Executive Summary

- Location matters: smart investors will combine asset classes (such as stocks and bonds) and account types (such as a 401(k) or Roth IRA) in ways that minimize the lifetime tax liability.

- The nuances of the U.S. tax code create opportunities for “arbitrage” for investors who take advantage of volatility in taxable income.

Up to now, this guide has largely provided guidance for getting as much of your portfolio as possible into tax advantaged structures such as IRAs, HSAs, and 401(k) accounts.

In this chapter, I’m going to talk about some optimizations that you can make once you’ve accomplished this. These are some strategic moves that you can make to further optimize the tax efficiency of your portfolio.

I’ve saved these until now, because they build on the principles and concepts that you’ve learned throughout the guide.

There are two main ideas that I’m going to cover in this chapter.

First, I’ll talk about the importance of pairing up certain asset classes (such as stocks, bonds, and real estate) with certain account types (such as a 401(k), Roth IRA, and taxable brokerage account). As you’ll see, this exercise can bear significant fruit.

Second, I’ll touch on tax arbitrage opportunities. Specifically, I’m going to discuss specific ways that you can “liberate” your investments in a tax efficient manner by taking advantage of the nuances of the tax code as well as the ebbs and flows of your professional life.

Download This Guide As a PDF

Get the full PDF version of this Ultimate Guide To Tax Efficient Investing.

Your free instant download includes special bonus content.

Lessons From The Greatest Investment Ever Made

In 2004, Peter Thiel made what is perhaps the greatest investment of all time: he bought a little more than 10% of Facebook for $500,000 (just think about that for a second).

The most amazing thing about this investment isn’t the 200x return he realized in eight years. It’s the taxes he paid when he sold his shares for $1 billion following the 2012 IPO.

$0.

Thiel realized that asset location matters, and that smart investors will put the assets with the highest expected appreciation into a Roth IRA.

You can learn more about Thiel’s massive Roth IRA below, and then continue reading to understand how you can apply this lesson to your own portfolio.

The Investing "Green Thumb"

My favorite aunt loved gardening. She had a beautiful yard, and her house was always full of colorful bouquets.

She always tried to pass on her green thumb to me, but I was never a great student. I came to realize many years later, however, that there were lessons from her garden that made me a better investor.

You see, different plants have different optimal growing conditions. If you plant petunias in the shade and hostas in the sun, you’re not going to have much of a garden.

But if you switch that up – and you get a little bit of rain – you’ll have a beautiful yard.

That same principle applies to tax efficient investing as well.

Some asset classes will do best in a Roth IRA. Others might be best suited for a 401(k).

Garden Varieties

Each account structure – taxable account, Traditional IRA/401(k), Roth IRA/401(k) – has certain advantages and disadvantages. By strategically matching up the account type and the asset class, it’s possible to generate excess returns – more free lunch.

Consider how qualified dividends are taxed in various accounts:

| Account Type | Tax On Dividends (When Received) | Tax On Dividends (Upon Withdrawal) |

|---|---|---|

| Roth IRA | 0% | 0% |

| Traditional IRA | 0% | Up to 37%, Plus State Taxes |

| 401(k) | 0% | Up to 37%, Plus State Taxes |

| Taxable Account | Up to 23.8%, Plus State Taxes | n/a |

It’s a similar story for interest income generated from bonds, except with an even higher tax rate:

| Account Type | Tax On Interest (When Received) | Tax On Interest (Upon Withdrawal) |

|---|---|---|

| Roth IRA | 0% | 0% |

| Traditional IRA | 0% | Up to 37%, Plus State Taxes |

| 401(k) | 0% | Up to 37%, Plus State Taxes |

| Taxable Account | Up to 37%, Plus State Taxes | n/a |

With capital gains, however, a new wrinkle is introduced. Because all withdrawals from Traditional IRAs and 401(k)s are taxed as Ordinary Income, that means that capital gains are effectively subject to these taxes as well.

A taxable account actually has some advantages here over a Traditional IRA or 401(k), since capital gains are taxed more favorably than Ordinary Income.

| Account Type | Tax On LT Capital Gains (When Received) | Tax On LT Cap Gains (Upon Withdrawal) |

|---|---|---|

| Roth IRA | 0% | 0% |

| Traditional IRA | 0% | Up to 37%, Plus State Taxes |

| 401(k) | 0% | Up to 37%, Plus State Taxes |

| Taxable Account | Up to 23.8%, Plus State Taxes | n/a |

An (Extreme) Asset Location Example

To illustrate the importance of asset allocation, I’m going to use a simplified and extreme example.

Assume an investor with:

- $500,000 in a Traditional IRA;

- $500,000 in a Roth IRA;

- California resident in the top tax brackets: 37% federal plus 14.4% state = 51.4%;

- Invests $500,000 in pre-IPO Facebook, which grows to $1 billion over 10 years;

- Invests $500,000 in bonds, which pay interest of 5% annually for 10 years.

Here’s what happens if this investor puts the Facebook investment in his Roth IRA, and the bonds in his Traditional IRA:

| Roth IRA: Facebook | Traditional IRA: Bonds | Total |

|

|---|---|---|---|

| Starting Value | $500,000 | $500,000 | $1,000,000 |

| Pre-Tax Value After 10 Years | $1,000,000,000 | $814,447 | $1,000,814,447 |

| Tax Due on Withdrawal | $0 | -$418,626 | -$418,626 |

| Ending Value | $1,000,500,000 | $395,821 | $1,000,395,821 |

And here’s what happens if he makes the exact same investments, but in the other accounts (i.e., holds the Facebook investment in his Traditional IRA):

| Roth IRA: Bonds | Traditional IRA: Facebook | Total |

|

|---|---|---|---|

| Starting Value | $500,000 | $500,000 | $1,000,000 |

| Pre-Tax Value After 10 Years | $814,447 | $1,000,000,000 | $1,000,814,447 |

| Tax Due on Withdrawal | $0 | -$514,000,000 | -$514,000,000 |

| Ending Value | $1,314,447 | $486,000,000 | $486,814,447 |

In this example, the asset location decision was worth an extra $513 million — more than 100% of the final value of the portfolio under the second scenario.

This makes sense intuitively: in Scenario #1, the investor maximized the tax advantages of the Roth IRA — avoidance of any future taxation on dividends or appreciation — by “applying” these benefits to the asset class that would experience huge growth.

Dive into the data behind this example. Click here to open the underlying calculations in a Google Sheet. You can save as an Excel file or to your personal Google Drive.

Asset Location Rules of Thumb

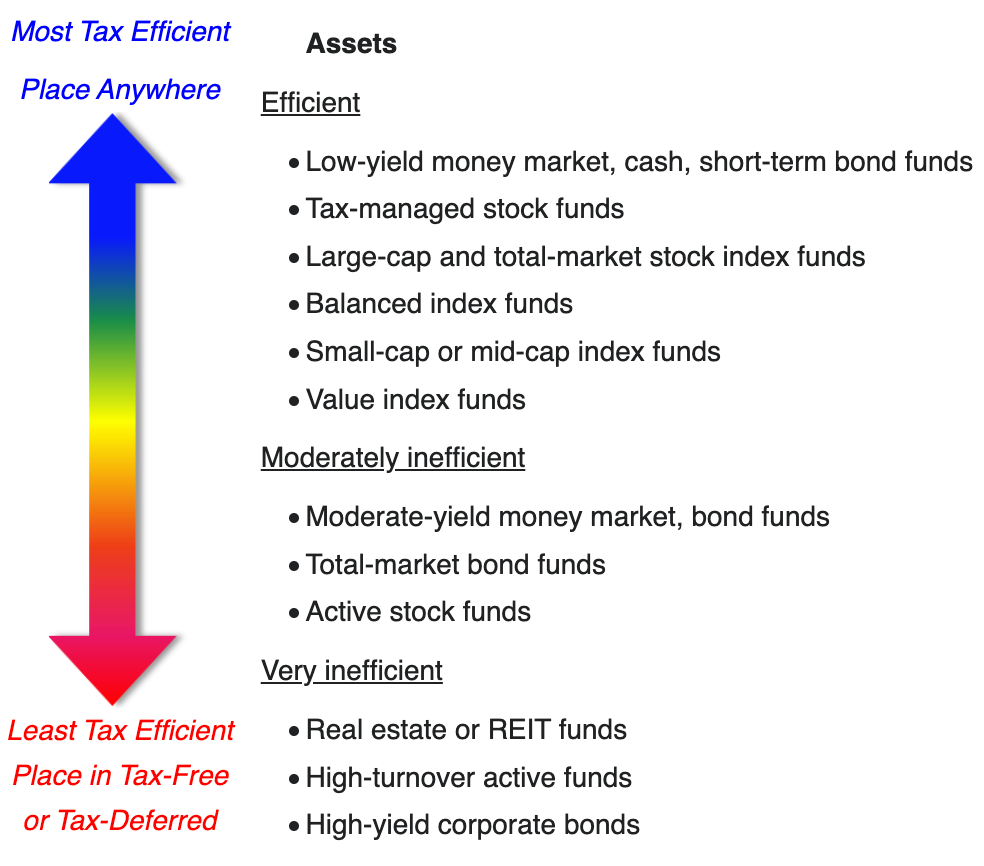

Some asset classes are more tax efficient than others. Corporate bonds, for example, make regular interest payments that are treated as Ordinary Income — and thus taxed at relatively high rates.

In general, you want to put your least tax efficient asset classes in tax advantaged accounts. The table below provides a general summary of the tax efficiency of various asset classes:

Source: Bogleheads.

Tax Efficient Asset Location Rules of Thumb

For most investors, here’s the asset location strategy that will make the most sense:

- Hold bonds in your Traditional IRA.

- This shields interest payments from Ordinary Income rates, allowing you to reinvest all interest received.

- Hold assets with high expected capital appreciation in a Roth IRA.

- As shown above, this allows you to avoid all future taxes.

- This may be international stocks (including emerging markets) or real estate.

- In your taxable account, hold a diversified, low turnover domestic stock fund.

At a high level strategy, this approach will be optimal for most investors. Of course, your individual circumstances — and your best approach — may vary.

If you’d like to dive deeper into this topic, watch the video below:

Tax Arbitrage

I’ve been fortunate to interview a lot of brilliant fund managers, tax planners, attorneys, and accountants.

Beyond their technical wisdom, many of them have offered deep insights into tax efficient investing principles.

A couple come to mind that are important for this chapter.

Here’s one:

For many high earners, accumulating assets is easy. It’s the “de-accumulation” part that is hard.

Here’s another:

Start at the end.

Both of these suggestions relate to the concept of tax arbitrage: deferring taxes when your marginal rates are high, and paying taxes – or triggering taxable events – when your marginal tax rates are low.

This is a pretty simple concept intuitively. But theory is ultimately worthless: you need to understand how to implement it in the real world. So let’s consider a couple of examples.

Smart Roth Conversions

Consider a couple that has built up $1 million in a Traditional IRA by diligently putting away the maximum amount each year and investing in a tax efficient U.S. stock fund.

This couple is expecting to experience quite a bit of volatility in earnings over the next few years. After being in a very high tax bracket for the past few years, they’re expecting the future to look quite different.

Over the next two years, they’re planning to take time off to bike across the country and then start a business when they return.

They don’t expect to make much money over the course of these two years:

| Year | Taxable Income | Marginal Tax Rate [a] |

|---|---|---|

| Two Years Ago | $500,000 | 35% |

| Last Year | $550,000 | 37% |

| This Year | $600,000 | 37% |

| Next Year | ($100,000) | 0% |

| Two Years Ahead | $25,000 | 12% |

| Three Years Ahead | $600,000 | 37% |

[a] Based on 2023 brackets for married filing jointly. Ignores state tax impact.

There are a couple of ways to look at a table like this one. Most people will be terrified; the idea of making no money for two years is a scary thought.

Tax efficient investors, however, will be salivating – because they see a golden opportunity to make a couple of smart tax moves during the low income years.

To understand this, I’ve added a column to the table below that shows the cost of converting $100,000 from the couple’s Traditional IRA to a Roth IRA in each year:

| Year | Taxable Income | Marginal Tax Rate [a] | Cost of $100k Roth Conversion |

|---|---|---|---|

| Two Years Ago | $500,000 | 35% | $35,000 |

| Last Year | $550,000 | 37% | $37,000 |

| This Year | $600,000 | 37% | $37,000 |

| Next Year | ($100,000) | 0% | $0 |

| Two Years Ahead | $25,000 | 12% | $16,145 [b] |

| Three Years Ahead | $600,000 | 37% | $37,000 |

[a] Based on 2023 brackets for married filing jointly. Ignores state tax impact.

[b] $58,550 on the conversion would be at a 12% rate; the remaining $41,450 would be at a 22% rate.

There is value in converting dollars from a Traditional IRA to a Roth IRA. Once dollars are in a Roth IRA, they’re done being taxed forever. You’ll pay no taxes on dividends or interest income, and you’ll pay no taxes when you sell and withdraw.

There is also a cost to this exercise: a Roth conversion is a taxable event, and the amount that you convert is taxed as Ordinary Income.

But this cost varies, as the table above shows. In general, it’s a bad idea to do a Traditional to Roth conversion in a year when you are making a lot of money.

It’s a much better idea to do a conversion in a year when your income is lower.

Practically, there can be a number of reasons why you might experience a year of low income.

Perhaps you’re going back to school or starting a new business that won’t pay you much. Maybe you have a big loss from a pass-through entity. Maybe you’re just taking a year off to spend with your kids or to travel the world.

Regardless of the reason, low income years represent a wonderful opportunity to convert part of your Traditional IRA to a Roth IRA.

Think of it as a “sale” on a product that is tremendously valuable to you. You want to stock up when the “price” of this good – the taxes that you’ll owe to execute the conversion – is deeply discounted.

One quick note: it’s important to understand how a progressive tax code works when planning out Roth conversions. Using the example above: this hypothetical couple may not want to convert their entire Traditional IRA in a low income year, because that would generate $1 million in taxable Ordinary Income.

Some of that amount would be taxed at relatively low rates, but much of it – anything over about $578,000 – would be taxed at the sky high 37% rate.

The video below dives into the math behind this concept:

Harvesting Gains

Throughout the course of this guide, I’ve mentioned several times that a taxable brokerage account is generally the least desirable place to hold appreciating assets.

Taxable accounts must be funded with after-tax dollars; unlike a 401(k) or Traditional IRA, contributing to one doesn’t reduce your taxable income this year.

They also don’t experience tax free growth; and dividends from stock or interest from bonds will result in an immediate tax liability, which creates a “tax drag” and reduces your effective rate of return.

And withdrawals from a taxable brokerage account are generally a taxable event, unlike a Roth IRA.

But the key word there is generally.

Unlike a 401(k) or a Traditional IRA (where withdrawals are treated as Ordinary Income), taxable brokerage account withdrawal “costs” are based on Capital Gains rates.

There are three nice things about that.

- First, Capital Gains tax rates are generally lower than Ordinary Income tax rates.

- Second, only part of the withdrawal – the amount of the gain – is taxed.

- And, finally, the structure of the Capital Gains tax rates creates some opportunities for tax efficient investors to lower their lifetime tax bill.

Specifically, if your income (including long term capital gains) is less than $89,250 for a married couple, your capital gains tax rate is 0%.

Many investors are familiar with the concept of Tax Loss Harvesting, which involves selling poorly performing stocks to generate a capital loss – thereby reducing your taxable income this year.

But Tax Gain harvesting can be an even more powerful tool.

To understand how you can use this in your favor, let’s take a look at another real world example.

We’ll use our same hypothetical couple, who are anticipating some volatility in their income in coming years.

Let’s assume that they have a taxable account with $100,000 of Vanguard Total Stock Market Fund (VTSAX). The cost basis – what they initially paid for the stock – is just $25,000. That means that, if they were to sell the stock, they would have a capital gain of $75,000.

| Year | Taxable Income | Marginal Capital Gain Tax Rate [a] | Cost of $100k VTSAX Sale |

|---|---|---|---|

| Two Years Ago | $500,000 | 15% | $12,308 |

| Last Year | $550,000 | 15% | $14,808 |

| This Year | $600,000 | 20% | $15,000 |

| Next Year | ($100,000) | 0% | $0 |

| Two Years Ahead | $25,000 | 0% | $1,613 |

| Three Years Ahead | $600,000 | 20% | $15,000 |

[a] Based on 2023 brackets for married filing jointly. Ignores state tax impact.

Again, the exact same move – selling $100,000 worth of stock – comes at a drastically different price tag depending on the year.

This couple could sell the stock next year without paying a nickel in capital gains taxes, and use the proceeds to fund their living expenses while they travel.

Tax Gain Harvesting can be a useful tool for liquidating investments to fund living expenses during low income years. But it can also be a worthwhile exercise even if you don’t need the money.

Here’s what I mean…

Let’s say this hypothetical couple sold their VTSAX next year… and then immediately reinvested the $100,000 proceeds back into VTSAX.

- They would have harvested the unrealized capital gain while they were in a 0% tax bracket.

- And they would have reset their basis in the stock to $100,000.

To understand the value in accomplishing that, let’s fast forward ten years.

- Now that VTSAX is worth $200,000.

- Instead of sitting on an unrealized capital gain of $175,000, this couple would incur only $100,000 of capital gains if they were to sell their position to fund living expenses in retirement.

By harvesting the capital gain at an opportune time – in a year when income was low – this couple reduced future taxable income by $75,000.

For many investors, the years between the end of their professional career and the start of Social Security payments represents a golden window of tax planning opportunity.

Income in these years is low; you’re no longer receiving a salary, but your Social Security checks haven’t yet started coming in. This can be a great time to harvest gains from your taxable accounts, either using the proceeds to fund your living expenses or simply reinvesting them immediately to reset your basis in a tax efficient manner.

Smart Withdrawal Strategies

Many investors spend a lot of time thinking about how they can fund and grow their investment accounts, including their tax-deferred accounts like 401(k)s and Traditional IRAs and tax-free accounts like Roth IRAs.

They often overlook the importance of withdrawing from these accounts. This is another area where strategy can matter quite a bit.

Consider a 60-year old couple that has recently retired with a $3 million portfolio, split evenly ($1 million in each) between a taxable account, Traditional IRA, and Roth IRA:

| Account | Value |

|---|---|

| Taxable Brokerage | $1,000,000 Basis: $250,000 |

| Traditional IRA | $1,000,000 |

| Roth IRA | $1,000,000 |

They could take it from the Roth IRA, and the entire amount would be tax free.

They could withdraw from the Traditional IRA, in which case the withdrawal would be taxed as Ordinary Income. A married couple with $100,000 in Ordinary Income would pay about $14,700 in federal income taxes.

Or they could liquidate part of the taxable account. They’d incur a $75,000 capital gain in doing so, but because that would be the entirety of their income for the year, this couple would find themselves in the 0% capital gain tax bracket.

This third strategy – withdrawing from the taxable account – is probably the optimal one for this hypothetical couple. In addition to avoiding any taxes on the withdrawal, they also allow their investments in tax-sheltered accounts to continue to grow.

Remember, tax-deferred accounts (such as a 401(k) or a Traditional IRA) and tax-free accounts (such as a Roth IRA) do not experience the “tax drag” that lowers the effective returns for taxable accounts.

Rules of Thumb

This is a somewhat complex topic; the wide range of possible scenarios can make it a bit challenging to provide hard and fast rules around withdrawal strategies.

Hopefully the examples in this chapter have given you the framework you need to evaluate your own scenario, and determine the withdrawal strategy in retirement that makes the most sense for you.

There are some general rules of thumb that can be helpful.

Ideally, withdrawals in retirement will accomplish two things:

- Number one: they will be tax free.

- Number two: they will leave your tax-free accounts intact, allowing them to continue to grow.

If you can accomplish both of these – like our hypothetical investor in the example above – that’s probably the ideal strategy.

In our example, knowledge of the capital gains tax brackets allowed this couple to withdraw $100,000 without incurring any taxes. And they didn’t have to tap into either the Roth IRA or Traditional IRA, maximizing the ability of those tax-advantaged accounts to continue to grow.

It won’t always be that easy.

Sometimes you’ll have to decide between a withdrawal from a taxable account that will result in a tax bill or a withdrawal from your Roth IRA.

- The former would accomplish goal #2 (leaving your IRAs untouched), but not #1 (you’d owe taxes).

- The latter would accomplish goal #1 (you’d have a tax free withdrawal), but not #2 (you’d reduce the value of your Roth IRA).

Closing Thoughts

Many investors looking to minimize their lifetime tax bill spend significant time working to maximize contributions to tax advantaged accounts. But your work isn’t complete once the contribution is made.

It’s also important to think about how to maximize the impact of these tax advantaged accounts by:

- Finding the optimal “pairings” between the asset classes that make up your portfolio and the various accounts types; and

- Developing a withdrawal strategy that allows you to minimize taxes paid when you liquidate your investments to pay for retirement expenses.

Download This Guide As a PDF

Get the full PDF version of this Ultimate Guide To Tax Free Investing.

Your free instant download includes special bonus content.

Table of Contents

This page is part of our Ultimate Guide To Tax Efficient Investing. Follow the links below to read through the entire guide. Or, click here to download the full PDF version.

- Chapter 1: Why Taxes Matter (The One Big Myth) — The impact of taxes on your portfolio.

- Chapter 2: The Four (Yes, Four) Types Of Income Taxes — Understanding the “default” tax treatment your income receives.

- Chapter 3: Guiding Principles (And An “Aha Moment”) — Six rules of thumb that will make your life easier.

- Chapter 4: The 401(k) (Your Tax Free “Workhorse”) — My the 401(k) is the most powerful wealth creation account for most investors.

- Chapter 5: IRA Strategy (And the Value of Flexibility) — How to use IRAs optimally to minimize your lifetime tax liability.

- Chapter 6: Asset Location (And the Greatest Investment Ever Made) — Why it matters where you hold your bonds.