 401(k) is the required minimum distribution, or RMD. Starting at age 72, you’re required to start withdrawing from your 401(k).

That might sound like a strange rule: why should you be forced to take money out of your retirement account?

The answer is that Uncle Sam wants to limit that length of time that you can defer your tax bill.

He wants to get paid eventually, so you’re forced to start taking distributions at age 72 and every year thereafter.

Basic 401(k) Strategies

If your employer offers any sort of match, be sure to contribute enough to your 401(k) in order to maximize their matching contributions. This is essentially free money that your employer is offering you, to reward you for planning for your retirement.

For example, let’s assume you make $150,000 and your employer offers a 100% match up to 8% of your salary.

You should contribute at least $12,000 to your 401(k) account each year, in order to receive a matching $12,000 from your employer. If you contribute an amount less than this, you are leaving money on the table.

After you’ve maxed out your employer match, your next steps will depend on your individual circumstances.

One option is to contribute the maximum to your 401(k). In 2024, that means contributing $23,000 over the course of the year. If you have enough cash to max out all of your tax advantaged accounts, this is likely a good idea.

If, however, you don’t have enough cash to max out your 401(k), IRA, 529, and HSA, then you are going to have to identify which tax strategy will get you the most bang for your buck.

We’re going to cover all of these vehicles in the coming chapters, so don’t worry if you’re not sure what your optimal strategy should be.

Advanced 401(k) Strategies

I’m going to briefly touch on some more advanced strategies related to the 401(k) here.

For most investors, these strategies won’t apply. But for business owners or certain High Net Worth investors, they may be able to add some incremental value.

Roth 401(k)

All of the examples in this chapter assume a “traditional” 401(k) model that allows investors to defer part of their earnings to a future year, thereby allowing them to invest a greater amount now into an account that will experience tax free growth.

Some 401(k) and 403(b) plans will offer a “Roth option” that allows investors to instead contribute after-tax dollars to a 401(k).

Let’s use the same example from earlier: an employee receiving a $23,000 bonus. When utilizing a 401(k), this employee is able to defer the taxes on this amount and invest the entire $23,000.

In a Roth 401(k), the investor would pay the taxes now. If he’s taxed at a 25% marginal rate, that means he would pay $5,750 in taxes now and have a net amount of $17,250 to invest in a Roth 401(k).

This amount would grow tax free – no taxes owed on dividends or interest income. And when this investor goes to withdraw from the Roth 401(k) in retirement, the entire withdrawal is tax free.

We’re going to cover the benefits and drawbacks of a Roth account in the next chapter, but I can give you a sneak preview now…

Whether a Roth contribution makes sense comes down to an analysis of your current tax rate versus your future tax rate.

Generally speaking, it’s in your best interest to make Roth contributions when your marginal tax rate is low, and “traditional” 401(k) contributions when your marginal tax rate is high.

Many employees able to take advantage of a 401(k) will be in their peak earnings years, when the Roth route is less advantageous.

But, again, we’re going to cover this a lot more in the next chapter.

Mega Backdoor Roth

As you’ve probably learned by now, there are a lot of wrinkles in the tax code.

I mentioned earlier that the maximum an employee can contribute to their 401(k) in 2024 is $23,000 (assuming you’re under 50).

But the full picture is a bit more complicated. The maximum set by the IRS is actually $69,000.

The $23,000 is the maximum deferral that an employee is allowed to make.

The difference between those two amounts – $46,000 – can come from a couple of places.

First, it can come from your generous employer match. But most employers cap this match well below $43,000, so that will likely only get you part of the way there.

The so-called “Mega Backdoor Roth” involves making an after-tax contribution to your 401(k) and then immediately converting that piece of it to a Roth account.

If you’ll max out your contributions to tax advantaged accounts this year, the Mega Backdoor Roth can be a powerful strategy to protect a significant amount of money from taxes.

Unfortunately, not every 401(k) plan is set up to accommodate the Mega Backdoor Roth.

If you’re interested in pursuing this strategy, the first step is figuring out if your 401(k) even allows it. Reach out to your HR or benefits administrator and ask them the following questions:

- Question #1: Does our 401(k) plan offer a Roth option?

- Question #2: Does our 401(k) plan allow after-tax contributions after the annual elective deferral limit has been reached?

- Question #3: Does our 401(k) plan allow in-plan conversions to Roth?

- Question #4: Does our 401(k) plan offer in-service withdrawals of funds?

If the answer to #1 and #2 is “yes” and the answer to either #3 or #4 is “yes” then you are in luck. You’ll be able to pull off a Mega Backdoor Roth contribution to your 401(k) and shelter another big chunk of money from taxes.

Solo 401(k)

I can imagine that some entrepreneurs have been frustrated by this chapter.

They’ve made it this far, only to learn that the first pillar of tax efficient investing is a 401(k) – something that a lot of entrepreneurs don’t have access to.

Well, I have some good news.

You do have access to a 401(k), even if you’re a solo entrepreneur.

In fact, many entrepreneurs have access to one of the greatest tax free investing accounts out there: the Solo 401(k).

This is a special 401(k) account that can be set up for sole proprietors or business owners without any employees. It’s relatively cheap and easy to set up, and allows you to protect a significant portion of your earnings and profits from taxation.

The added bonus is that you get to set up the plan. So, for example, you can include a generous employer match (which can be a tax deductible expense for the business).

Or you can write your plan such that it allows for the aforementioned Mega Backdoor Roth maneuver, allowing you to shield nearly $70,000 each year.

And many entrepreneurs are able to include their spouse in their Solo 401(k), doubling their tax savings potential.

The Solo 401(k) is only available to business owners who don’t have any full time employees.

If this describes you, there are a couple of options.

- The easiest way to set up a 401(k) is to reach out to Vanguard. They have an “off-the-shelf” plan that can be up and running in a matter of days. You’ll pay a low annual fee for each fund you include in your plan, and there is very little maintenance.

- The recommended option is to spend a bit more money and work with a bespoke Solo 401(k) provider. These companies can craft a plan that allows you to maximize your 401(k) contributions, including enabling the Mega Backdoor Roth.

Ubiquity and MySolo 401k are two such providers.

If you do have employees, you’ll need to set up a more “standard” 401(k). Vanguard and Fidelity are two low cost providers.

Net Unrealized Appreciation (NUA)

If you’ve accumulated a significant amount of your company’s stock in your 401(k), you may be able to take advantage of an NUA election to lower your tax bill.

This makes sense if you own some highly appreciated company stock in your IRA. Let’s say that you own company stock that is now worth $500,000. But the basis of this stock – what you paid for it – is just $50,000.

When you make an NUA election, you pay taxes at ordinary income rates immediately on the basis of your company stock.

Now, I know what you’re thinking… that violates the rule that the best times to pay taxes are later and never. Why would we want to pay taxes now when we could push them down the road?

NUA allows you to transfer your company stock to a taxable brokerage account, where it will receive a more favorable tax treatment.

If you keep the stock in your 401(k) or roll that 401(k) into a Traditional IRA, withdrawals down the road will be taxed at Ordinary Income rates.

If you make the NUA election and move the stock to a taxable brokerage account, your withdrawal will be taxed as a capital gain.

Let’s play out this hypothetical scenario to understand the opportunity here.

If you don’t make the NUA election, your company stock will continue to appreciate in your 401(k). If it grows at 8% per year for 10 more years, it will grow from $500,000 to about $1,079,000.

If you withdraw at this point, the entire amount will be taxed as Ordinary Income. If you’re in a 32% marginal tax bracket, that means a tax bill of $345,000 and net proceeds of about $734,000.

Alternatively, let’s say you make the NUA election today. You’ll owe Ordinary Income taxes at 35% on the basis of the stock.

That comes out to $17,500.

That leaves you with $482,500 to invest. Remember that you’ve had to move this stock out of a 401(k), so it no longer experiences tax free growth. If it grows at a “tax dragged” rate of 7.6% annually over 10 years, it will grow to just over $1,000,000.

Here’s where the payoff comes in: this amount is taxed at Capital Gains rates, which are generally lower than Ordinary Income rates. If the applicable Capital Gains tax rate is 15%, you’ll owe about $143,000 in taxes when you liquidate.

That leaves you with about $861,000 after taxes in retirement, which means more than $125,000 in incremental wealth compared to the first scenario.

Dive into the data behind this example. Click here to open the underlying calculations in a Google Sheet. You can save as an Excel file or to your personal Google Drive.

Bottom Line: Your 401(k) Playbook

The 401(k) is the workhorse of your retirement account, and the first pillar in a tax efficient investing strategy.

While the math behind the 401(k) gets a little complicated, the basic strategy here is very straightforward.

The first dollars you save each year should be 401(k) contributions up until any employer match is maxed out.

Until you’ve reached this point, don’t allocate retirement funds anywhere else.

If you have the ability to max out your retirement accounts, you should contribute the maximum deferral amount (this is $23,000 in 2024).

If you can’t max out your retirement accounts this year, you may want to continue to prioritize your 401(k). But you’ll want to weigh further contributions against your other options at this point, which will include a Roth IRA and the “stealth IRA.”

We’ll cover those in the next chapter.

Download This Guide As a PDF

Get the full PDF version of this Ultimate Guide To Tax Free Investing.

Your free instant download includes special bonus content.

Table of Contents

This page is part of our Ultimate Guide To Tax Efficient Investing. Follow the links below to read through the entire guide. Or, click here to download the full PDF version.

- Chapter 1: Why Taxes Matter (The One Big Myth) — The impact of taxes on your portfolio.

- Chapter 2: The Four (Yes, Four) Types Of Income Taxes — Understanding the “default” tax treatment your income receives.

- Chapter 3: Guiding Principles (And An “Aha Moment”) — Six rules of thumb that will make your life easier.

- Chapter 4: The 401(k) (Your Tax Free “Workhorse”) — My the 401(k) is the most powerful wealth creation account for most investors.

- Chapter 5: IRA Strategy (And the Value of Flexibility) — How to use IRAs optimally to minimize your lifetime tax liability.

- Chapter 6: Asset Location (And the Greatest Investment Ever Made) — Why it matters where you hold your bonds.