Estimated reading time: 6 minutes

Converting a Traditional IRA to a Roth can be a very “high leverage” move. If done correctly, it can create significant wealth – essentially out of thin air.

But if done at the wrong time, it can actually erode your wealth – and make you poorer.

In this article:

Why It Matters

Millions of Americans have both a Traditional IRA and a Roth IRA. If you’re one of them, you may have wondered about a so-called “Roth Conversion” that moves dollars from your Traditional IRA to your Roth.

This can be a very smart — or a very bad — idea. It all depends on tax rates, expected returns, and a few other variables. If you understand the math behind this conversion, you’ll be able to assess whether it makes sense for you.

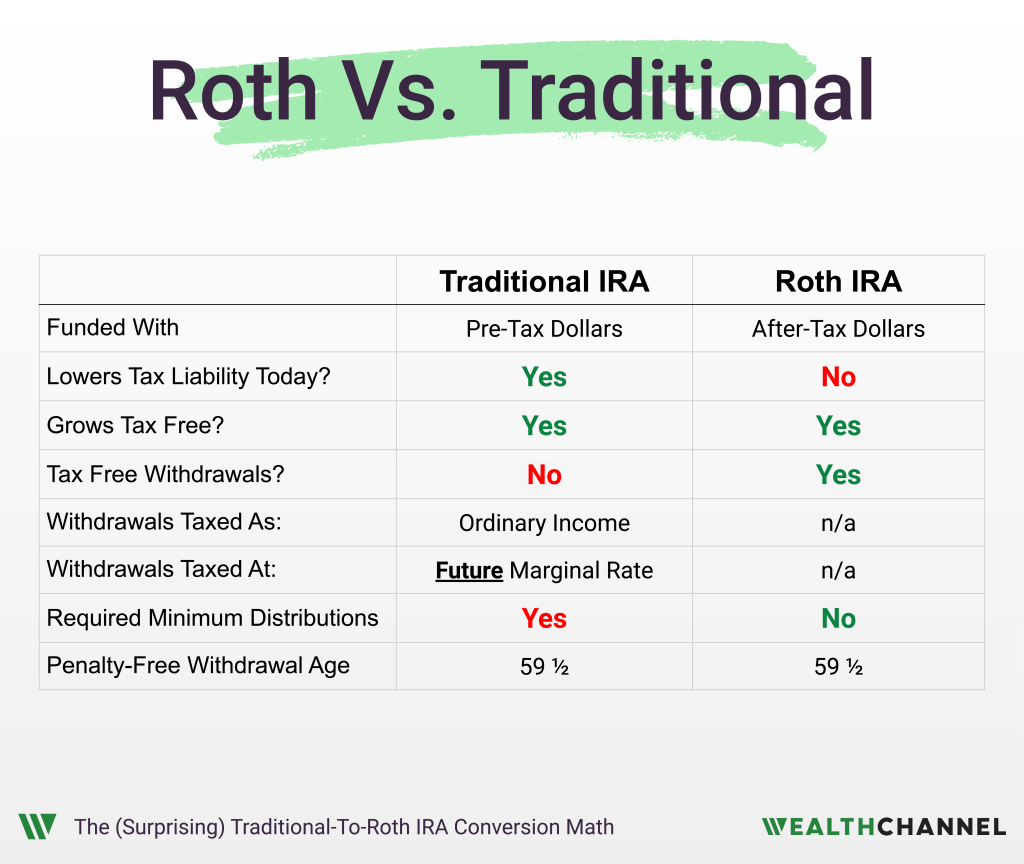

Roth Vs. Traditional

In this guide I’m going to walk you through the exact approach that I would use when determining whether or not to convert a Traditional IRA to a Roth IRA.

Let me start with a very quick overview of the differences between these two accounts. A Traditional IRA is funded with pre-tax dollars. That means that funding a Traditional IRA reduces your taxable income, and therefore your taxes due, in the current year.

Once your money is in a Traditional IRA, it grows tax free: there are no taxes due on dividends or any capital gains.

When you go to withdraw money from your Traditional IRA – which most people do to fund their retirement – any withdrawals will be taxed as ordinary income.

A Roth IRA is a little different. It’s funded with after-tax dollars. That means you pay income taxes, and then can use whatever is left over to fund your Roth IRA.

Similar to a Traditional IRA, a Roth IRA grows tax free: no taxes on dividends or capital gains. And when you withdraw from a Roth, there are no taxes owed. Assuming you’re 59.5 or older, all withdrawals are tax free.

Side Note: Now, there’s a lot that I’m not covering here, like the rules around eligibility to contribute or penalties on early withdrawals.

Conversion Math

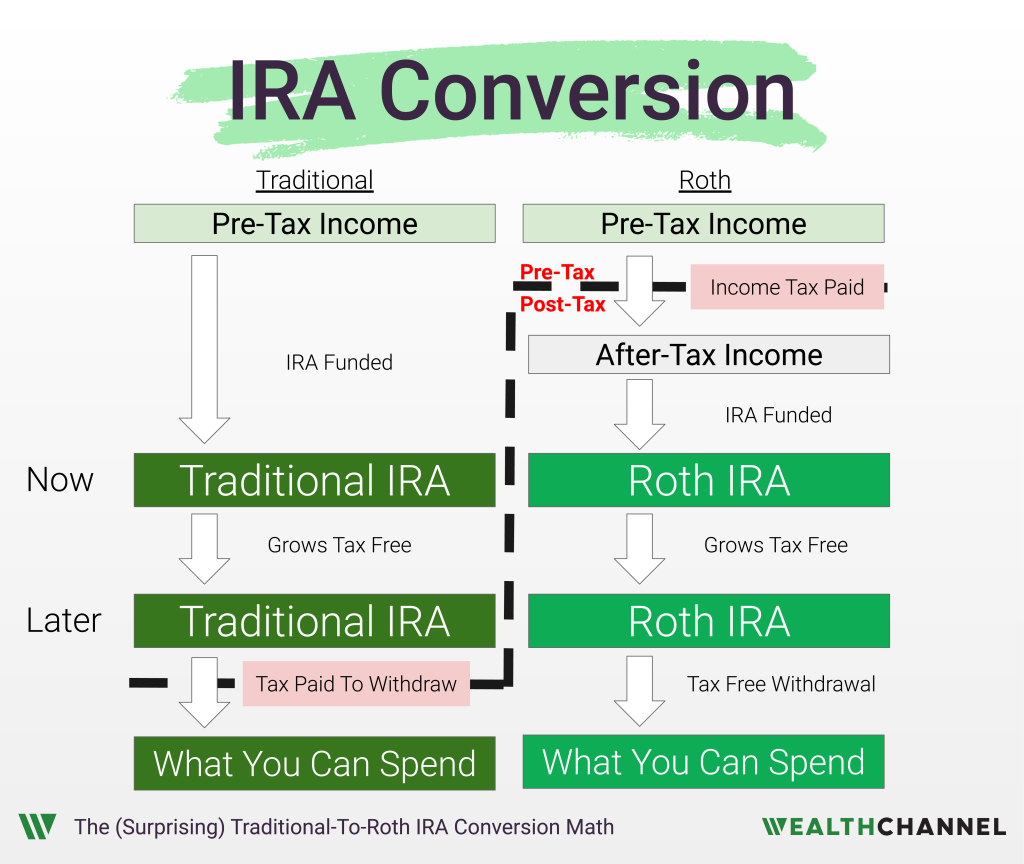

Let’s jump into the math behind a Traditional to Roth IRA conversion. Now, this is a taxable event. You are moving money on which no taxes have been paid in the past – the Traditional IRA – to an account where no taxes will be paid in the future – the Roth IRA.

You’re crossing this dotted line. And in order to do that, you will need to pay taxes today.

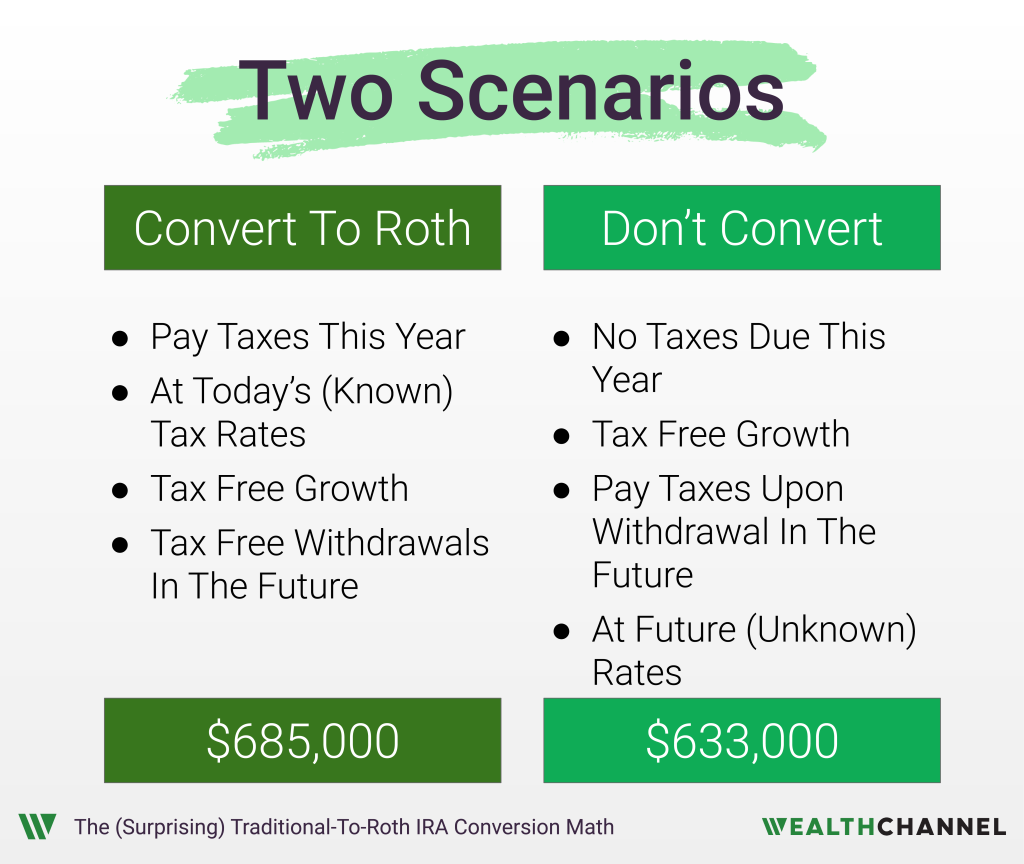

So, here’s how I think about this question. I consider two scenarios: one where I convert from a Traditional to a Roth IRA, and one where I don’t. And then I make some assumptions about the present and about the future, and I estimate which scenario leads to me having more money, after taxes, at some point in the future.

Below is the spreadsheet that I used to calculate this example; feel free to download it (or make a copy) and run your own numbers.

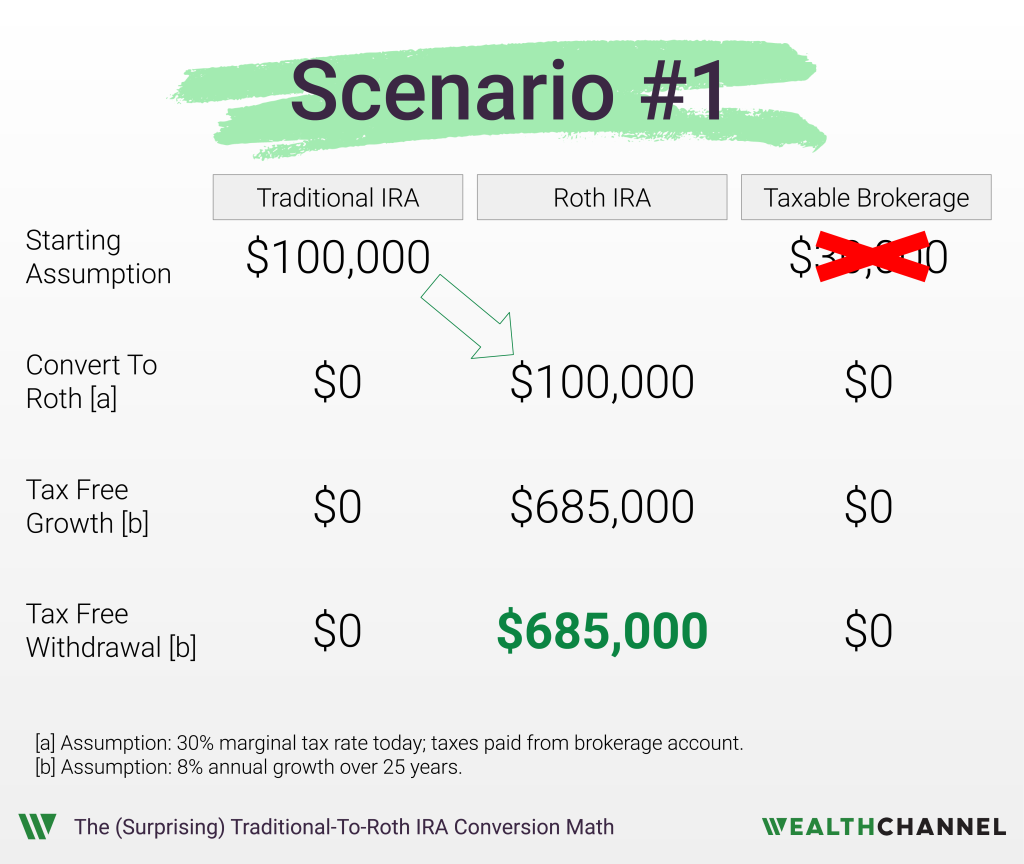

Scenario #1: Convert

Let’s assume I have $100,000 in a Traditional IRA and $30,000 in a taxable brokerage account.

I’m going to assume that my marginal combined federal and state income tax rate is 30%. That means I will owe $30,000 in taxes to do the conversion. And I’ll use the money in that brokerage account to do that.

Now my $100,000 is in a Roth IRA. I’m going to assume that it will return 8% a year for 25 years. That means it will grow to $685,000. And because this is a Roth IRA, there are no taxes on withdrawal. So that’s the end of the first scenario: I’ll have $685,000 in after tax money to spend in retirement.

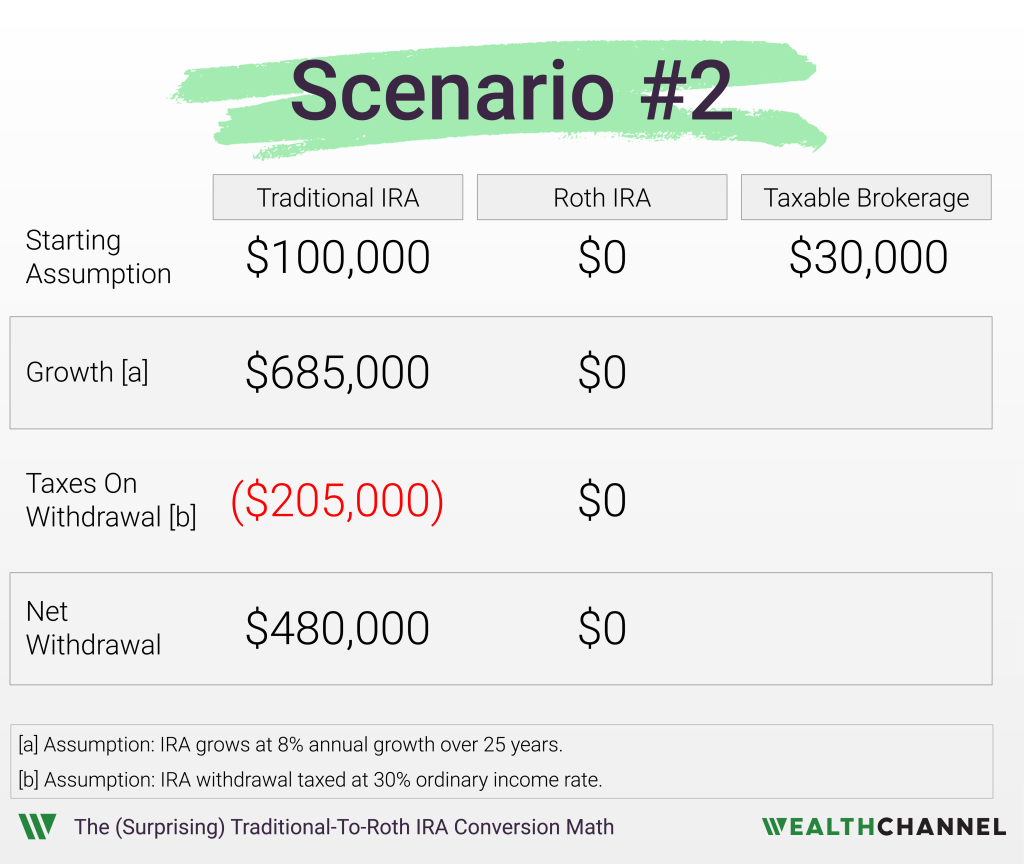

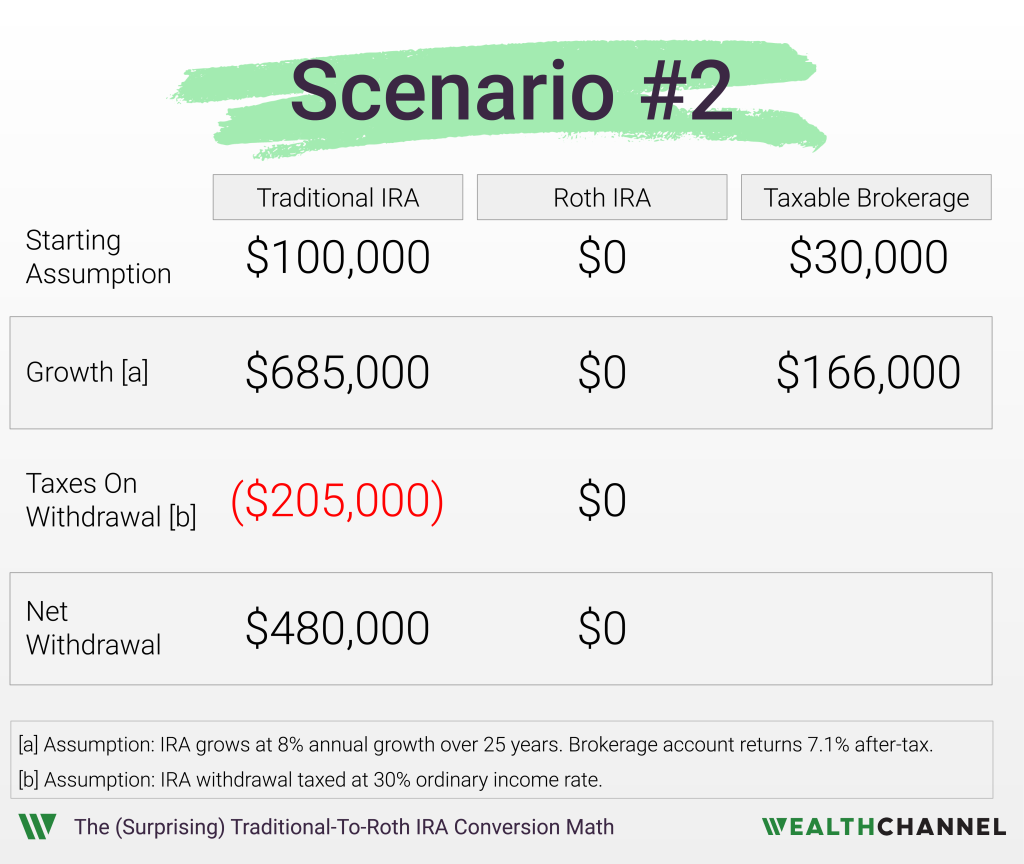

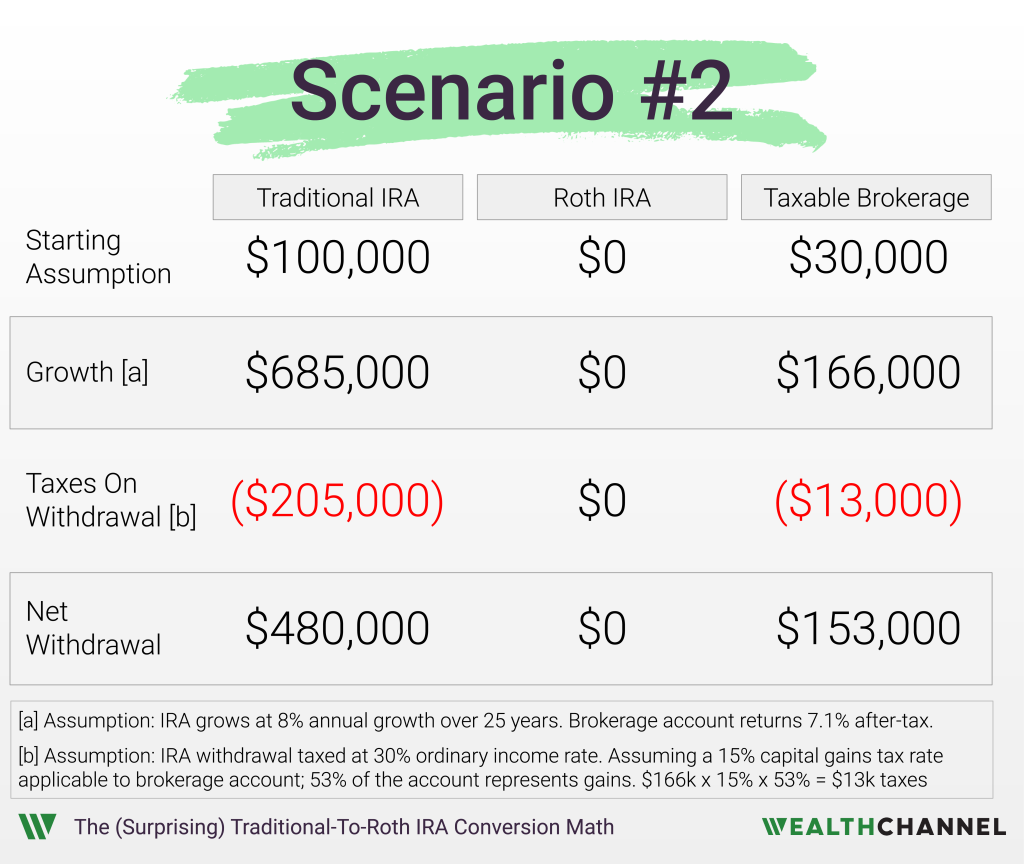

Scenario #2: Don’t Convert

OK, Scenario #2 – where I do NOT convert to a Roth IRA – is a little more complicated. Let’s start with the money in my Traditional IRA: the $100,000. Assuming the same 8% growth rate and 25 year time horizon, this will grow to $685,000.

Now, I have to estimate the marginal combined tax rate that I will pay when I withdraw from this account. This is essentially impossible to do with any certainty. For one, we don’t know what tax brackets and rates will be in the future. I might live in a state that has no income tax, or one with a high income tax.

And the marginal tax rate will depend on how much I am withdrawing each year – assuming that we still have a progressive tax system.

And what is tough about this is that the outcome of this analysis is very sensitive to this assumption.

Having said all that, I’m going to assume the same 30% marginal tax rate in the future. I suggest that you use the tools in the notes to see just how sensitive this analysis is to this assumption though. You might be surprised.

OK, so using an assumption of a 30% combined marginal tax rate in the future means that I’ll owe $205,000 in taxes to withdraw this money from my Traditional IRA.

Now, this isn’t quite right. It’s unlikely that I would withdraw the entire amount at one time. But it’s a simplifying assumption I’m making for now.

That leaves me with $480,000 after tax to spend.

But there’s another piece to this analysis. In this scenario, I did not convert from Traditional to Roth. That means that I do not need to use the $30,000 in my taxable brokerage account to pay taxes today. I can invest that amount as well.

So let’s assume that I invest the $30,000 in the same portfolio – the one that returns 8% annually for my Traditional or Roth IRA. Now, that same strategy won’t return 8% annually in a taxable account. Because in this account, I will have to pay taxes on any dividends and capital gains.

So I need to estimate the effective after tax return on this $30,000. This is a little tricky. Presumably, I’ll invest this account in a portfolio of stocks and bonds. The interest income from bonds will be taxed as Ordinary Income, while qualified dividends paid by stocks are generally taxed at a lower rate.

I’m going to estimate an after tax return of 7.1%. I’m estimating that the 8% return will be split evenly between distributions and capital appreciation – in other words, the yield each year will be 4%, and I’ll have to pay taxes on that.

I’m estimating an effective tax rate of 22.5%, which is a blended rate accounting for the fact that part of the distributions are interest from bonds and part are dividends from stocks.

That gets me an after-tax rate of return on this account of 7.1%. That means that over 25 years, it will grow to $166,000.

Now, in order to liquidate this account and have the money available to spend, I’m going to incur some capital gains taxes. So I need to estimate the effective capital gains tax rate. And there’s actually two pieces to this.

First, I can assume that I’ll owe 15% taxes on any capital gains. But I can’t just take this 15% and multiply it by the pre-tax value of this account. For one, the starting value of the account was $30,000. And then remember that I’ve been receiving distributions every year, paying taxes, and then reinvesting those. That means my effective basis is a lot higher than the initial $30,000.

I’m going to estimate that about 53% of this account is capital gains that is subject to capital gains taxes. The rest represents the amounts that I’ve invested, which can be withdrawn tax free.

So multiplying this 53% times 15% times the account value of $167,000 gets me an estimated capital gains tax liability of about $13,000 and an after-tax value of my brokerage account of $153,000.

I add that to the $479,000 after tax value of my Traditional IRA, and my total in this Scenario – where I DON’T convert – is $633,000.

That compares to $685,000 in the scenario where I do convert. So, by this analysis, I’ll be better off by about $52,000 if I convert today to a Roth IRA.

Now, I’m going to sound like a broken record here, but this analysis is very sensitive to the assumptions I made, some of which are impossible to predict with certainty. It’s obviously sensitive to the tax rates, but in this case the long time horizon – 25 years – also makes for a bigger tax drag on the brokerage account in Scenario #2.

But hopefully you now have a better understanding of what the variables are that affect the outcome of this analysis. If you want to play around with the numbers a little more, there are links in the notes.

Bottom Line On Roth Conversions

Determining the wealth that you will create — or destroy — by executing a Roth conversion is a challenging exercise, in part because it depends on many assumptions that are difficult (or impossible) to estimate with precision.

These conversions can be very powerful tools for investors experiencing low marginal tax rates; if done correctly, they can significantly increase expected after tax wealth in retirement.

How An Advisor Can Help

Even this analysis is a simplified one that does not take into account all aspects of a Roth IRA conversion. A good financial advisor can assist clients in running detailed analyses covering potential conversions, including the impact that a Roth conversion can have on other retirement accounts.

If you’re looking for a financial advisor, use our free Advisor Match tool to get connected with a fiduciary today.

About WealthChannel Academy

This article is part of WealthChannel Academy, the ultimate guide to planning a worry-free retirement.

WealthChannel Academy has a simple premise: to build a $1 million portfolio and enjoy a worry-free retirement, you need to understand just 7 basic concepts. WealthChannel Academy is your guide to simple and effective retirement planning, without the hype.