Estimated reading time: 6 minutes

“Start at the end” is sound advice in many situations. And it certainly applies to the process of retirement planning.

In this article:

Why It Matters

We created WealthChannel Academy with the goal of radically simplifying retirement planning — and bringing it within reach to millions of Americans.

We understand why planning and investing for retirement feels so complex: the amount of information is overwhelming. There are multiple 24/7 financial news networks. Hundreds of websites. Thousands of videos, and millions of articles.

But investors don’t need to know a million things. They need to know seven things. There are seven key concepts. Understand these, and you’ll “win.”

The first thing investors need to understand is their goal. What is the endgame? What are they working towards? Why are they doing this planning, saving, and investing?

If you don’t start at the end and first figure out what you’re working towards, you’re unlikely to make it to your destination.

The Big Picture

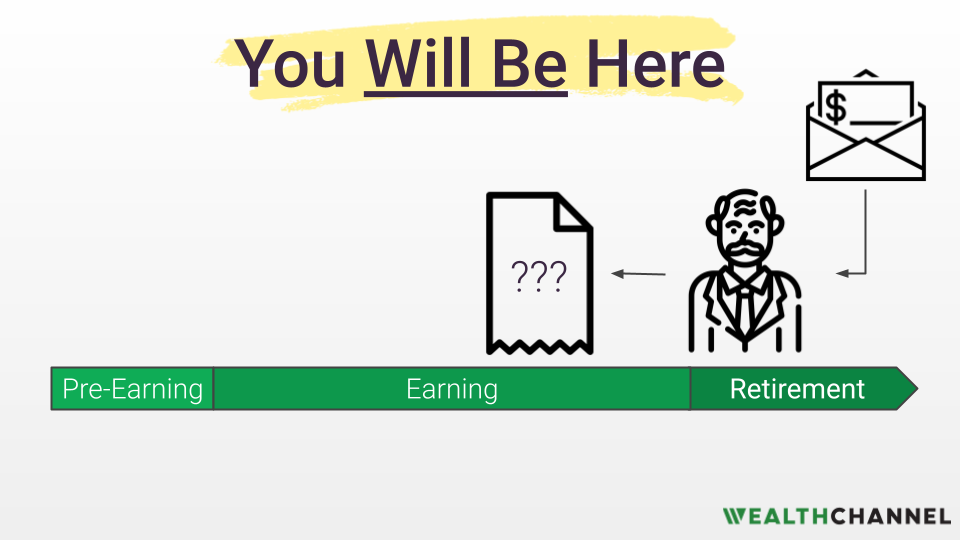

Let’s start with the big picture. If you’re reading this, odds are that you are in the “Earning” or “Accumulation” phase of your life — sometime between school and retirement:

Right now you have money coming in from a job or business, and you have money going out to pay for things like groceries, healthcare, kids, vacations, etc.

Someday, you’ll be here – in your retirement years.

You may look quite a bit different – you’ll have a few more wrinkles and gray hair – but your financial system may actually look a lot like it does now.

You’ll still have money coming in, but it won’t be in the form of a paycheck from your employer. Instead, it will be coming from Social Security, any pensions you may have, and your retirement savings.

But don’t worry about where the money is coming from for now. The first thing you need to figure out is: where is that money GOING in retirement?

In other words, how much are you going to be spending each year on needs – like food and utilities – as well as your wants – like vacations and entertainment.

Types Of Retirement Expenses

There are two broad categories of retirement expenses: essentials, and discretionary. Or, you can think of this as “Needs” and “Wants.”

Your Needs include things like housing, food, utilities, transportation, and clothing.

Your Wants include things like travel, charitable contributions, entertainment, and gifts.

| Essential Retirement Expenses (Needs) | Discretionary Retirement Expenses (Wants) |

|---|---|

| Housing (Mortgage / Rent, Property Taxes, Maintenance & Improvements) | Travel (Airfare, Hotel, Entertainment) |

| Utilities (Phone, Internet, Water, Electric/Gas, Trash) | Dining Out |

| Transportation (Gas, Car Insurance, Repairs) | Entertainment |

| Healthcare (Health Insurance, Medications, Dental, Vision) | Pet Care |

| Clothing | Charitable Contributions |

| Groceries | Gym Memberships |

The table above is by no means exhaustive, but it is a good starting point for thinking about the expenses that you’ll have in retirement.

Retirement Expense Worksheet

Below is a link to the WealthChannel Academy Retirement Expenses Worksheet. This resource is pretty intuitive: for each line item – each expense – make your best estimate for what you will need or want to spend in retirement. You can enter the number on a monthly or annual basis – whatever is easiest for you.

Then you enter in an assumption about how much prices will increase each year between now and your retirement. By default, our spreadsheet uses 3% – that’s a pretty good estimate of what inflation has been historically – but you can enter in your own assumptions.

This tool will calculate your expected annual expenses in retirement. This is the first concept you need to grasp. This is your endgame – you want to be able to spend this amount annually in retirement.

Download This Calculator

Common Mistakes

This is a pretty straightforward exercise. But it’s important to note here that there is inherent uncertainty in this process. Future expenses are impossible to know with absolute certainty.

There are two places where people often go wrong with this exercise.

Impact Of Inflation

The first mistake is to ignore the impact of inflation. It would be a mistake to assume that, for example, a gallon of gas is going to cost the same in 25 years.

That’s obviously not true. And this mistake could result in unrealistic expectations and bad outcomes. If you predict your future expenses based on current price levels, you may end up not saving nearly enough.

Think about if you were going through this exercise in 1980, when a gallon of gas cost about $1. If you’d projected that same expense during your retirement 40 years later, you’d find yourself with not nearly enough set aside:

Fortunately, this trap is pretty easy to avoid. The worksheet above incorporates inflation expectations for each line item, and allows you to either use one assumption for all costs or customize each line item.

Now, when you use this tool, you may experience a bit of a shock at how much you’ll be wanting to spend in retirement. Using just a 2% inflation rate over 25 years translates to about a 65% total increase. If you assume inflation will run at about 3%, that means costs will more than double over 25 years.

| Annual Inflation Rate | Impact Over 25 Years |

|---|---|

| 1% | +28% |

| 2% | +64% |

| 3% | +109% |

| 4% | +167% |

| 5% | +239% |

Now, the good news is that the money you are saving for retirement is going to grow as well. And, historically, a diversified portfolio of stocks and bonds has delivered returns greater than the rate of inflation.

Healthcare Costs

The second mistake relates to healthcare expenses in retirement. It’s easy to screw this estimate up, because for most people healthcare works a bit differently in retirement than it does during your working years.

Most American retirees are covered by Medicare, a federal health insurance for those over 65. I want to dive into this a little bit more, so we’re going to devote the next video in this series entirely to this topic. You can learn more about estimating retirement healthcare expenses here.

Bottom Line On Retirement Expenses

There’s not a “right” or a “wrong” number to come up with from this exercise. Everyone is going to be different. Some people may be very happy spending $50,000 a year in retirement. Others will want to spend $100,000 or more a year.

Your objective should be to get as good of an estimate as possible. In other words, a “good” number is an accurate one. If you do that, you’ll understand what your endgame is. And that is a HUGE first step.

You’ve essentially figured out half of the equation – what you’re planning to spend. Now you just need to figure out how to pay for it…

Next Article: How To Estimate Healthcare Expenses In Retirement (Coming Soon)

How An Advisor Can Help

Some investors will be comfortable estimating their anticipated retirement expenses on their own, while others may prefer to receive some assistance from a fiduciary financial advisor.

An advisor can assist with more detailed projections and modeling more complicated scenarios that may include:

- Large “lump sum” cash outlays such as a vacation home or charitable contribution;

- Planning to leave a meaningful inheritance to heirs or beneficiary charities;

- Living abroad during part of your retirement; or

- Being prepared for “extreme” scenarios, such as hyperinflation… or living to be 120.

About WealthChannel Academy

This article is part of WealthChannel Academy, the ultimate guide to planning a worry-free retirement.

WealthChannel Academy has a simple premise: to build a $1 million portfolio and enjoy a worry-free retirement, you need to understand just 7 basic concepts. WealthChannel Academy is your guide to simple and effective retirement planning, without the hype.