Estimated reading time: 11 minutes

Tens of millions of Americans rely on Social Security checks for a substantial portion of their retirement income.

Yet the outlook for this program is uncertain, due to shifting U.S. demographics. Is it true that Social Security is running out of cash? And what happens if it does?

In this article:

Why It Matters

You’ve probably seen a headline at some point that hints at an uncertain future for Social Security. You may have heard that the program is running out of cash, headed for bankruptcy, or something along those lines.

While it’s true that Social Security faces some severe financial challenges, the implications of those challenges aren’t as dire as some headlines would have you believe.

Whether you’re already in retirement or just starting out your career, it’s important to have realistic expectations of what Social Security will be able to provide during your lifetime.

Side Note: I’ll do my best to steer clear of politics here. This guide is about how Social Security actually works — and how it got to its current predicament — and not how I think it should work.

The Big Picture

Here’s the quick summary: Social Security is not going to disappear. But it’s possible that benefits change or are reduced from their current state.

That’s the short answer. Before we get to the long answer, I’ll start with a quick refresher and overview of the program.

Social Security is a program that is designed to replace a portion of your pre-retirement paycheck. Effectively, it is a forced or mandatory retirement savings program.

I like to break life down into three phases:

| Phase | Also Known As | Your Financial Goal(s) |

|---|---|---|

| Pre-Earning | School | Prepare yourself to earn and accumulate |

| Earning | Accumulation | Earn and save (accumulate) |

| Retirement | De-Accumulation | Enjoy yourself 😎 |

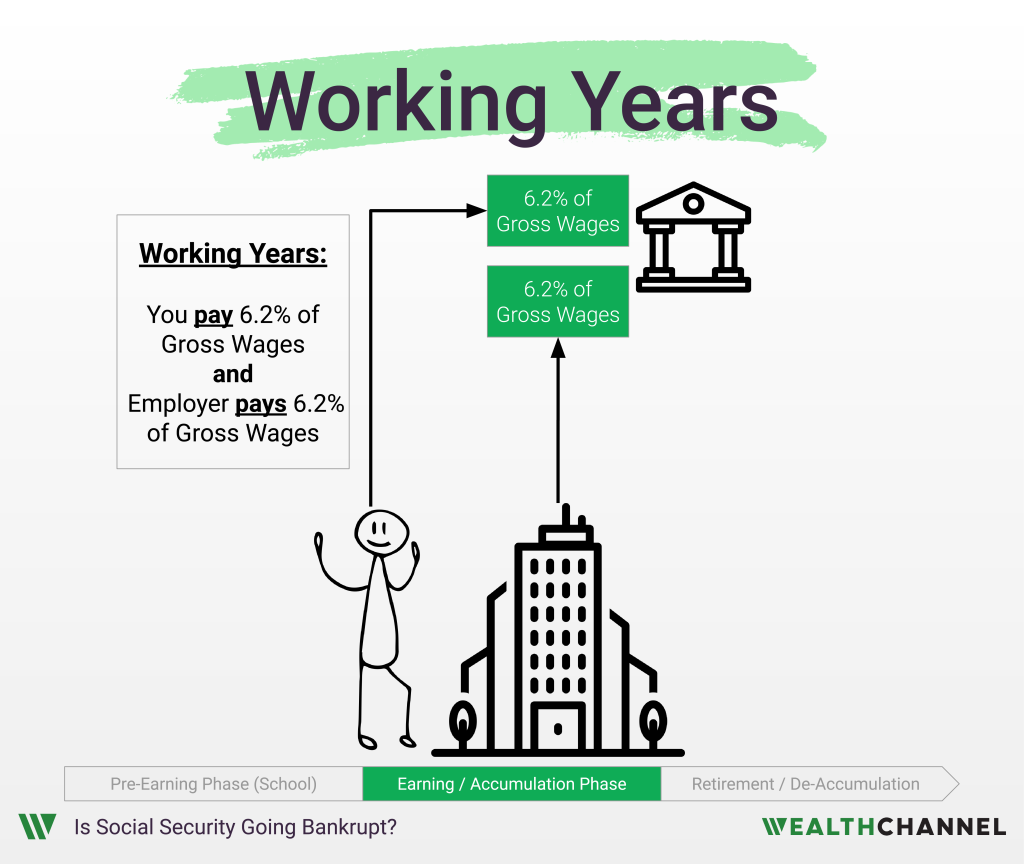

The inflows into Social Security come from the U.S. workforce — Americans in their Earnings Phase. Workers pay 6.2% of their gross wages into Social Security; you’ve probably seen a deduction on your paycheck called FICA. And their employers match that 6.2%, meaning that a total of 12.4% of gross wages are paid into Social Security.

The outflows from Social Security are to retirees. Most people have the option to start receiving benefits between the ages of 62 and 70. I covered the pros and cons of different benefit start dates in the last episode.

History Of Social Security

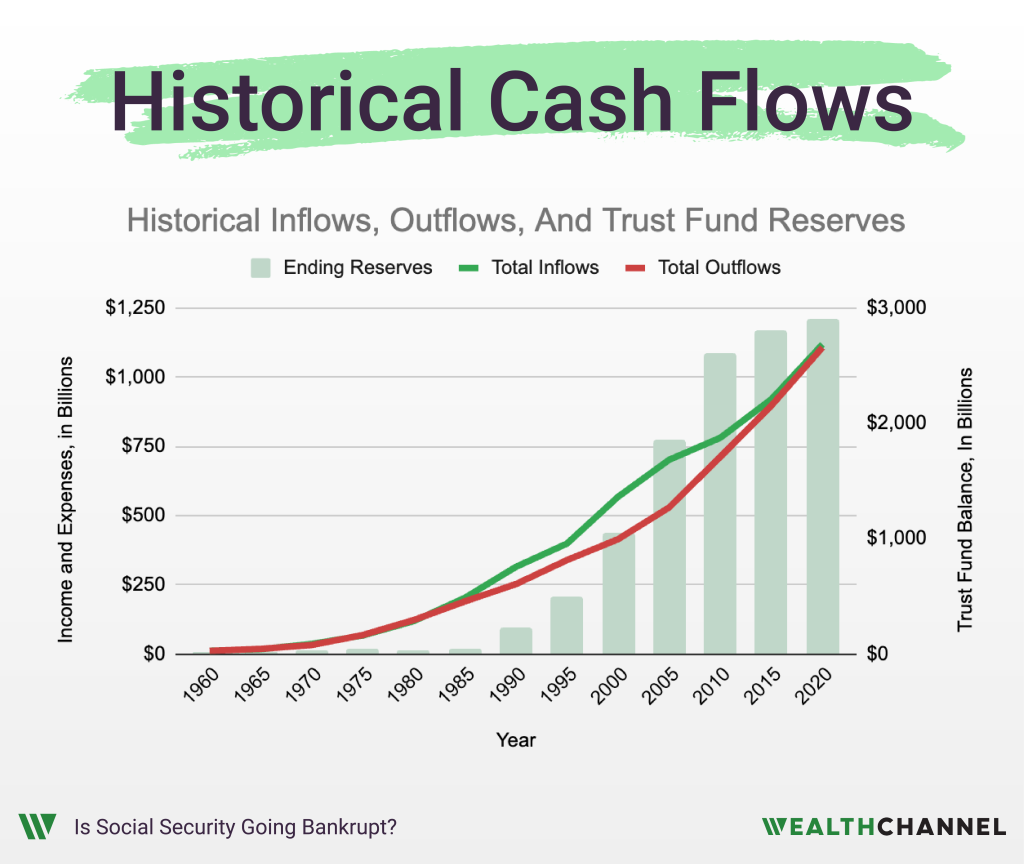

For most of the last several decades, the inflows to Social Security have been larger than the outflows. In 2005, for example, Social Security took in $702 billion but only paid out $530 billion in benefits. The difference – about $170 billion for that year – went into the Social Security Trust Fund.

Thanks to decades of surpluses, that Trust Fund had grown to about $2.8 trillion – with a T – in 2021.

But in the last couple years, the costs – or outflows – of Social Security have started to exceed the income – or inflows – of Social Security. And this is expected to continue – essentially indefinitely – going forward.

And so instead of the Trust Fund increasing in value each year, the government is dipping into this reserve to cover the difference between taxes collected and benefits paid.

And this reserve, or this Trust Fund, that was built to nearly $3 trillion over the last several decades is going to be depleted relatively quickly.

The Social Security Trust Fund will be drained by about $130 billion in 2024. That means it’s losing about $365 million a day, or more than $15 million every hour. And that is only going to accelerate; in 2030, it will decline by approximately $266 billion.

Based on the most recent projections, it is expected to run out entirely around 2033 – less than a decade from now.

Now, you might be wondering: what happened? Why can’t the tax collections cover the benefit payments like they did for so long?

Well, the short answer is that the number of people receiving benefits has increased a lot more quickly than the number of people paying taxes into the system.

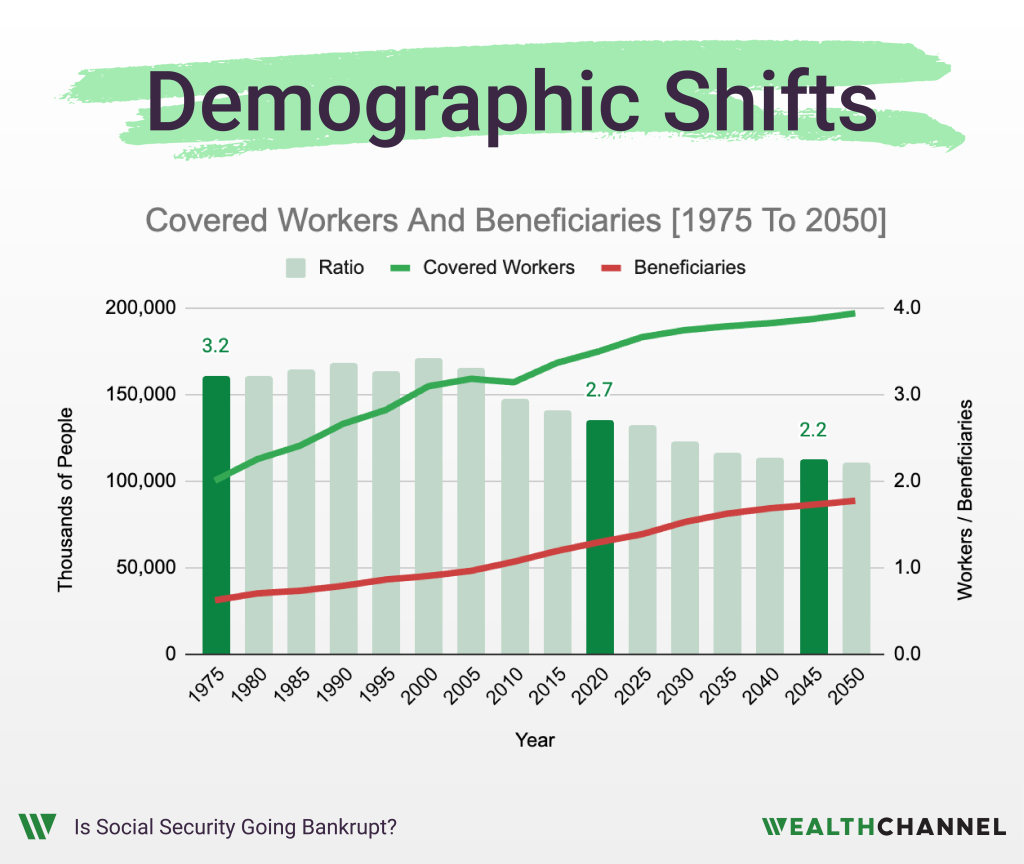

In 1975 there were about 100 million Covered Workers – Americans paying into Social Security – and about 31 million Americans receiving benefits. The ratio was about 3.1.

By 2020, there were about 175 million Covered Workers and 65 million Beneficiaries – a ratio of just 2.7. In other words, there are about 2.7 Americans paying Social Security taxes for every American who is receiving benefits.

And that ratio is expected to continue to decline; by 2045, it is expected to be just 2.2. And the upshot of that declining ratio is that there aren’t enough people working to generate enough in payroll taxes to cover all the benefit payments.

And there are two primary reasons why this happened, one good, and one not-so-good.

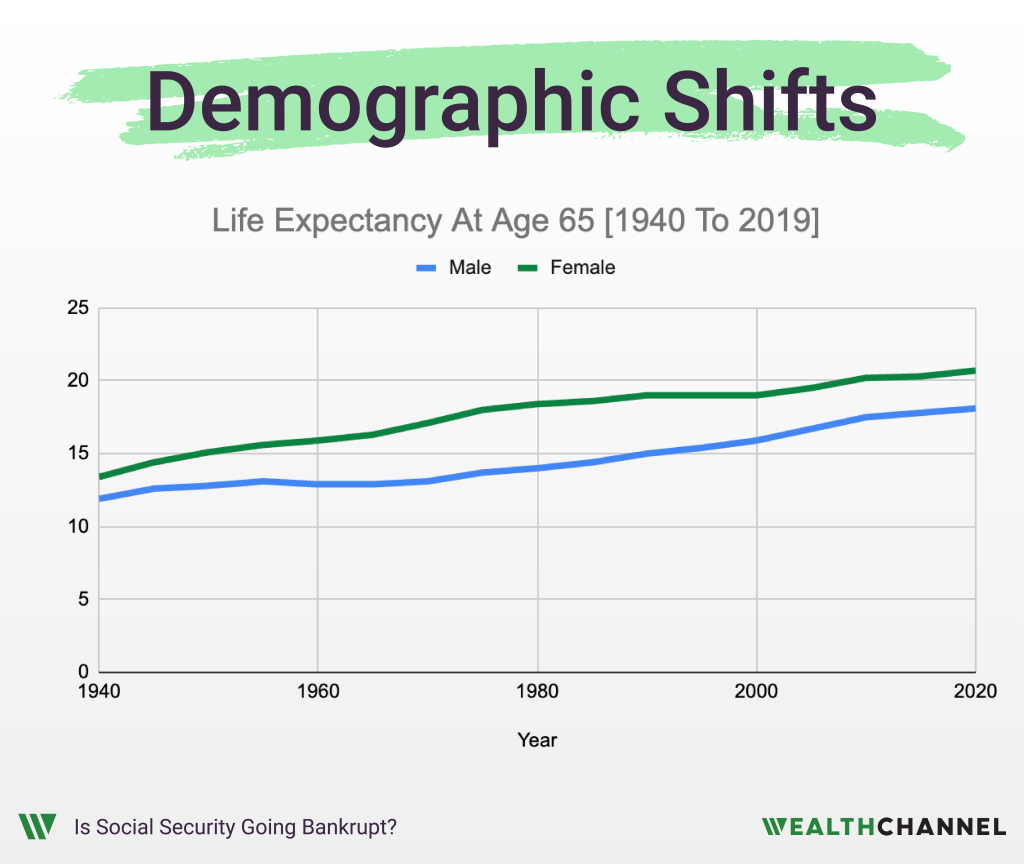

The first reason is that Americans started living longer. In 1970, the life expectancy at age 65 was about 13 years for men and 17 years for women. By 2019, that expectancy had increased by about 5 years for men and about 3 and a half years for women.

That’s great news of course, that Americans are living longer. Fiscally, an additional five years of life expectancy means another 60 monthly benefits payments from Social Security.

So that longer life expectancy has translated into higher outflows.

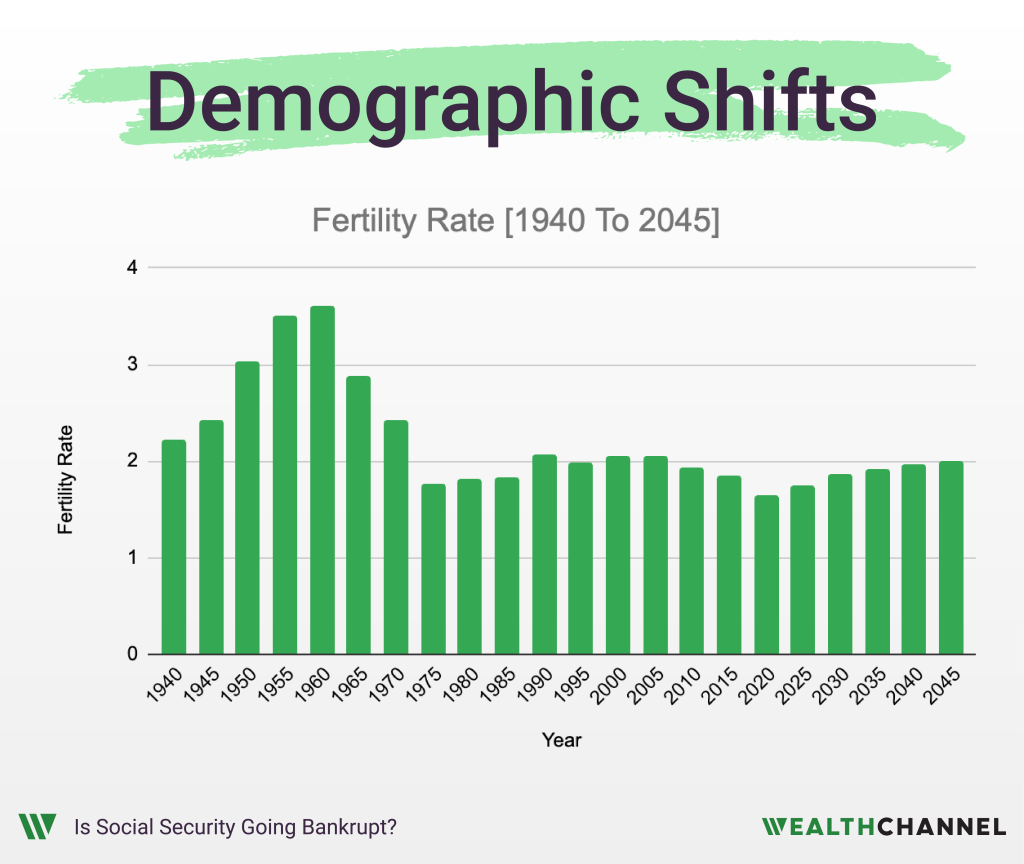

The other reason why there are no longer enough workers to cover the number of beneficiaries is that the birth rate has dropped – quite a bit actually.

In 1960, the U.S. fertility rate was about 3.6 – every American woman was having an average of 3.6 children. That dropped under 2 by 1995, then rebounded a bit in the early 2000s, and then fell precipitously to about 1.64 in 2020.

That is a massive change. And of course all those babies born in the 1960s are now retiring and there aren’t enough babies born in the late 1990s and early 2000s who are now entering the workforce to replace them.

Side Note: if you want to be skeptical about future projections for the Social Security program, this is where I don’t quite buy the predictions. The official estimates call for the fertility rate to start increasing again and climb to 2.0 over the next 20 years. And I just don’t buy that.

The Paths Forward

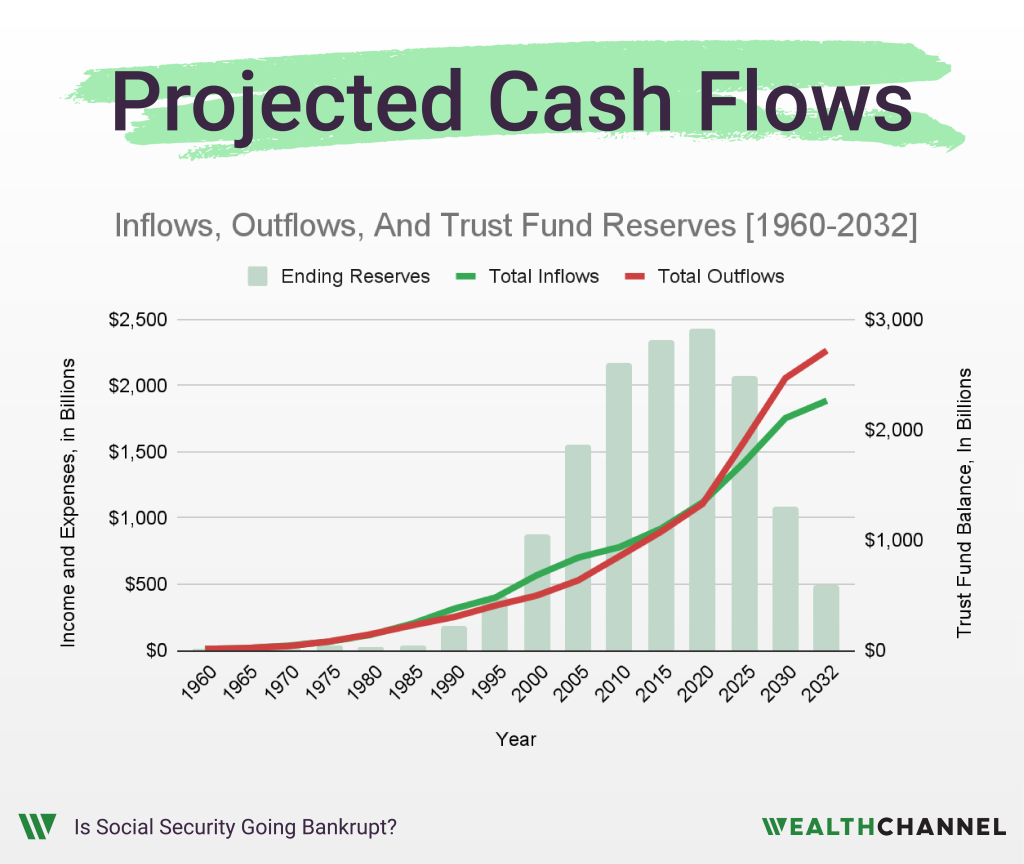

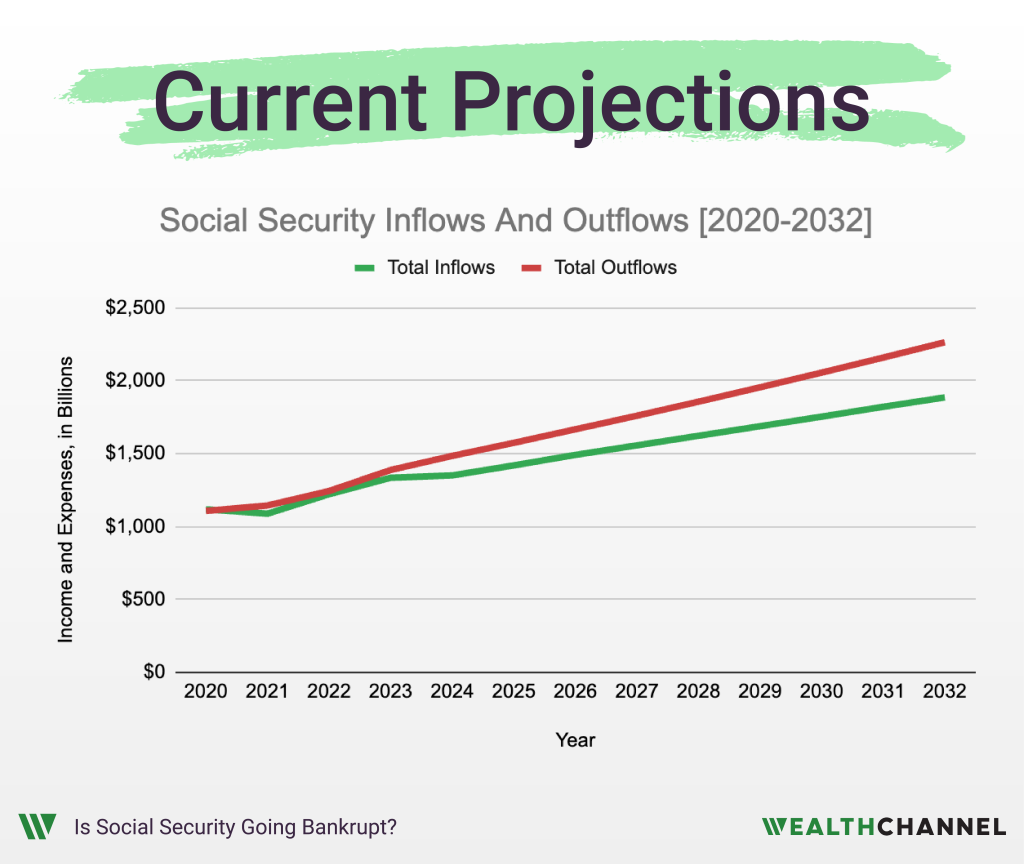

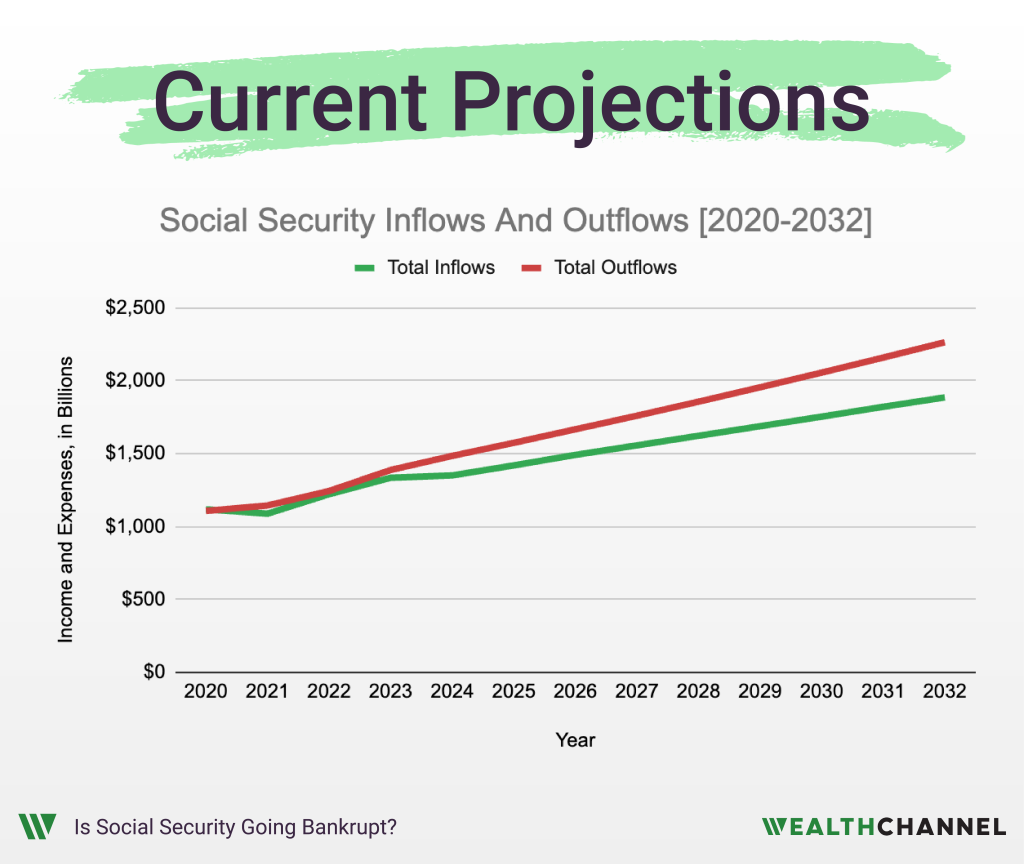

OK, so now you hopefully have a better understanding of the financial challenges that Social Security is facing. The issue is not that the program is going to stop generating revenue. In 2033, inflows to Social Security will be higher than ever. The issue is that outflows will also be higher than ever, and will exceed inflows by hundreds of billions of dollars each year.

So, what does this all mean? What’s going to happen?

Well, there are a few possibilities. Number one is that benefits get cut. In other words, the government reduces outflows to match inflows.

Benefit Cuts?

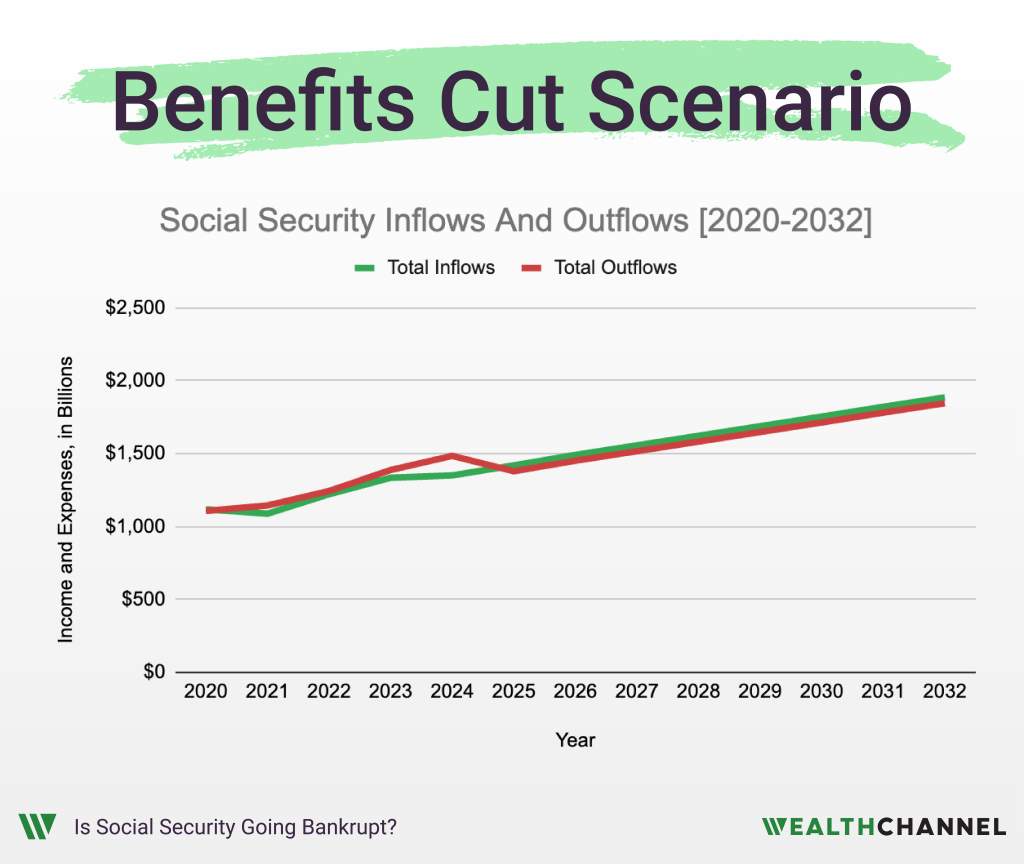

This chart shows the current projected inflows and outflows.

If the government were to go with this option, they’d cut expenses by 10% to 20%.

That would make the future cash flows look like this:

Personally, I think this is pretty unlikely. For one, this would be devastating to retirees who were planning on this income, and the impact would ripple throughout society. And, practically, one thing that retirees do pretty consistently is show up on election day.

So it’s not impossible, but I think this is pretty unlikely. To the extent that benefits are impacted, I think it would come from delaying the eligibility date. Instead of getting your benefits at age 67, you now have to wait until 70.

We’ve actually done this before; the full retirement age used to be 65, and we’ve increased it to 66 and then 67.

Tax Increases?

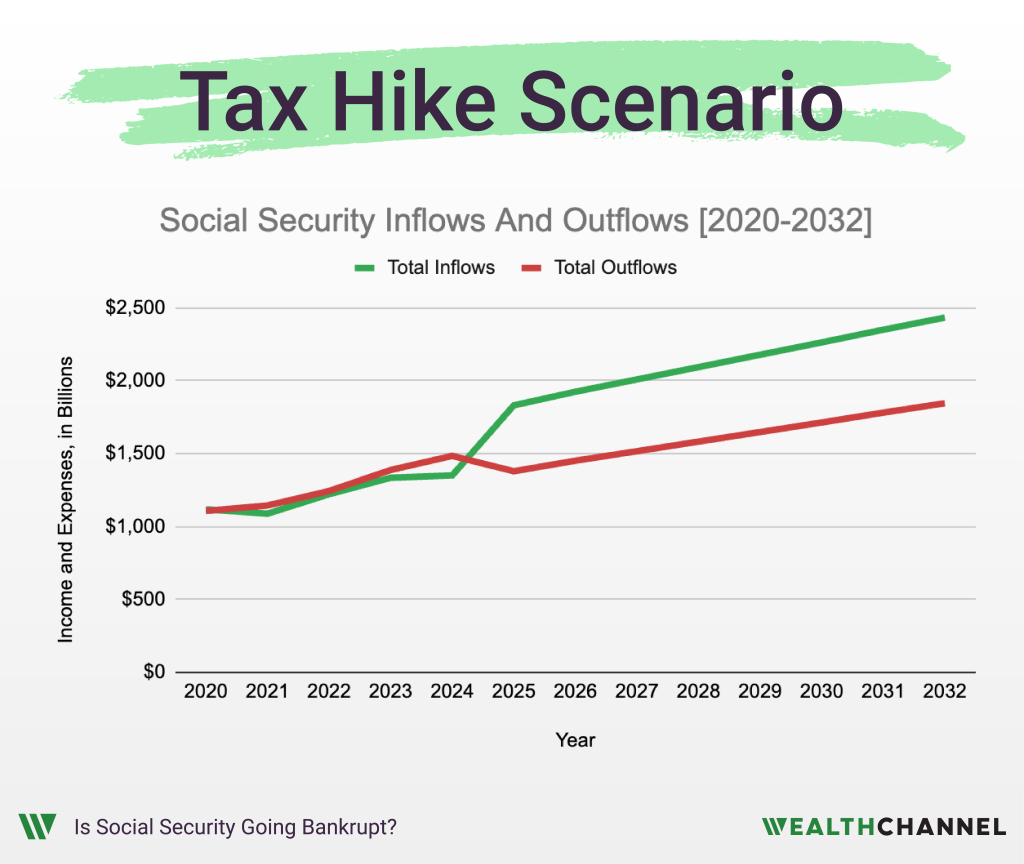

There’s another obvious lever to pull, and that’s increasing revenue. And the easiest way to do that would be to just increase the Social Security tax rate. I mentioned earlier that both employees and employers pay 6.2% right now, for a total of 12.4%.

By some estimates, increasing that to 16% – or 8% for both employees and employers – would keep Social Security solvent for another 75 years.

Let’s look again at the current projections:

Increasing taxes from 12.4% to 16% would mean a huge jump in revenues. Initially, revenue would outpace expenses — and the Trust Fund would begin to grow again. Eventually, however, expenses would catch up.

The immediate future would look something like this:

Personally, I think this would be a tough sell to both employees and employers. This is just my opinion, but I think it’s more likely that additional revenue comes from other sources. For example, there is some chatter about ending the tax incentives for contributions to retirement plans like IRAs and 401(k)s, and using the incremental revenue generated there to shore up Social Security.

That’s kinda like robbing Peter to pay Paul, but the optics of it – especially if it’s targeted at high earners – make it much less painful politically than a direct increase in taxes.

The “Frankenstein” Solution

Perhaps the most likely scenario is a bit of a Frankensteined solution. For example, pushing back retirement age and reducing cost-of-living adjustments would lower outflows.

And increases to payroll taxes combined with elimination of other tax incentives would increase the revenue side of the equation.

But don’t hold your breath for a solution to get put forth here. This is a political hornet’s nest – any solution is going to be unpopular, which means that this can will probably get kicked down the road for as long as possible.

Bottom Line On Social Security

OK, so what are the takeaways here?

Social Security cannot survive in its current form for the next decade. Something will have to change, because the “rainy day fund” that was built up over several decades is being rapidly depleted.

The good news — if you want to call it that — is that there are a few different “levers” that can be pulled to “fix” Social Security. We have a few different ways to cut expenses, and we have a few different ways to increase income.

The bad news is twofold. First, none of these “fixes” are great options. They’re actually all pretty terrible, for one reason or another.

Second, it’s difficult to predict which option will eventually be implemented. And it’s unlikely that we’ll know any time soon. This is a political hornet’s nest; any solution is going to be unpopular, which means that this can will probably get kicked down the road for as long as possible.

How An Advisor Can Help

When it comes to analyzing the risks of Social Security, an experienced advisor can help in a few different ways:

- Ensuring that you have a “backup plan” in the event benefits are cut;

- Determining the potential benefit of delaying the start of your Social Security benefits; and

- Determining if you’ll be able to pass on your Social Security benefits after you die.

Notes

About WealthChannel Academy

This article is part of WealthChannel Academy, the ultimate guide to planning a worry-free retirement.

WealthChannel Academy has a simple premise: to build a $1 million portfolio and enjoy a worry-free retirement, you need to understand just 7 basic concepts. WealthChannel Academy is your guide to simple and effective retirement planning, without the hype.