Estimated reading time: 7 minutes

The 401(k) might be the greatest tax incentive ever created. I call it the “workhorse” of retirement planning, because for most Americans this account does the heavy lifting. It often accounts for the lion’s share of your net worth at retirement.

I took a deep dive into the math behind the 401(k) in a previous guide, to show you how it can create $1 million or more of incremental wealth.

Today, though, I want to talk about the biggest mistake that people make with their 401(k), because it has the potential to derail your retirement plans.

In this article:

The Common, Devastating 401(k) Mistake

OK, so let’s just dive right into it. The biggest mistake that people make with the 401(k) is thinking that it’s all theirs. Unfortunately, that’s not the case. If you have $1 million in your 401(k), that does not mean that you have $1 million to spend in retirement.

That’s because the money in your 401(k) has not yet been taxed – which effectively means that the federal government owns a piece of your 401(k). And depending on where you live, your state government might own a piece as well.

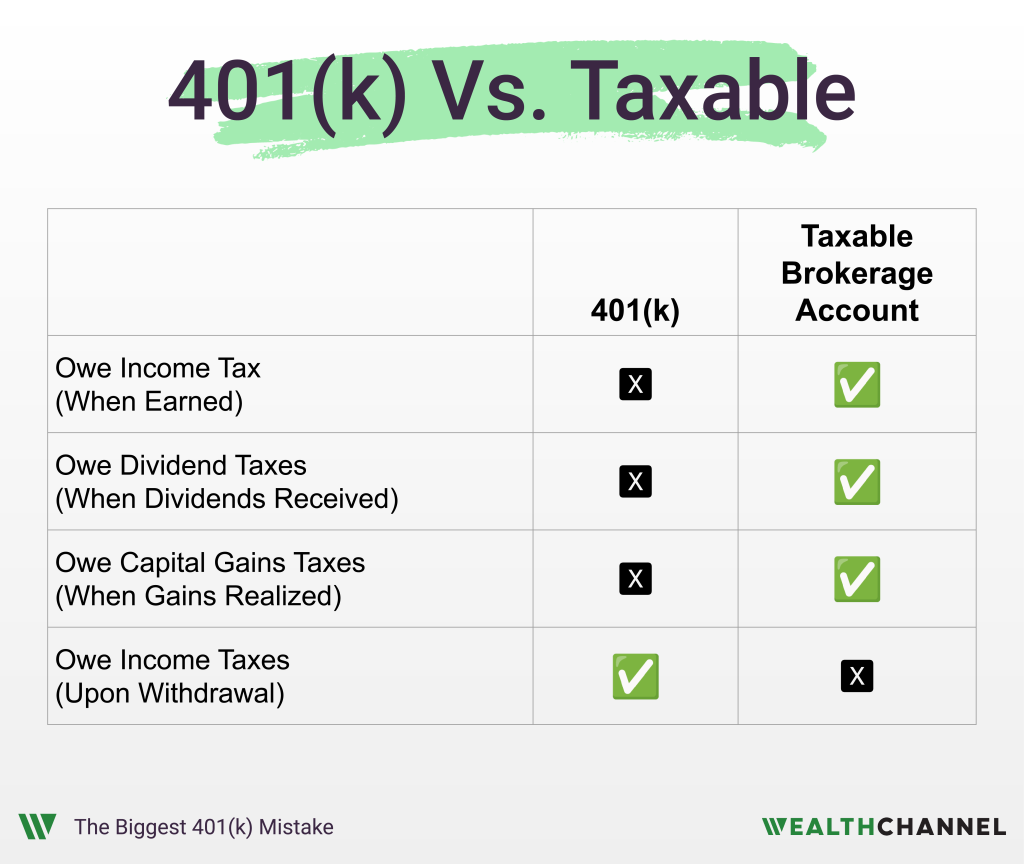

The 401(k) is a tax-deferred account. What that means is that you elected NOT to pay income taxes at the time your income was earned, opting instead to put that money into a 401(k) and defer the payment of taxes until a later date.

In this case, the tax bill comes due when you make withdrawals from your 401(k). For most people, that happens in retirement when they gradually sell the assets in their 401(k) and use the proceeds to pay for living expenses.

Now, this tax deferral is a beautiful thing; I always say that the two best times to pay taxes are later and never. But if you’re going to have to pay later, you need to plan for that.

Maximizing Your 401(k) “Ownership”

Now, if you weren’t aware of this already – that you don’t actually own 100% of your 401(k) – you’re probably asking: is there anything I can do about this?

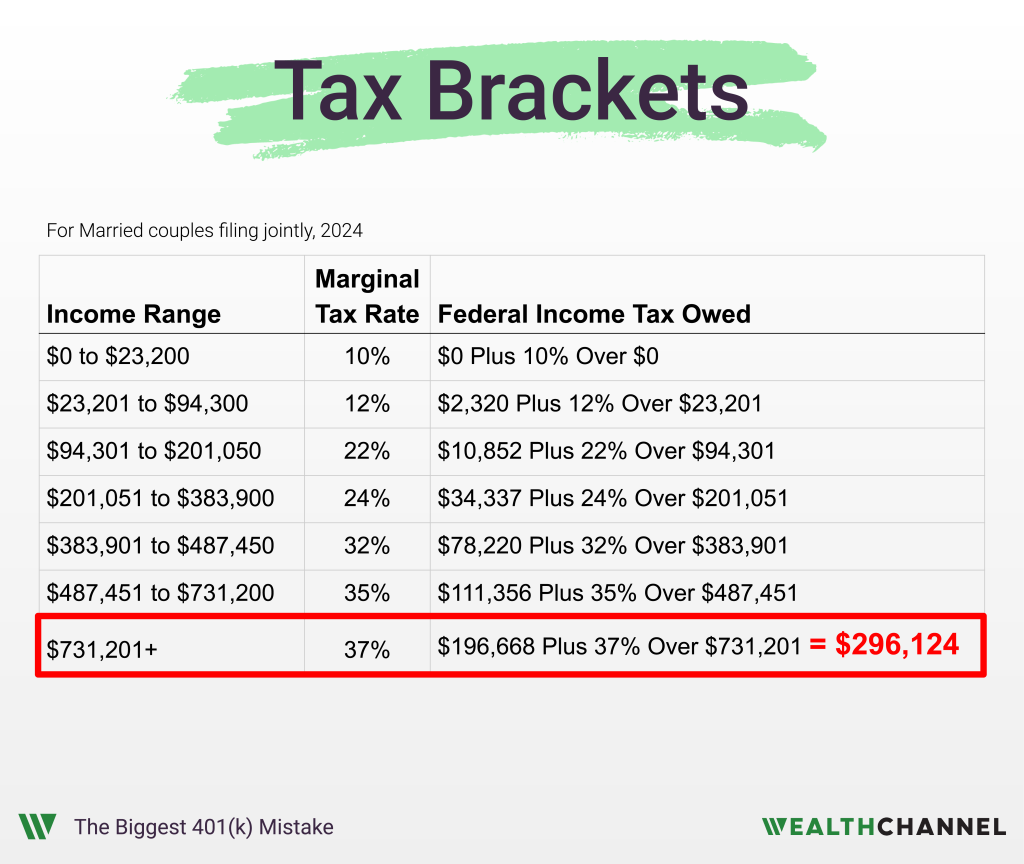

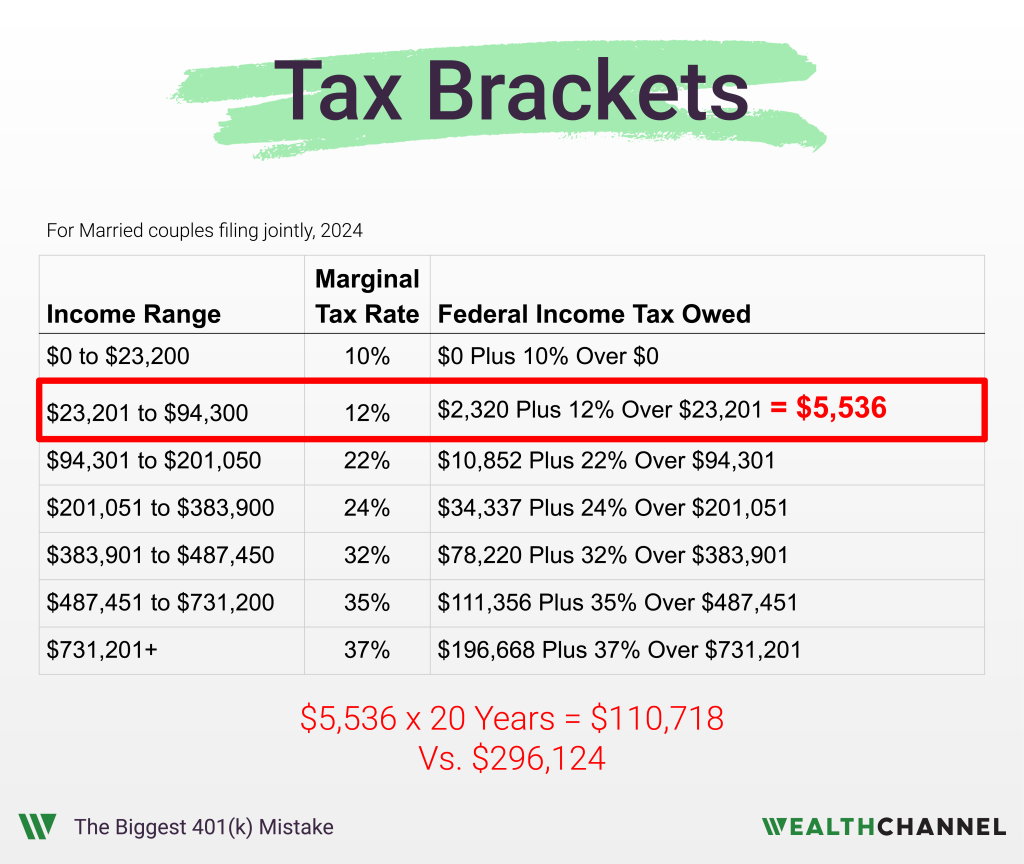

There is actually – to a point. Withdrawals from a 401(k) are taxed as ordinary income, which means they get the same tax treatment as your salary. The income tax system in the U.S. is progressive, which means that the tax rate increases as your income does.

This creates an opportunity for you to strategically withdraw from your 401(k) so that you can hopefully avoid getting into these higher tax brackets. Let me show you what I mean with a simplified, extreme example.

Say you have $1 million in a 401(k) and you withdraw it all at once. That would mean $1 million in ordinary income, with a big chunk of that being in the highest tax bracket. Your total tax bill would come to about $296,000. That’s nearly 30% of your total assets, and we haven’t even considered state taxes yet – more on that in a minute.

Alternatively, let’s say you withdraw $50,000 a year for 20 years. That would keep you in the lower tax brackets; your total bill would be about $5,000 a year and about $110,000 total over the 20 years. That’s still pretty significant, but not nearly as bad in the first example.

I call this “strategic de-accumulation,” and it is one of the services that many financial advisors can provide. They can take a look at your tax-deferred accounts – like your 401(k) – along with your taxable brokerage accounts and any tax free accounts – like a Roth IRA – and figure out a withdrawal strategy that minimizes taxes.

So you obviously need to consider this pending tax liability when determining whether or not you can retire. Again, even in the second example you don’t actually have $1 million to spend in retirement. You owe more than $100,000 in federal income taxes.

Asset Allocation Considerations

You should also consider this when allocating assets. Let’s say you have your 401(k) invested in a stock market index fund, and you’re targeting a portfolio mix of 60% in stocks and 40% in bonds.

In my opinion, you shouldn’t use the $1 million number when tallying up your net exposure to stocks. Because, again, your 401(k) is not all yours. Part of it is yours, and the other part is effectively an investment that you’re holding for Uncle Sam.

The State Tax Bite

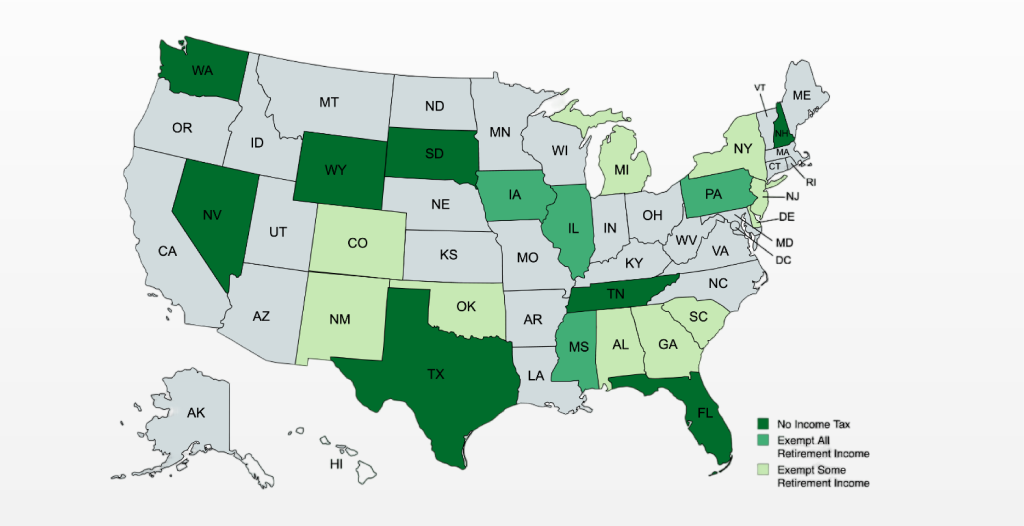

Another thing that you can control is the impact of state taxes on your 401(k) withdrawals. There are nine states that have no income tax: Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington and Wyoming.

Four more states – Iowa, Mississippi, Illinois, and Pennsylvania – have a state income tax but exempt distributions from 401(k) and pension plans.

And then there are more states that exempt part of retirement plan withdrawals. Alabama, for example, exempts the first $6,000 of retirement plan withdrawals from income taxes. In Georgia, taxpayers age 65 and older can exclude up to $65,000 of retirement income.

Colorado, Delaware, Michigan, New Jersey, New Mexico, New York, Oklahoma, and South Carolina offer some sort of exemption from state income taxes. And then in the 29 other states I didn’t mention, withdrawals from your 401(k) are fully taxable.

So, if you really care about minimizing taxes you can elect to spend your retirement in a state that is tax friendly towards retirees.

There’s another strategy that can lower your tax bill on 401(k) withdrawals that I’ll mention briefly, and that’s a Roth conversion. Essentially, that means paying the taxes today so that you can avoid them in the future.

That conversion requires a pretty careful analysis, and I’m going to dive into the math behind it in a future episode.

Does This Make Your 401(k) A Scam?

One last point I want to make here: by no means do I think the 401(k) is a scam. Quite the opposite actually – like I said at the beginning, I think it’s the greatest tax incentive ever created.

But it’s important to understand what that tax incentive gets you, and what it doesn’t. The 401(k) creates massive value by allowing investors to defer their income tax liability and avoid taxes on dividends and capital gains. But it doesn’t allow them to avoid income taxes altogether.

And because it allows for tax free growth – meaning there are no taxes on dividends or capital gains – the tax bill that does eventually come due is much bigger than some people realize. And that’s actually a good thing – the bigger your tax bill, the more incremental wealth you’ve created by using a 401(k).

But I realize that it won’t feel like it at the time – it never feels good to pay taxes. Now, I may have been the bearer of bad news here. If that’s the case, hopefully this realization can help you to more effectively plan for retirement.

Bottom Line On Your 401(k)

The 401(k) is an incredible vehicle for retirement savings. Investors who maximize their contributions can easily accumulate $1 million or more in a 401(k).

It’s critical, however, to know how much of the account balance you get to keep — and what you’ll owe in taxes. Planning strategically can be a “high leverage” activity that significantly increases your after-tax net worth in retirement.

How An Advisor Can Help

When it comes to getting the most out of your 401(k), an experienced advisor can help in a few different ways:

- Determining how much is enough to retire;

- Implementing the “strategic de-accumulation” strategy that allows you to keep more of your 401(k); and

- Considering Roth conversions in low income years to minimize your lifetime tax bill.

About WealthChannel Academy

This article is part of WealthChannel Academy, the ultimate guide to planning a worry-free retirement.

WealthChannel Academy has a simple premise: to build a $1 million portfolio and enjoy a worry-free retirement, you need to understand just 7 basic concepts. WealthChannel Academy is your guide to simple and effective retirement planning, without the hype.