Estimated reading time: 10 minutes

For almost every American, Social Security is a key component of the retirement planning equation.

There’s a lot of confusion about what Social Security is and isn’t, and exactly how the program works. In this guide, I’ll separate fact from fiction and simplify Social Security.

In this article:

Why It Matters

For better or worse, Social Security is a major part of the financial lives of most Americans. It is a tax that anyone who works pays, and it is a benefit that the majority of retirees will receive. Thus, it’s a key component of most successful retirement planning exercises.

Side Note: I’m not going to get political here. This guide is all about how Social Security actually works, and not how I think it should work. If you’re looking for a hot political take, there are plenty of them out there. But you’re not going to find it here.

The Big Picture

OK, so let’s start at a high level. Social Security is a program that is designed to replace a portion of your pre-retirement paycheck. Effectively, it is a forced or mandatory retirement savings program.

I like to break life down into three phases:

| Phase | Also Known As | Your Financial Goal(s) |

|---|---|---|

| Pre-Earning | School | Prepare yourself to earn and accumulate |

| Earning | Accumulation | Earn and save (accumulate) |

| Retirement | De-Accumulation | Enjoy yourself 😎 |

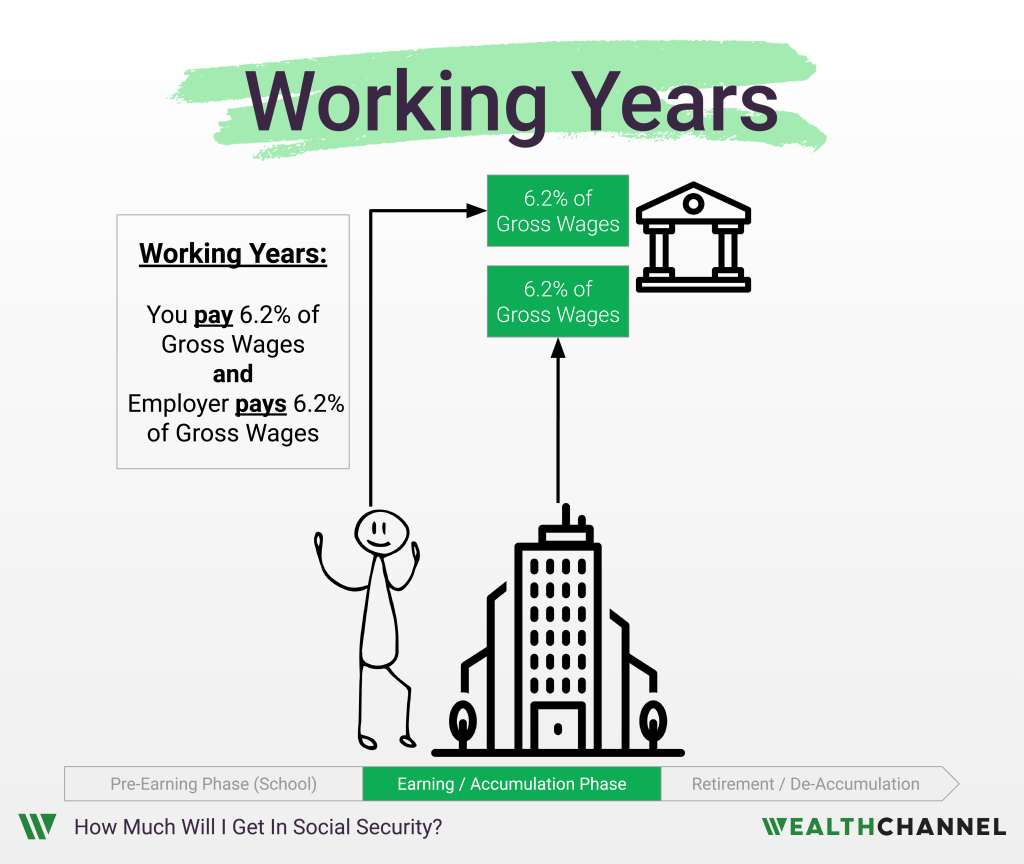

During your working years, a tax is deducted from your gross wages and paid into Social Security.

Once you turn 67 you start to receive money from Social Security each month.

How Much Will You Get In Social Security?

Now, the most common and most relevant question about Social Security is: how much am I going to get each month in retirement?

The Short Answer

There’s a short answer and a long answer. The short answer is, you log in to your account at SSA.gov, and you’ll see a record of both your historical earnings by year and your expected benefit check in retirement.

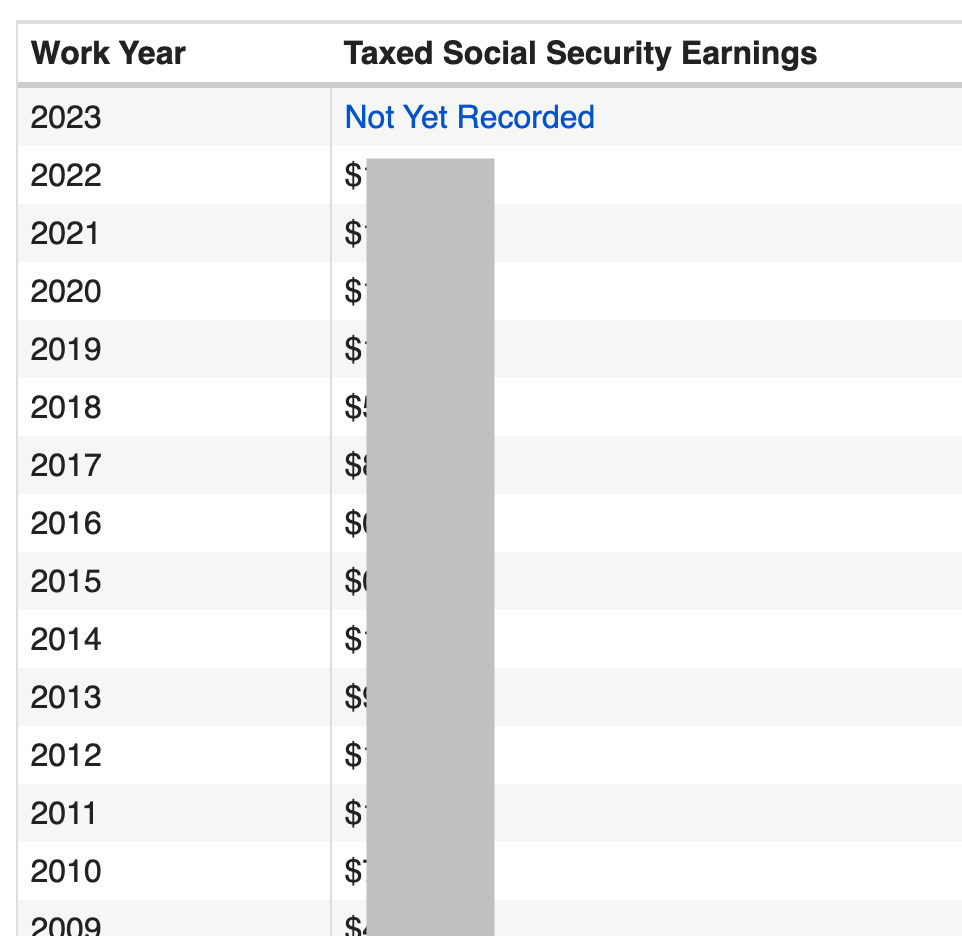

Your history of taxed Social Security earnings will look something like this:

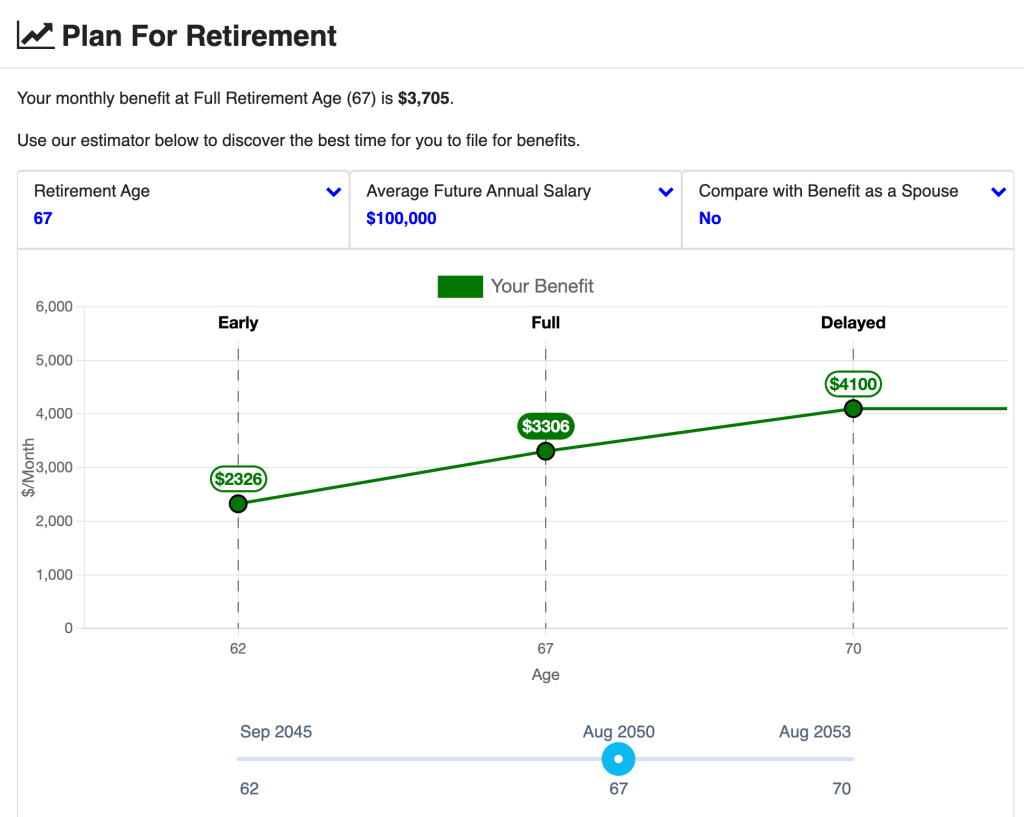

And you’ll also see a tool that estimates your future benefit under different scenarios.

That will look like this:

It’s pretty easy.

The Long Answer

Now, to the long answer – which gets a little wonky but will give you a better understanding of how to maximize your Social Security income in retirement.

Your benefit is determined by how much you pay in Social Security taxes. Like all things related to taxes, it can seem pretty complicated. But this guide will break it down for you.

Every paycheck you receive has 6.2% of your gross wages deducted as a Social Security tax. This usually shows up on your paystub as “FICA.” Now, not all of your income is subject to this tax. Investment income – such as dividends from stocks you own, interest from bonds you own, or capital gains – are not subject to FICA.

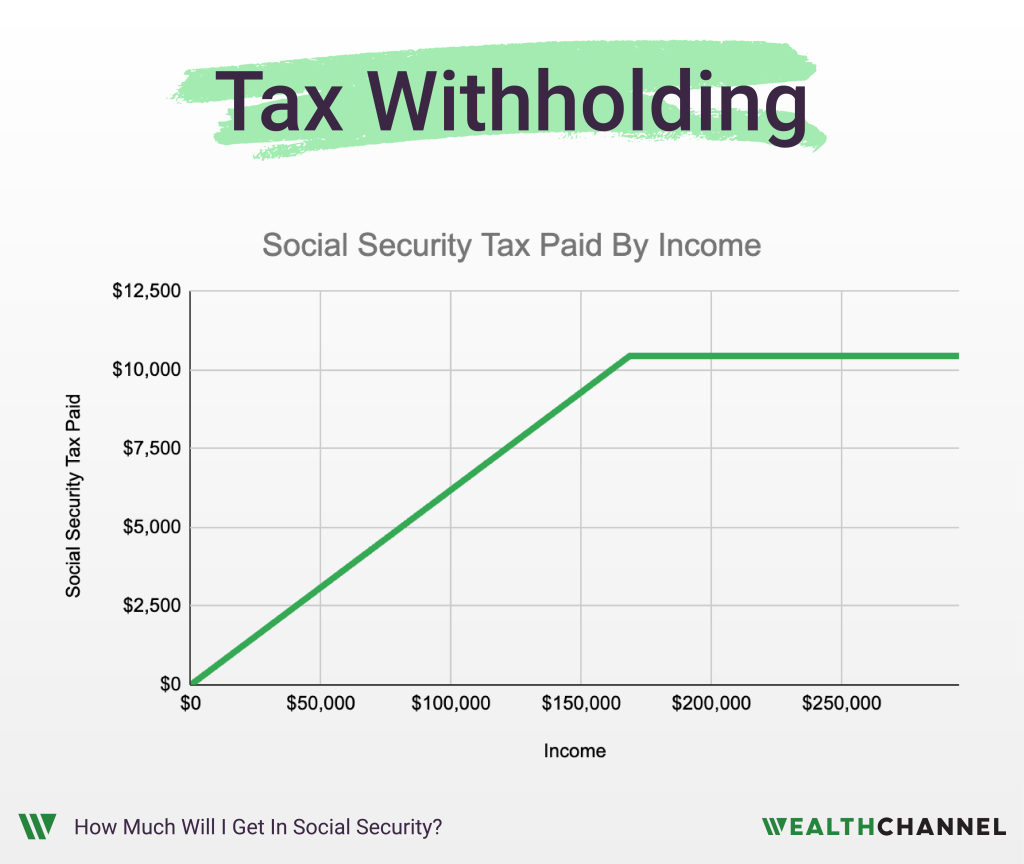

It’s only your so-called “Earned Income.” But not necessarily all of your Earned Income. Only the first $168,600 of income is subject to Social Security taxes. Any earnings above that amount won’t have the Social Security tax withheld.

So, 6.2% times $168,600 is about $10,453. That’s the maximum amount that you can have withheld as Social Security tax in 2024 – even if you make $1 million.

Two quick notes here: first, that $168,600 number is for 2024. This limit is adjusted each year, typically going up by 3% to 5%.

Second: you may be wondering if contributions to a 401(k) or IRA can reduce your Social Security taxes. The short answer is: no. Those so-called “pre-tax” contributions can reduce your income tax liability, but they don’t reduce your Social Security tax liability.

(If you’re not following this piece of it, I’m going to be covering taxes and tax-advantaged retirement accounts in upcoming guides).

OK, so you’re putting in 6.2% of your gross wages to Social Security, and you see that on your paycheck as a deduction called “FICA.”

What you probably don’t see is that your employer is making a matching contribution to Social Security. So, that means a total of 12.4% of your gross wages are being contributed.

(By the way, if you’re self employed you effectively have to pay both the employee and the employer piece. In other words, you’ll be contributing the entire 12.4%).

And the Social Security Administration is tracking all of this. They have a record of how much you’ve contributed to Social Security each year. And they use this contribution record to determine your benefit amount – the check you’ll receive each month in retirement.

The Math

Now, I know what you’re thinking: this is a super easy and simple and straightforward calculation, right?

Of course not! It’s convoluted!

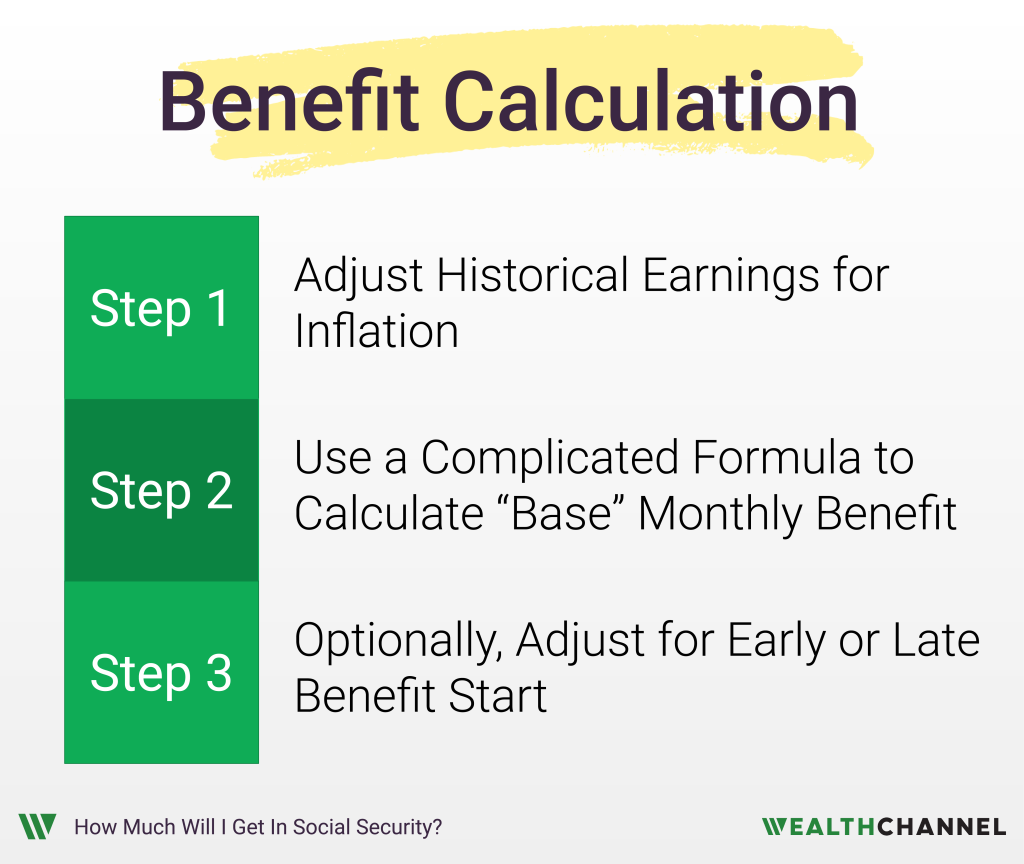

Essentially, there are three parts to the calculation.

First, we adjust your historical earnings for inflation and come up with your average annual earnings during your working years.

Second, we apply what I call a “progressive” formula which is essentially designed to ensure that individuals who earned less during their working years have a higher percentage of their pre-retirement earnings covered by Social Security.

That gets you the benefit amount if you elect to start receiving it at your “full retirement age,” which for most people is 67.

Third, you get the option to start receiving payments either earlier or later. If you want to start earlier, you can do that. But your monthly payment amount will be reduced. Conversely, if you delay the start of Social Security payments, your monthly check amount will increase.

Example

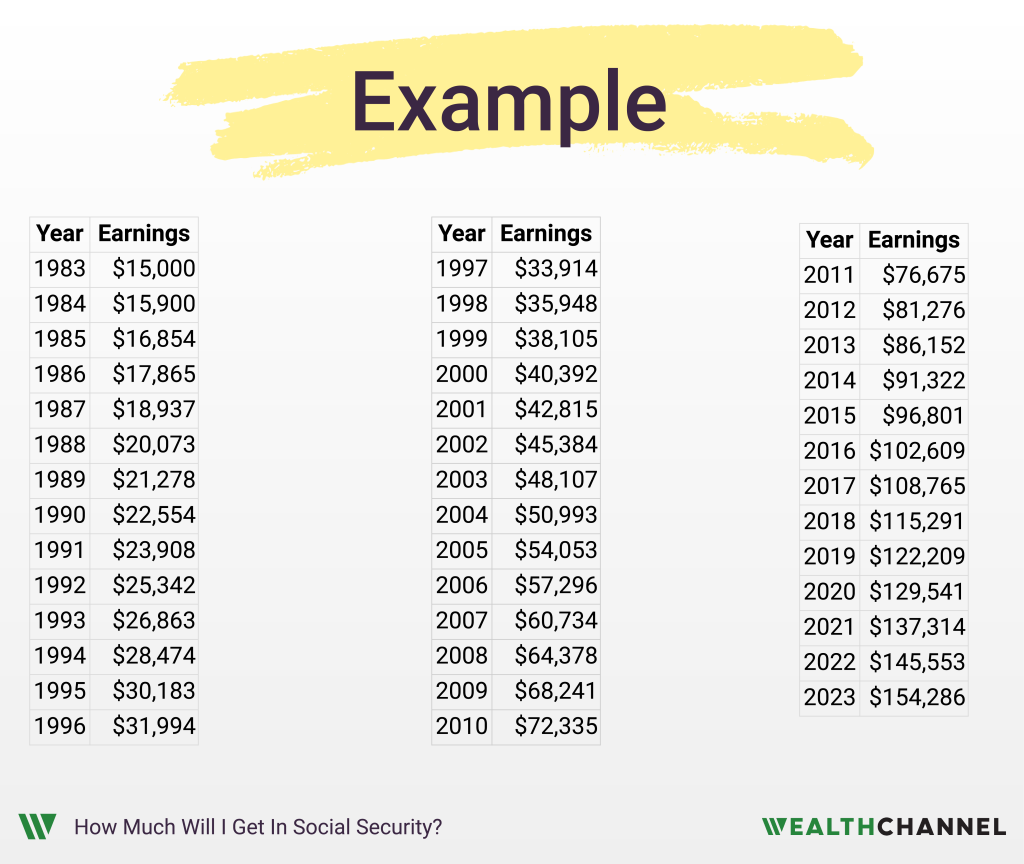

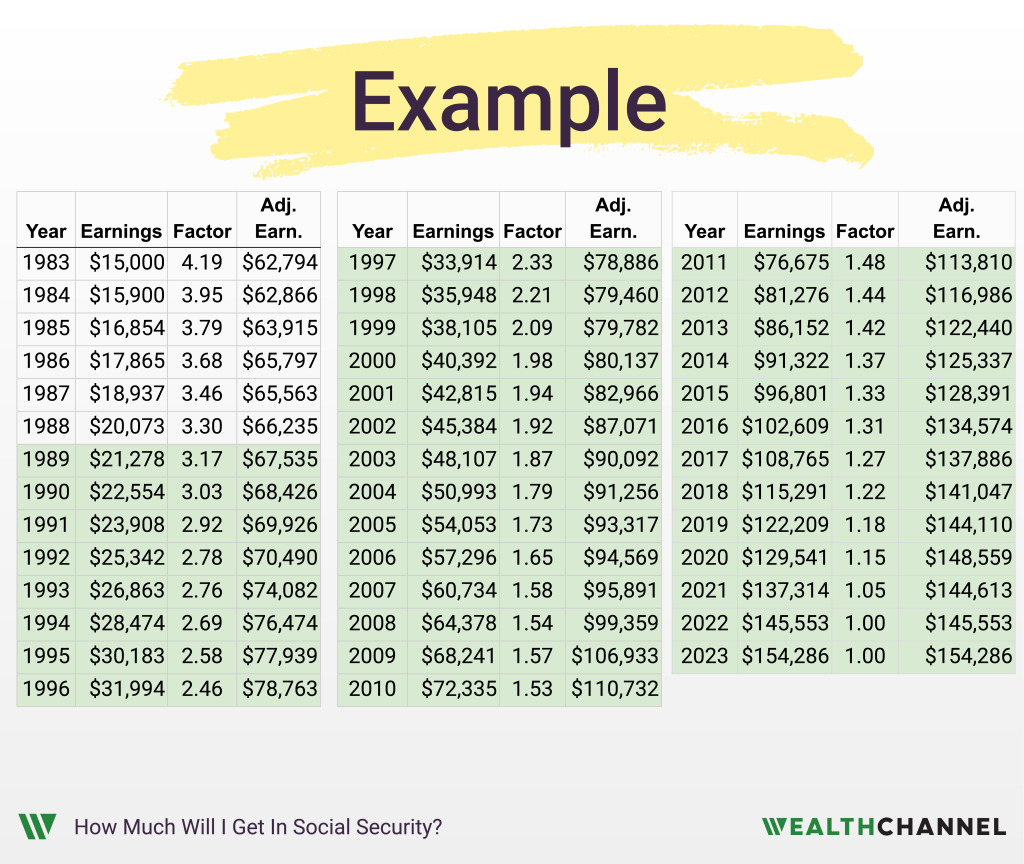

Let’s use a hypothetical example: someone born in 1962, turning 62 in 2024. I assume he started working at the age of 21 in 1983, making $15,000 a year at the time. And let’s say he got 6% raises every year – so in 2023 he made about $154,000.

So, step 1 is to adjust all these historical earnings amounts for inflation.

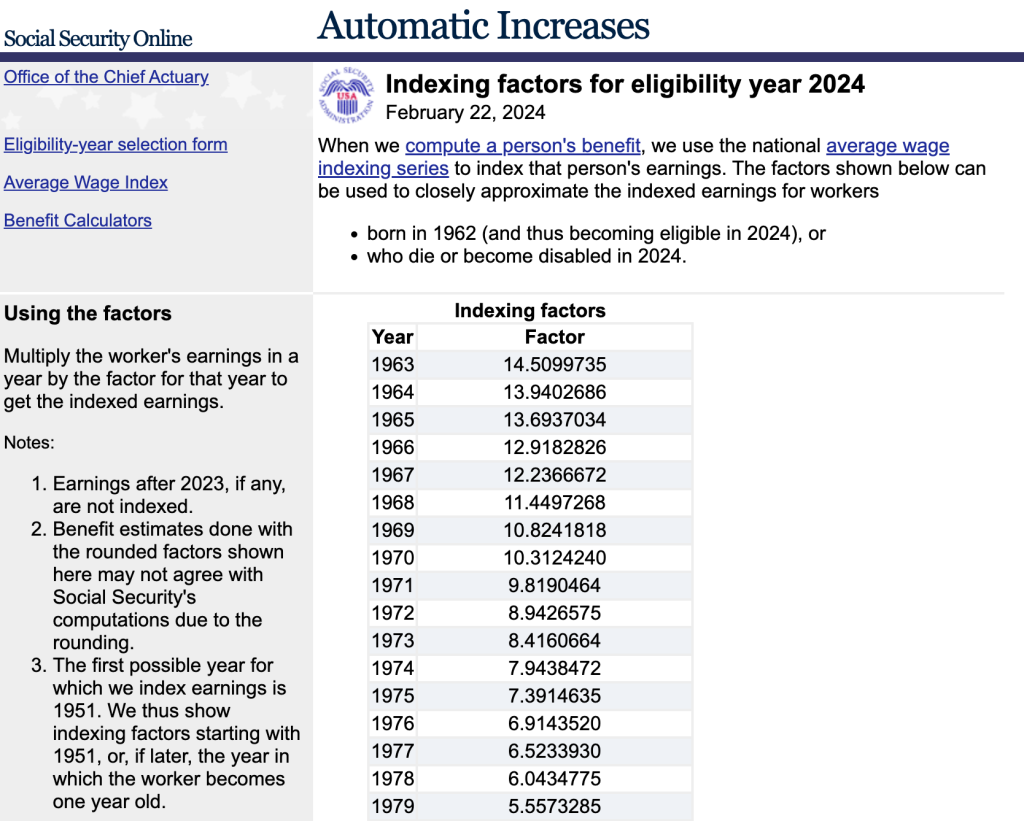

The Social Security Administration uses something called the National Average Wage Indexing Series to index your lifetime earnings. Again, the goal here is to ensure that future benefits reflect the general rise in the standard of living that occurred during your working lifetime.

It wouldn’t be fair to base your benefits off of your salary 40 years ago.

You can get the historical data for this series from SSA.gov by entering your year of eligibility for Social Security.

So, for my hypothetical retiree whose year of eligibility is 2024: the adjustment factor for 1983 – his first year of working – is about 4.2. So I take his 1983 earnings of $15,000 and multiply it by the adjustment factor of 4.2 and get adjusted earnings for that year of about $63,000.

Once we do that for every year, we take the average of the 35 highest earning years, and divide by 12.

This is the Average Indexed Monthly Earnings, or AIME.

For my hypothetical retiree, this comes to: $8,1591.

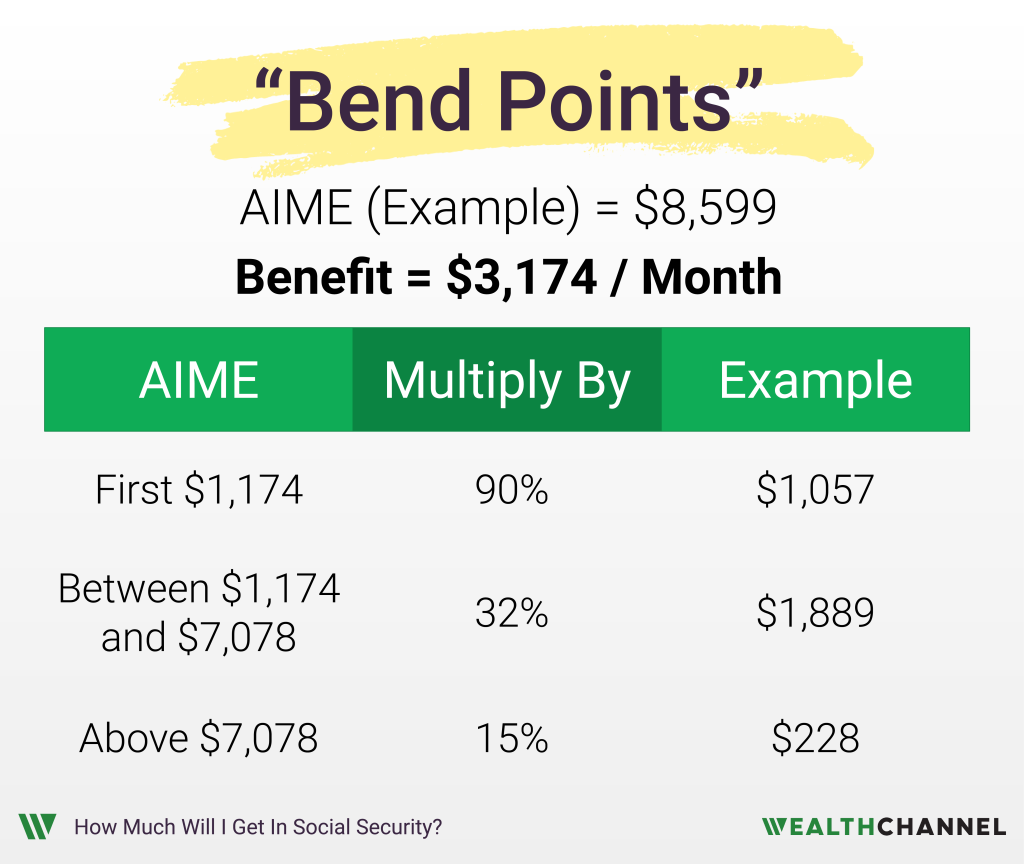

Step 2, we run this number through a formula that has two “bend points” and weights different portions of your AIME differently.

Here’s what you do:

- Multiply the first $1,174 of your AIME by 90%.

- Multiply any amount between $1,174 and $7,078 by 32%.

- Multiply any amount over $7,078 by 15%.

These are the so-called “bend points” for 2024. These numbers change each year.

For my hypothetical retiree, the calculation works out to a monthly benefit of $3,174 – which is about 25% of his 2023 income.

One quick note here: this is the starting benefit. Social Security benefits are subject to a COLA, or cost of living adjustment. That means that they generally increase each year to keep up with the rate of inflation.

Now, this is the so-called “base case.” This is what he will get if he elects to start receiving his Social Security benefit when he hits his full retirement age. But you will have the option to either start receiving benefits earlier or later.

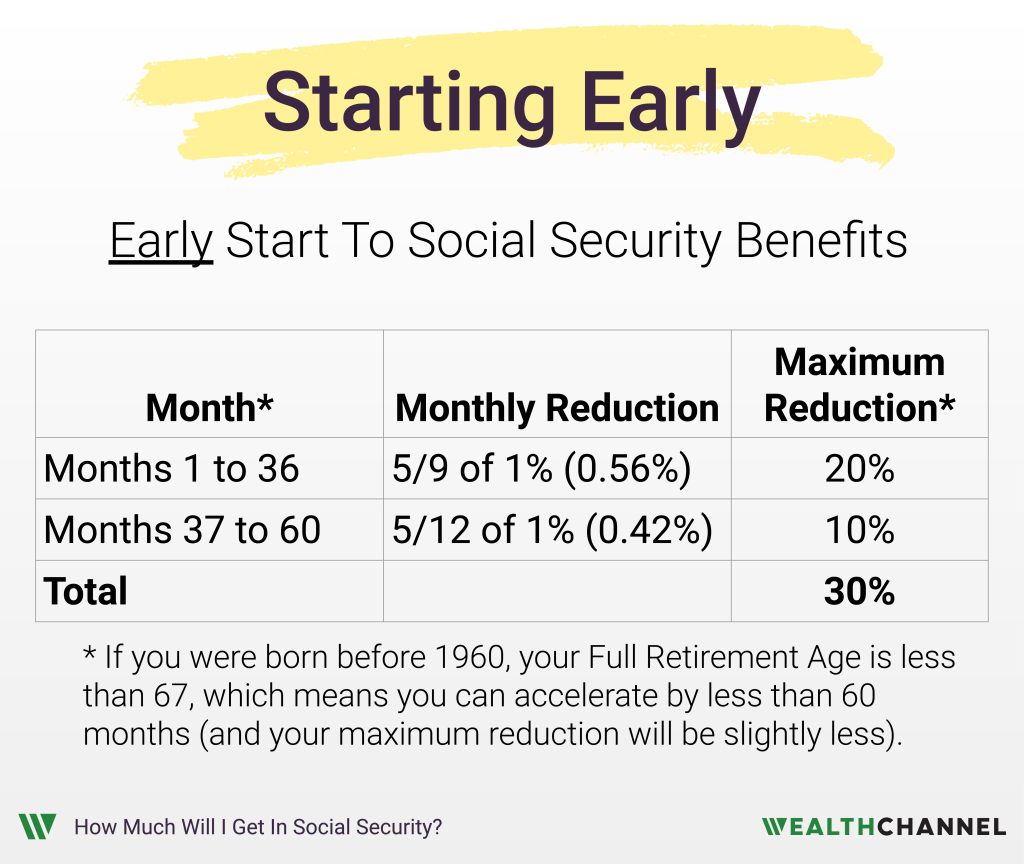

If he chooses to start earlier, his payment will be reduced. For the first 36 months you choose to move forward your start date, your payment will be reduced by 5/9 of one percent per month. So if you move it forward 36 months, your payment is reduced by 20%.

You can move it forward another 24 months if you want, in which case your payment is reduced by 5/12 of one percent for each additional month you bump up your start date.

That means you can move up your start date a total of 60 months, or five years. But if you do that, your monthly payment is reduced by 30%.

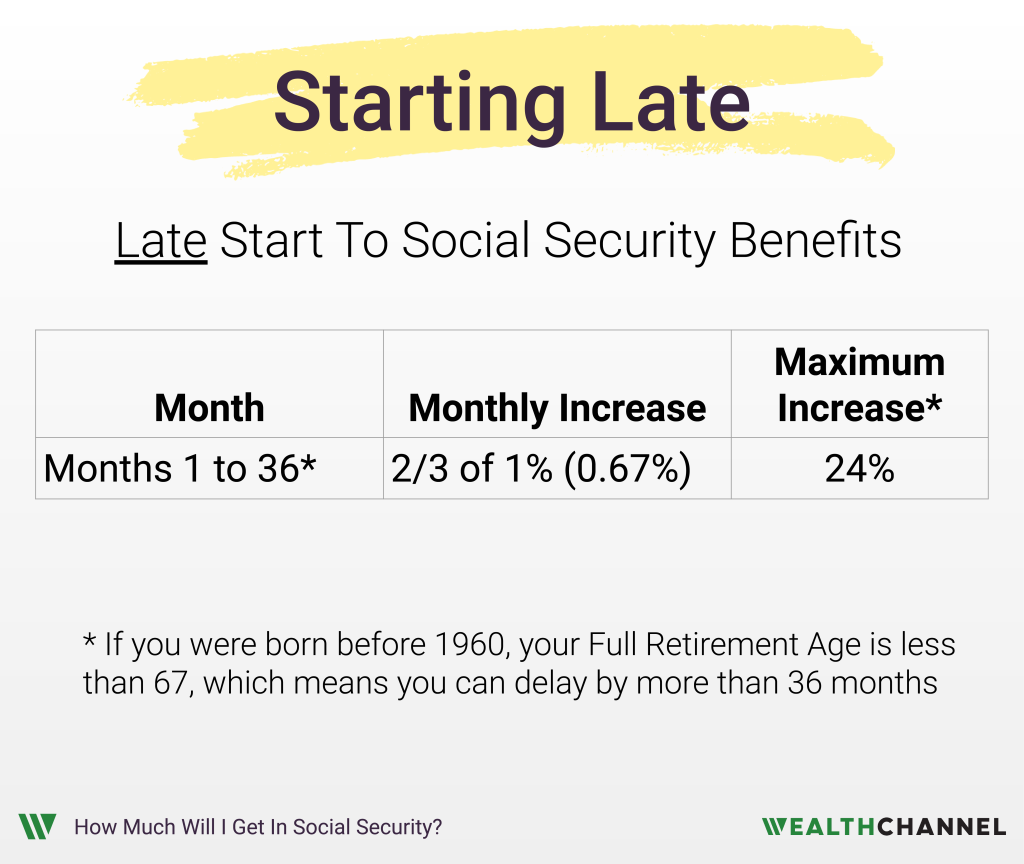

Alternatively, you can delay your start date until you turn 70. For each month you delay, your payment increases by two thirds of one percent. So if you delay by 36 months, your base rate is adjusted up by about 24%.

Bottom Line On Social Security

OK, so what are the takeaways here?

Basically, you have two options for increasing your Social Security benefit. Number one is: you work longer, and pay more into the system. Assuming that this year will be one of your 35 highest earning years, it will increase your expected benefit in retirement.

The second option you have for increasing your benefit is to delay your start date. Of course, that means that you’ll have to rely more heavily on your other retirement accounts during those years.

Future guides in this series are going to dive a bit deeper into Social Security, including the decision to start early or late.

How An Advisor Can Help

When it comes to determining the optimal Social Security Strategy, a good financial advisor can help in a number of ways:

- Determining the tradeoffs associated with the age at which you start receiving benefits;

- Assessing the impact of taxes on your Social Security receipts;

- Preparing for a scenario where Congress cuts Social Security benefits; and

- Determining if you’ll be able to pass on your Social Security benefits after you die.

Notes

- Note that this is a pre-tax amount. Social Security benefits are subject to Federal income taxes. Additionally, 11 states also tax Social Security benefits: Colorado, Connecticut, Kansas, Minnesota, Missouri, Montana, Nebraska, New Mexico, Rhode Island, Utah and Vermont. ↩︎

About WealthChannel Academy

This article is part of WealthChannel Academy, the ultimate guide to planning a worry-free retirement.

WealthChannel Academy has a simple premise: to build a $1 million portfolio and enjoy a worry-free retirement, you need to understand just 7 basic concepts. WealthChannel Academy is your guide to simple and effective retirement planning, without the hype.