Estimated reading time: 6 minutes

The 401(k) should be the “workhorse” of your retirement portfolio, doing much of the heavy lifting involved in wealth creation.

If you understand how the 401(k) works, you’ll never miss a contribution again.

In this article:

Why It Matters

Most Americans accumulate a significant portion of their retirement savings within a 401(k) account. Whether you’re a W-2 employee or a business owner, the 401(k) is one of the most powerful tools you have available to you.

Investors who use the 401(k) effectively can accumulate massive balances, and can generate millions in incremental, tax-free wealth to use in their golden years.

Side Note: I’ll use the term 401(k) throughout this guide, but almost everything I’m showing you applies to 403(b)s and other employer sponsored retirement plans as well.

My goal with this guide is pretty simple: I’m going to show you why the 401(k) is so powerful, and why you’re making a huge mistake if you aren’t using it to shelter your assets from taxes.

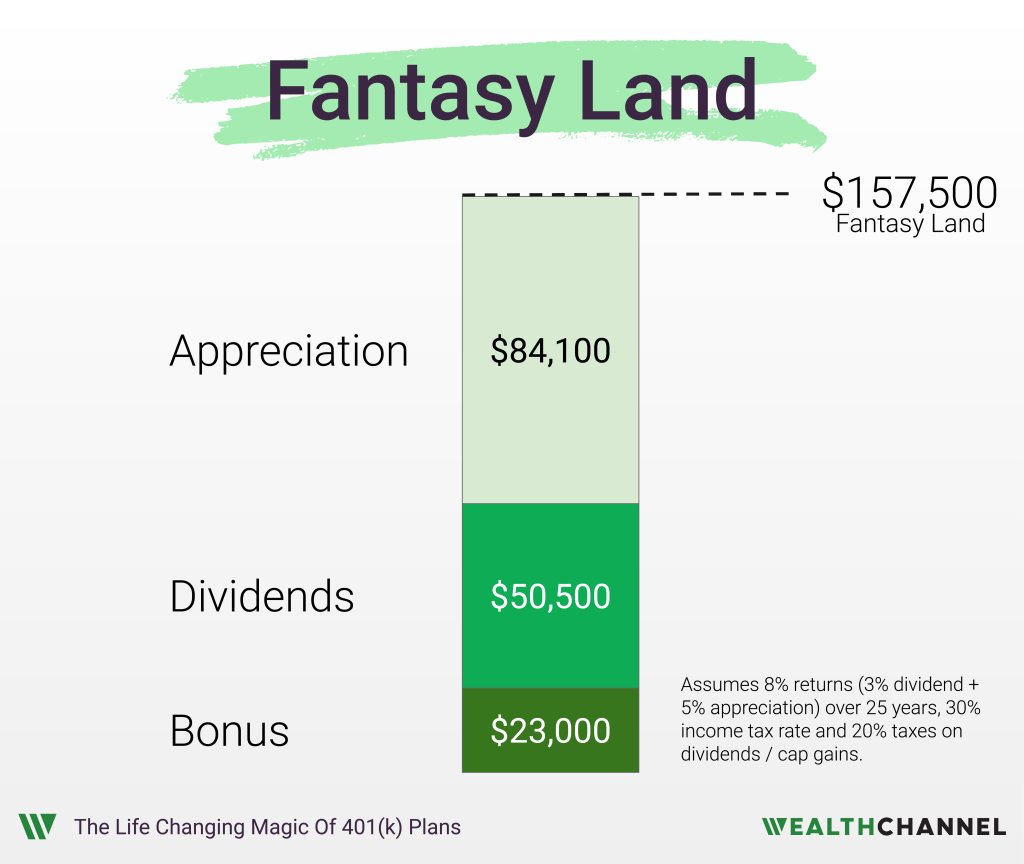

Fantasy Land

I want to start in a fantasy land of make believe – where there are no taxes. Let’s say that in this fantasy land, you get a bonus of $23,000, and you invest it in a portfolio of stocks and bonds.

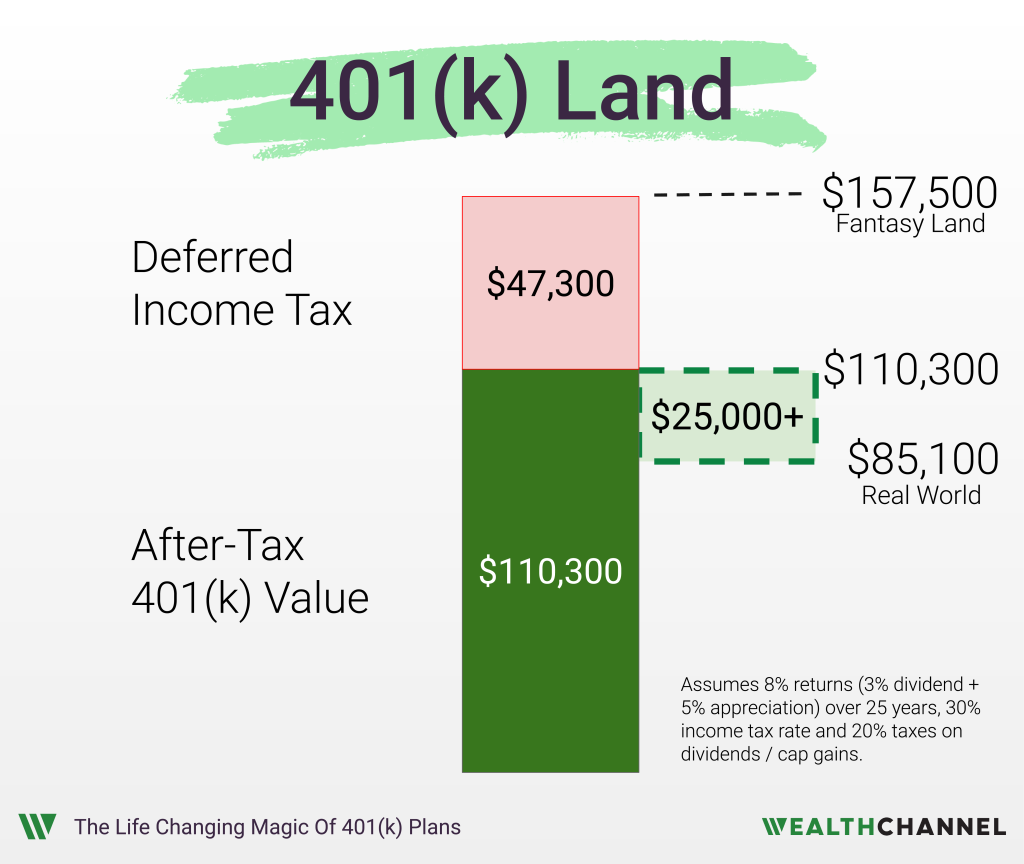

That portfolio returns 8% – consisting of 3% annual dividends and 5% in capital appreciation. And let’s say you invest for 25 years. Let’s look at how your initial $23,000 would grow.

You’ll collect more than $50,000 in dividend payments over that time period, and experience another $84,000 in capital appreciation. That means that after 25 years, your $23,000 investment has grown to more than $157,000 – it’s grown by 6x.

Reality Check

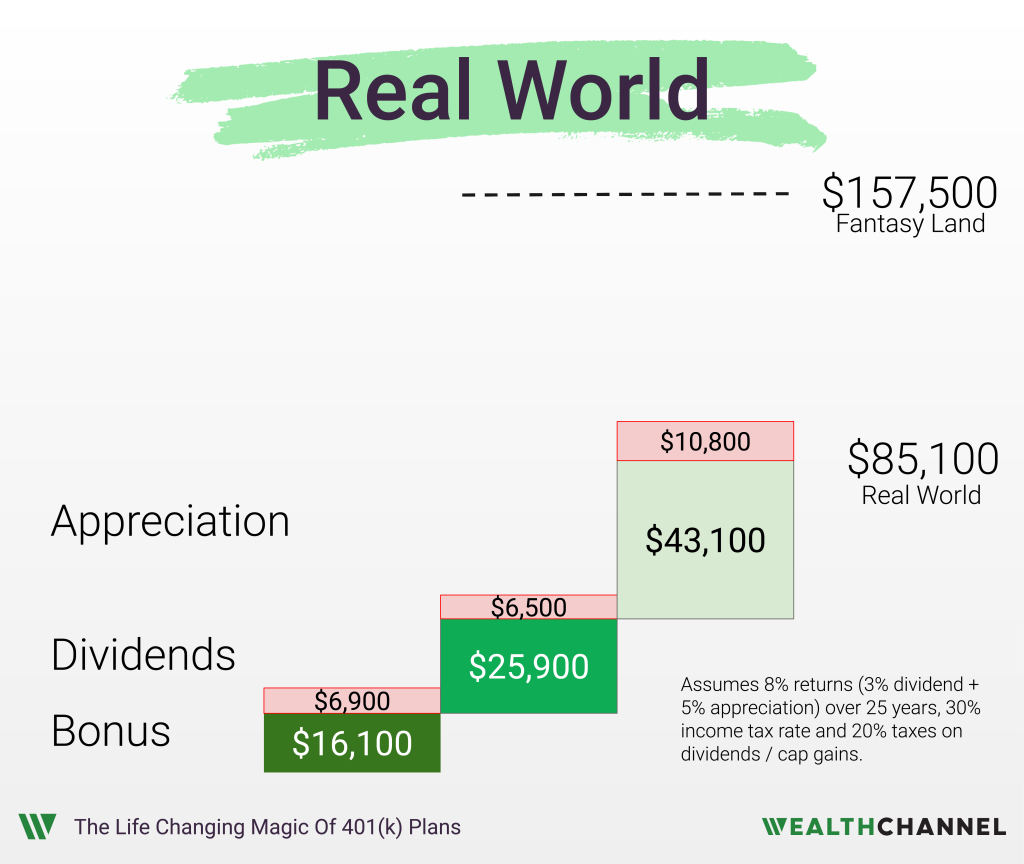

Unfortunately, we don’t live in this Fantasy Land. We live in a Real World where we have income taxes, dividend taxes, capital gains taxes – we have taxes on almost everything imaginable – but that’s a rant for another time.

So let’s see how this scenario plays out in the real world, if we assume a 30% income tax rate and a 20% tax on dividends and capital gains:

You get your $23,000 bonus, but you can’t invest that entire amount. You owe nearly $7,000 in income taxes, leaving you with about $16,000 to invest.

Now on that investment, you’ll collect about $32,000 in dividends over 25 years. But you have to pay 20% of that – about $6,500 – in taxes. Your investments appreciate by about $54,000, but you owe 20% of that – about $11,000 – in capital gains taxes.

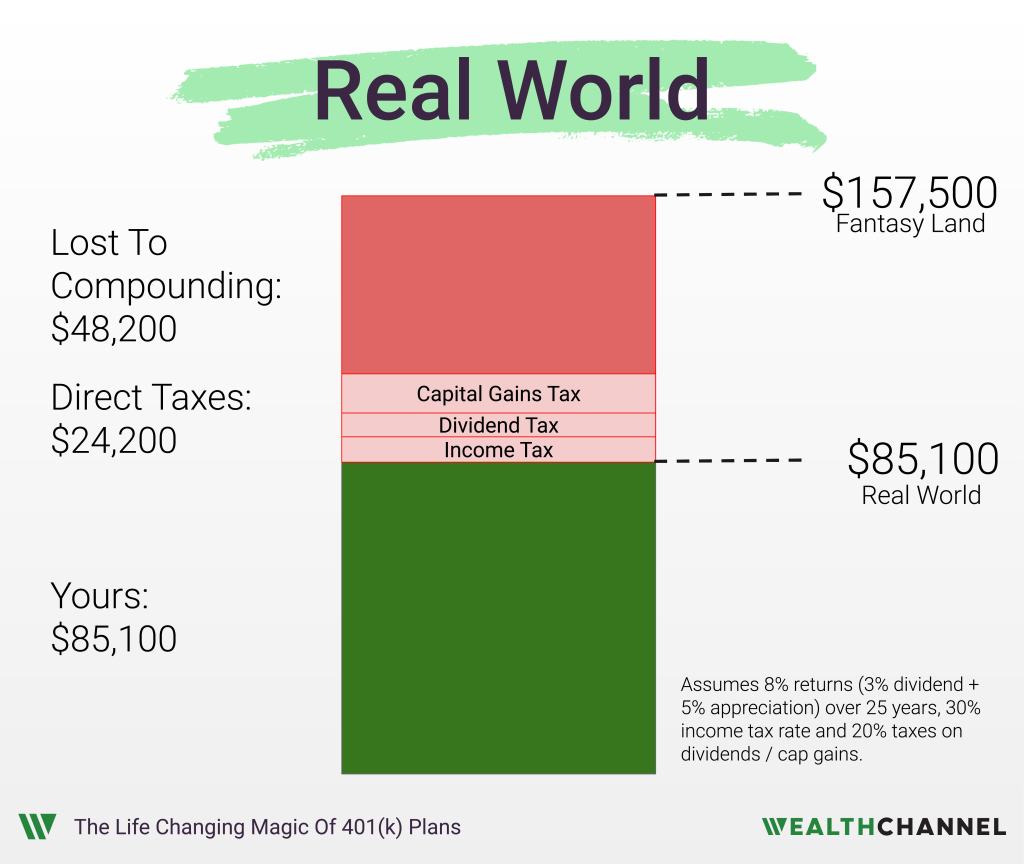

Now, you still do pretty well on this investment; your $23,000 bonus becomes about $85,000 after 25 years later. That’s impressive growth. But it’s about $72,000 less than in the alternate reality without taxes.

In this real world, you’ve paid about $24,000 directly in taxes, but the real whammy comes from the dollars that you lose to compounding. Because you only invest $16,000 up front and not $23,000, you miss out on significant dividends and appreciation over those 25 years.

There’s a similar effect on your dividends; because you owe taxes on these each year, you can’t reinvest the full amount. That means less in dividends and appreciation each year going forward.

So you really have 4 drags on your portfolio: income taxes, dividend taxes, capital gains taxes, and the indirect costs of compounding.

And here’s why the 401(k) is so incredible: it eliminates three of these entirely. Goodbye dividend taxes, capital gains taxes, and goodbye to that brutal cost of compounding.

All you have to deal with is income taxes.

The Beauty Of The 401(k)

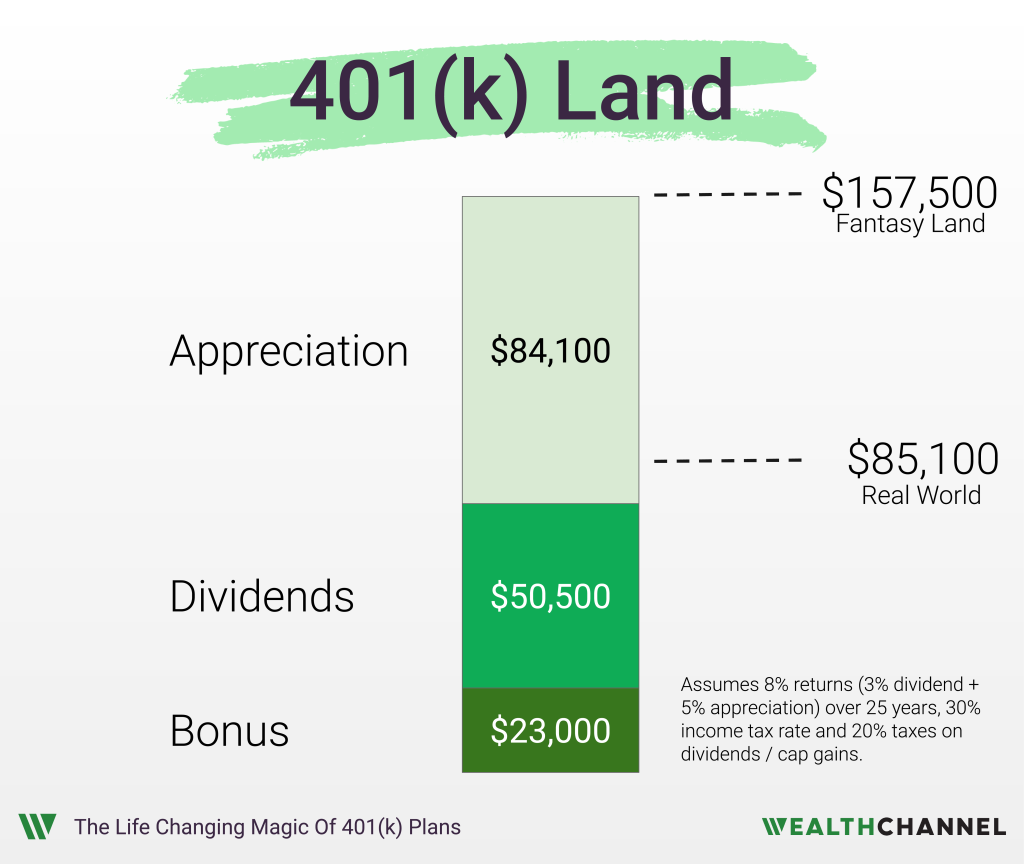

Let me show you how this works, in a world where you have access to a 401(k).

You get a $23,000 bonus. But you elect to use a tax deferred account like a 401(k), which means that you don’t owe any income taxes today. You get to invest the entire amount.

So you get your $50,000 in dividends over 25 years, and you don’t owe any taxes on those either. That means you can reinvest the entire amount. Awesome, right?

You get your $84,000 in capital appreciation, and don’t owe any capital gains taxes on those. Again, pretty awesome, right?

So, your $23,000 has grown to more than $157,000.

Now unfortunately, here is where the 401(k) magic runs out – and that’s because you have to pay income taxes on this entire amount.

So that takes a pretty big bite; in my example, you owe about $47,000 in taxes. So that leaves you with $110,000.

That means that you’re more than $25,000 ahead of where you’d be if you hadn’t used the 401(k). You created $25,000 in after-tax wealth.

But it’s actually way better than this, for 3 reasons. Number one is that a lot of employers will match part of your contribution. For example, a 20% match would mean that your employer chips in $4,600 in addition to your $23,000.

Number two is that the 401(k) is a renewable tax incentive. You’re limited in the amount that you’re able to defer, but that amount resets each year. That essentially means that you can do this same wealth creation alchemy year after year.

Finally, the 401(k) is an individual account. That means that if you’re married, both you and your spouse can contribute – assuming that your employer offers a plan – and you effectively double all the numbers in this video.

OK, there you have it: the math behind why the 401(k) is such an incredible wealth creation opportunity. If you’re surprised by the magnitude of these numbers, I hope that this will be good motivation to use your 401(k) to its absolute maximum.

Bottom Line On Your 401(k)

By using a 401(k), investors can potentially create significant incremental wealth for themselves — especially if they have a long time horizon to retirement.

How An Advisor Can Help

When it comes to fine-tuning your 401(k) strategy, an experienced advisor can help in a few different ways:

- Understanding the risks associated with early withdrawals, and strategies for avoiding costly penalties;

- The best approach to a “rollover” when you leave your current employer; and

- How business owners can take advantage of the Solo 401(k) and other alternatives.

About WealthChannel Academy

This article is part of WealthChannel Academy, the ultimate guide to planning a worry-free retirement.

WealthChannel Academy has a simple premise: to build a $1 million portfolio and enjoy a worry-free retirement, you need to understand just 7 basic concepts. WealthChannel Academy is your guide to simple and effective retirement planning, without the hype.