Estimated reading time: 4 minutes

In this guide, I’m going to show you some basic math that will forever change how you think about your portfolio and your investing strategy.

In this article:

Why It Matters

No matter what your idea of a worry-free retirement is, your ability to achieve that retirement ultimately comes down to one thing: how efficiently you grow wealth.

And whether you like it or not, the single biggest determinant of your ability to grow wealth is taxes.

My goal with this guide is pretty simple: I’m going to show you why tax efficient investing is so powerful, and why you’re making a huge mistake if you aren’t strategies available to you to shelter your assets from taxes.

Magic Penny

Now a lot of people look at me like I’m crazy when I say that. And they’re right of course – I am a little bit crazy – but I’m not wrong about this. And I can prove it to you in about 60 seconds.

I call it the Magic Penny.

And what makes this penny magic is that it doubles in value, every day for a month.

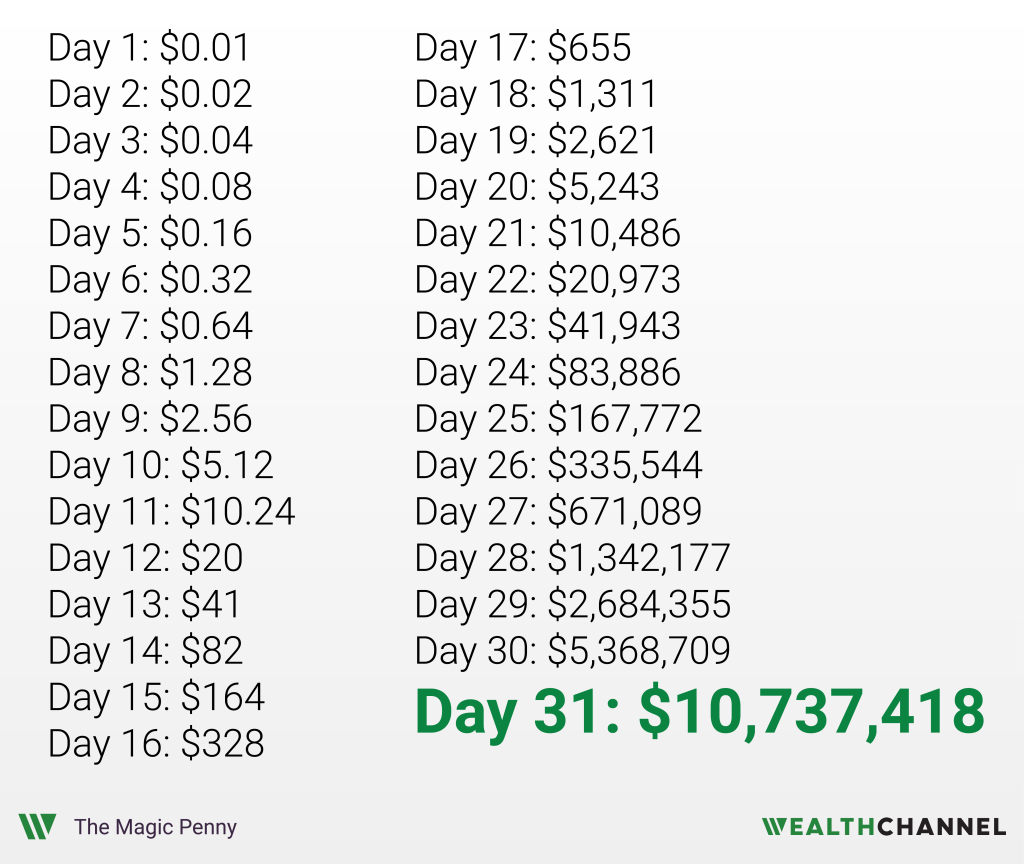

So you start with a penny. On day 2, it doubles to 2 cents.

On day 3, you have 4 cents and on day 4 you have 8 cents. And so on.

So that on day 31, you’ll have about $10.7 million dollars. That’s why Albert Einstein said that compounding returns are the 8th wonder of the world.

Now let’s run the same scenario, but with one twist: after your money doubles every day, you pay taxes equal to 35% on the gains.

So on day 2, your penny doubles to 2 cents, but you have to pay 35% of that penny in gains as taxes. On day 3, your account doubles again – and you pay 35% taxes again.

And so on, for a month.

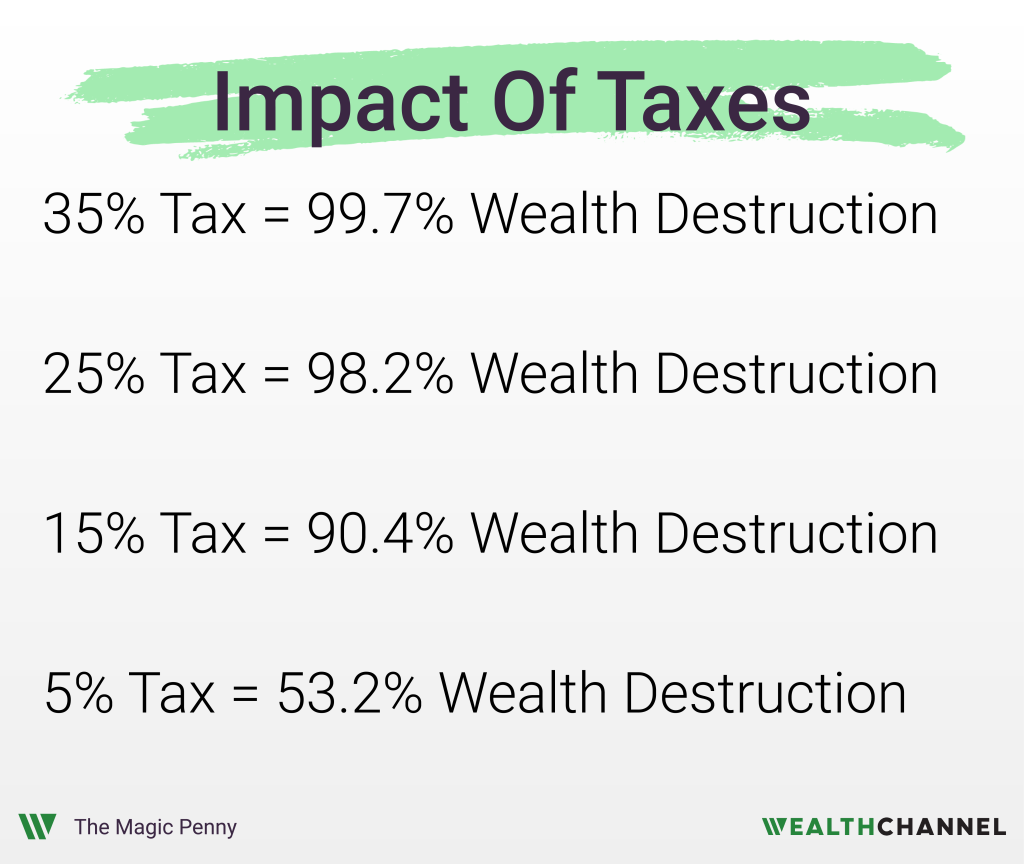

On day 31, you’ll have not the $10.7 million that you had in the first scenario. You’ll have a little over $33,000 – about three tenths of one percent of what you ended up with in the first example.

Put another way, introducing taxes eliminates about 99.7% of your wealth.

Just think about that for a minute. A tax rate of 35% destroys almost all of your wealth in this scenario.

I love this example because it perfectly illustrates how critical a tax efficient investing strategy is to building wealth for a worry-free retirement. Yet most people never realize how big of an impact taxes have on their wealth creation.

And by the way, even if it’s not a 35% tax rate, the results are similar. The same example with a 25% tax rate destroys more than 98% of your wealth. A 15% tax rate destroys 90% of your wealth.

Even a 5% tax rate destroys more than half of your wealth in this example.

And by the way, if you still don’t believe me, the spreadsheet is below. You can download it and see for yourself.

Bottom Line On Tax Efficient Investing

And if you do believe me, you might be asking: “OK, so what’s your point?”

The takeaway here is that there are tax advantaged and tax free strategies that are available to virtually every investor. And the investors who take advantage of these vehicles – who really understand them and shield their investments from taxes as much as possible – are the ones who are more likely to achieve a worry-free retirement.

How An Advisor Can Help

When it comes to maximizing the tax efficiency of your portfolio, an experienced advisor can help in a few different ways:

- Identifying unused tax advantaged investment opportunities, such as the Backdoor Roth and Solo 401(k);

- Making sure your assets are located in the most tax advantaged accounts;

- Practicing tax-efficient rebalancing each year;

- Executing tax loss harvesting to lower your annual liability;

- Planning for a tax efficient withdrawal strategy during retirement.

About WealthChannel Academy

This article is part of WealthChannel Academy, the ultimate guide to planning a worry-free retirement.

WealthChannel Academy has a simple premise: to build a $1 million portfolio and enjoy a worry-free retirement, you need to understand just 7 basic concepts. WealthChannel Academy is your guide to simple and effective retirement planning, without the hype.