The sad reality is that most Americans find retirement planning to be completely overwhelming — and with good reason. The problem isn’t that there’s too little information out there — it’s that there’s too much. Lots of folks feel like they need to understand a million different things to be successful.

But that’s just not the case. You need to understand seven basic concepts. Understand those, and your odds of a worry-free retirement skyrocket.

WealthChannel Academy is your guide to these seven concepts. Here you’ll find simplified explanations of what matters — with none of the noise.

So what are the seven concepts that matter? I’m glad you asked!

#1: The Goal

I’m a big believer in “starting at the end.” Whether baking a cake or planning for retirement, it’s always helpful to start with your “destination” in mind if you want to be successful.

At a high level, there are three phases in life:

| Phase | Also Known As | Your Financial Goal(s) |

|---|---|---|

| Pre-Earning | School | Prepare yourself to earn and accumulate |

| Earning | Accumulation | Earn and save (accumulate) |

| Retirement | De-Accumulation | Enjoy yourself 😎 |

If you’re reading this, odds are that you’re in the “Earning” or “Accumulation” phase of your life. For most people, this spans several decades between their schooling and their retirement.

You probably have money coming in from your job, and money going out to pay bills.

The Goal is to someday transition to your Retirement Phase. In this Retirement Phase, you’ll still have money coming in — but don’t worry about that yet.

The first thing you need to understand is: what are you going to spend money on in retirement?

This includes your “Needs” — things like groceries and shelter — and your “Wants” — things like travel and entertainment.

Until you know what you want to spend in your Retirement Phase, it’s pretty difficult to effectively plan for it.

An upcoming WealthChannel Academy video will walk you through exactly how to determine what you need and want to spend in retirement. But for now, let’s assume that you conclude you need $100,000 annually for your desired retirement.

#2: The Need

Once you know how much you want to spend in retirement, you can figure out how much you need to fund that spending.

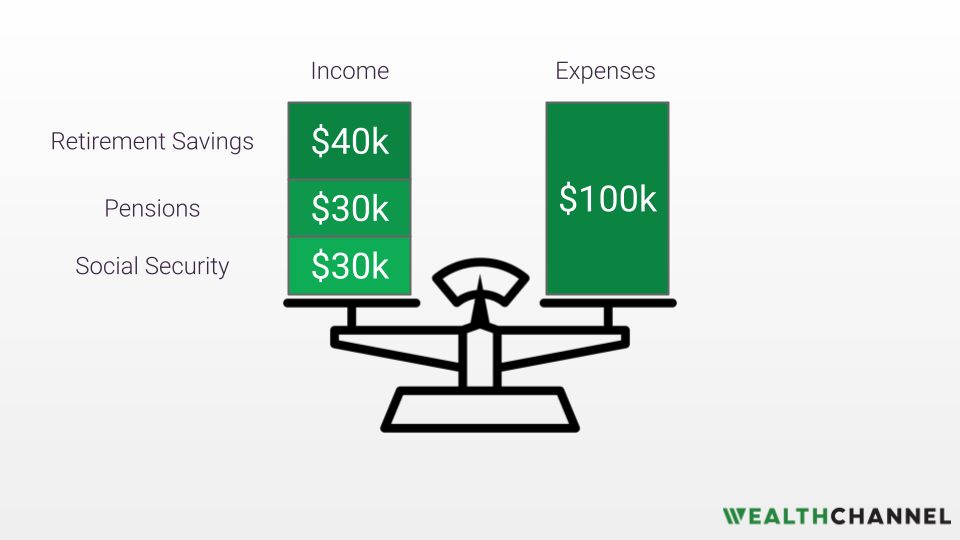

Most Americans have three potential sources of income in retirement:

| Source | Comes From | Notes |

|---|---|---|

| Social Security | U.S. Government | Amount will vary1 |

| Pension | Employer(s) | Not offered by all employers2 |

| Retirement Funds / Savings | You! | Usually a combination of 401(k)s, IRAs, and other savings accounts3 |

2 Pensions are no longer common; most Americans will NOT get a pension from their employer.

3 If you’re not sure what these terms mean… don’t worry! A future WealthChannel Academy episode will explain everything you need to know.

Let’s assume that you will receive $30,000 annually from Social Security and another $30,000 annually from an employer pension.

You want to spend $100,000 in retirement each year, so that leaves a gap of $40,000. This is the amount that you will need to fund from your own retirement savings.

This is your Need. We’ll cover how to calculate the amount you need to fund this level of expense in a future episode. For now, let’s assume you determine that you need $1 million saved.

#3: The “How”

Once you’ve determined how much you need for a worry-free retirement, the obvious question becomes: how do you get there?

Now, a lot of people are going to feel pretty intimidated at this stage — the prospect for saving $1 million or more for retirement can be pretty overwhelming.

But I have a couple pieces of good news.

First, you don’t have to do this overnight. The earlier you start, the more manageable this becomes.

The second piece of good news: historically, the stock market has been a pretty effective tool for growing wealth:

There’s a pretty simple and straightforward playbook for this part, which is covered in a separate video.

But a lot of investors screw this part up. Which leads me to the next thing you need to understand…

#4: The Traps

In general, there are three places where investing for retirement goes off track:

- Paying too much in fees;

- Paying unnecessary taxes;

- Falling into “behavioral traps” like panic selling or performance chasing.

Unfortunately, these mistakes are both common and financial devastating. The chart below shows what happens to an hypothetical investment of $100,000 with and without paying 3% in fees and tax drag annually:

Fortunately, these traps also pretty easy to avoid. We’ll break these down in a future episode of WealthChannel Academy.

#5: The Tools

Once you know where the traps are, you’ll appreciate that there are some “tools” that can help you avoid them.

I like to think of these tools as hiking gear. Let’s assume you’re climbing a mountain. Sure, you could set out to do it barefoot and without any gear. Maybe you’d make it to the top.

But your odds of reaching your destination go way up if you put on some hiking boots, pick up a couple hiking poles, and fill up a water bottle.

In this analogy, the “tools” or “gear” are things like IRAs, 401(k)s, and 529 plans. This alphabet soup might be causing your eyes to glaze over. But these tools are way easier to understand than their clunky names would lead you to believe.

Here’s some more good news: these tools are free and widely available, and they can make a massive impact on your wealth.

Here’s just one example: $23,000 invested in a 401(k) and returning 8% would grow to about $118,000 after 25 years.

Outside of a 401(k), the expected future value is just $79,000 — a difference of nearly $40,000!

This illustrates the importance of using the right tools, and future episodes of WealthChannel Academy will cover this in more detail.

Those are five key concepts. If you understand these, you’re ahead of 99% of investors and you are well on your way to a worry free retirement.

But there are two more concepts that I think are important…

#6: The Legacy

In other words: what happens to your stuff after you die?

This might feel morbid to discuss, but you are much better off considering this now as opposed to leaving it for your heirs to figure out later.

Here’s the bottom line: doing a a couple of basic “estate planning” tasks now will help to ensure two things:

- Your money ends up where you want it to — with your heirs or beneficiary charities — and not with the IRS; and

- Your heirs don’t also inherit a legal and administrative mess from you.

#7: The Team

Some investors will be comfortable doing all of this on their own. Others will want some help along the way, such as a CPA to prepare taxes, an attorney to create a will, and a financial advisor to help navigate some of these issues.

Every situation is different, so your “team” might look a little different than your neighbor’s.

Regardless of which route you go, it’s important to understand a few things about the team:

- How they’re compensated, and what their obligations are to you;

- What you should expect from them (and what you shouldn’t); and

- How to find high quality good professionals.

For what it’s worth, I encourage most folks who ask me to use a financial advisor. The value they provide in helping investors navigate the “traps” I mentioned above is enough to justify the fees charged in many cases.

But not all financial advisors are created equal. It’s important to find a fiduciary advisor who provides holistic financial wealth management services.

We’ll cover exactly what this means in some future episodes.

About WealthChannel Academy

About WealthChannel Academy

This article is part of WealthChannel Academy, the ultimate guide to planning a worry-free retirement.

WealthChannel Academy has a simple premise: to build a $1 million portfolio and enjoy a worry-free retirement, you need to understand just 7 basic concepts. WealthChannel Academy is your guide to simple and effective retirement planning, without the hype.