Estimated reading time: 6 minutes

In this guide, I’m going to walk through what I’m pretty sure is the greatest investment ever made. And while you’re probably not going to duplicate it, every investor can learn something really valuable from this.

In this article:

Why It Matters

You may have heard an old age that goes something like “anything worth doing is worth doing well.”

Many investors have a Roth IRA — which is great — but aren’t using it to its full potential.

The $5 Billion Roth IRA

Let’s dive right in here. You might have heard of a venture capitalist and entrepreneur named Peter Thiel. He was one of the founders of PayPal. And I’m pretty sure he holds the world record for the most valuable Roth IRA ever.

According to a ProPublica article, he had about $5 billion in his Roth IRA as of 2018. I’m going to show you how that happened.

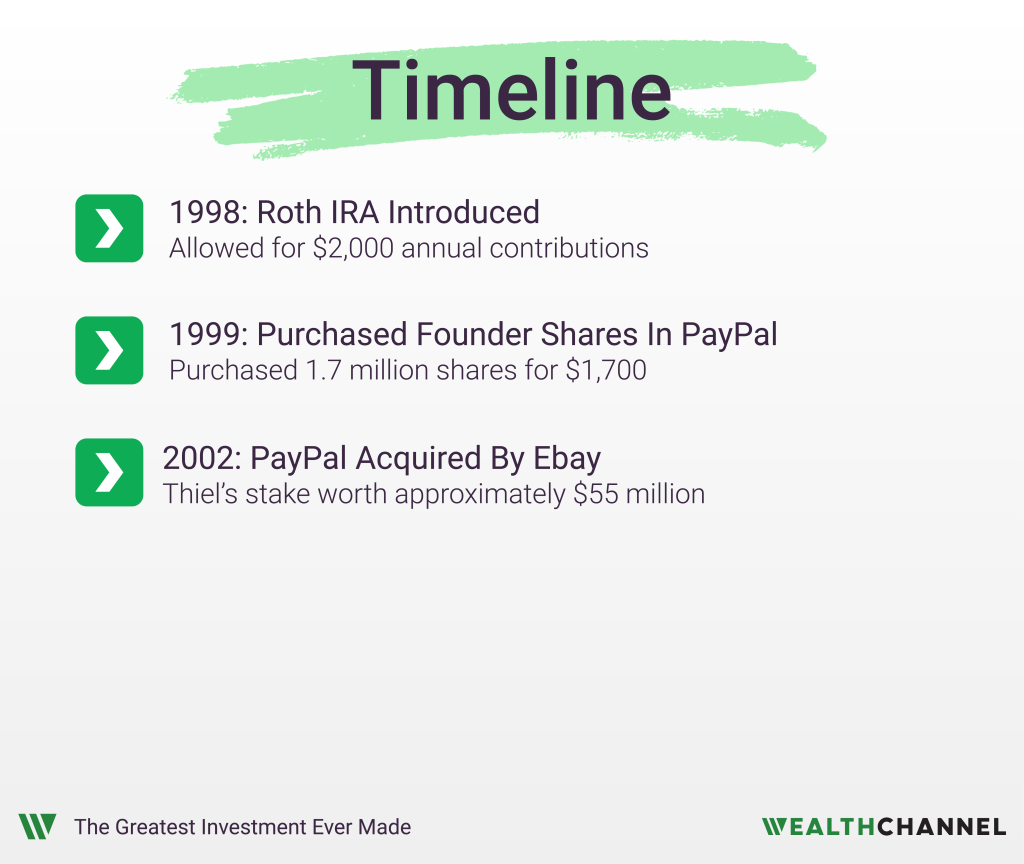

So, the Roth IRA was created relatively recently – in 1998. Back then, the annual contribution limit was just $2,000. It’s been adjusted upward since then of course; in 2024, the limit is $7,000 for anyone under 50.

But back to 1998, when Peter Thiel bought his founders shares in PayPal. He paid $1,700 for 1.7 million shares. That’s a tenth of a penny per share, which is a pretty common arrangement for founders.

And, importantly, he bought those shares in his Roth IRA.

Side Note: Now, a quick side note here: there are some pretty complicated rules around buying shares of privately held companies in your IRA. Specifically, there are rules around buying shares in a company that you control. But because Peter didn’t have a controlling stake in PayPal, he was OK to do this.

So PayPal was one of the great success stories of the initial dotcom boom; it went public in February 2002 – about four years after it was founded – and later that year it was acquired by eBay for $1.5 billion. Peter Thiel’s stake was about 3.7% of the company, or $55 million.

And because that investment was held in a Roth IRA, that gain – from $1,700 to $55 million – was entirely tax free.

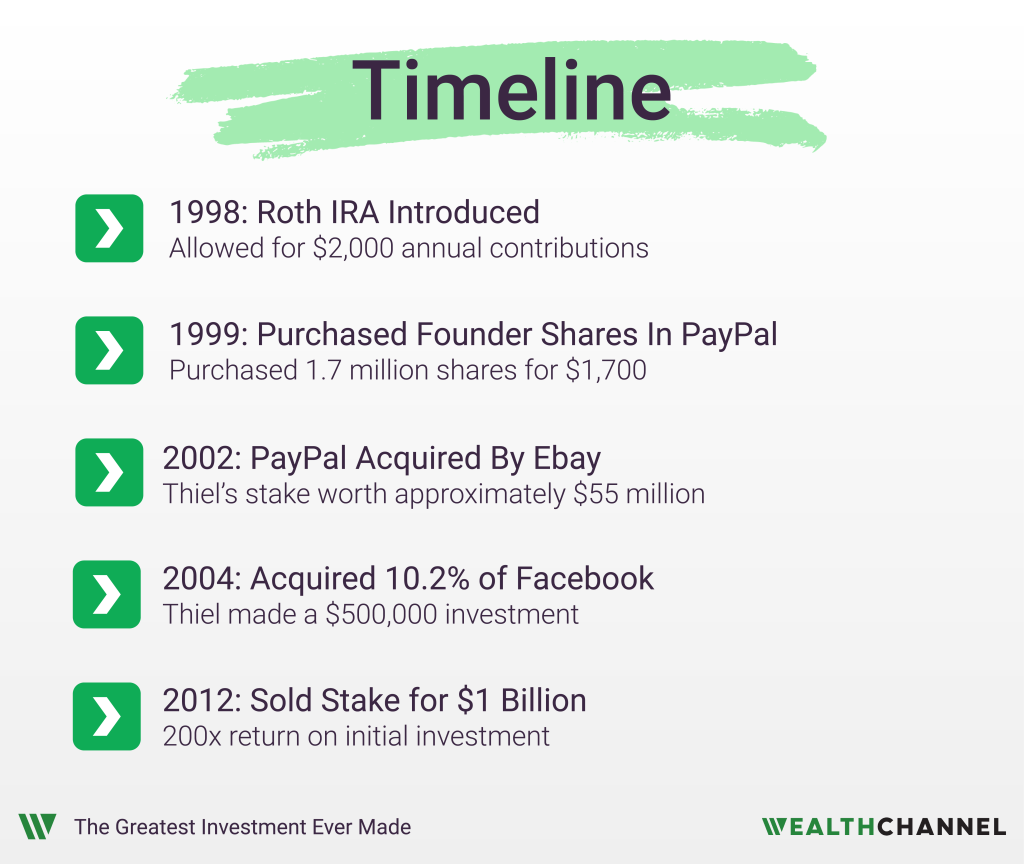

But he was really just getting started. A couple years later, in 2004, he made the greatest investment of all time: he bought just over 10% of Facebook for $500,000. Just think about that for a second.

Facebook went public in 2012 and Thiel sold his stake for about $1 billion. That’s a 200x return in about eight years.

By the way, this was actually NOT a great decision. If he’d held on to those shares, they’d be worth closer to $12 or $13 billion today.

At any rate, that’s how Peter Thiel has been able to amass billions in a Roth IRA even though he’s never been able to contribute more than $7,000 in any one year: he’s made bets on early stage companies that ended up with massive returns.

And, of course, because he made these investments in a Roth IRA he avoided taxes on these incredible gains. He would have owed about $18 million in federal and California taxes on his PayPal windfall, and about $283 million on his Facebook payout.

But if he waits until he turns 59 ½ – which will happen in 2026 – he will be able to liquidate his entire Roth IRA, tax free.

What You Can Learn

OK, so what lessons can you learn from this?

Let’s be realistic: you’re probably not going to make a lot of investments that return 200x like Peter Thiel has done.

But you can apply some best practices from his success to your own portfolio: you can put the assets that you expect to have the highest future returns into your Roth IRA.

Again, if Peter Thiel had held these investments in a taxable account, he would have owed about $300 million in taxes. If he’d held them in a tax-deferred account like a Traditional IRA or a 401(k), he could have been facing a tax bill of closer to $500 million.

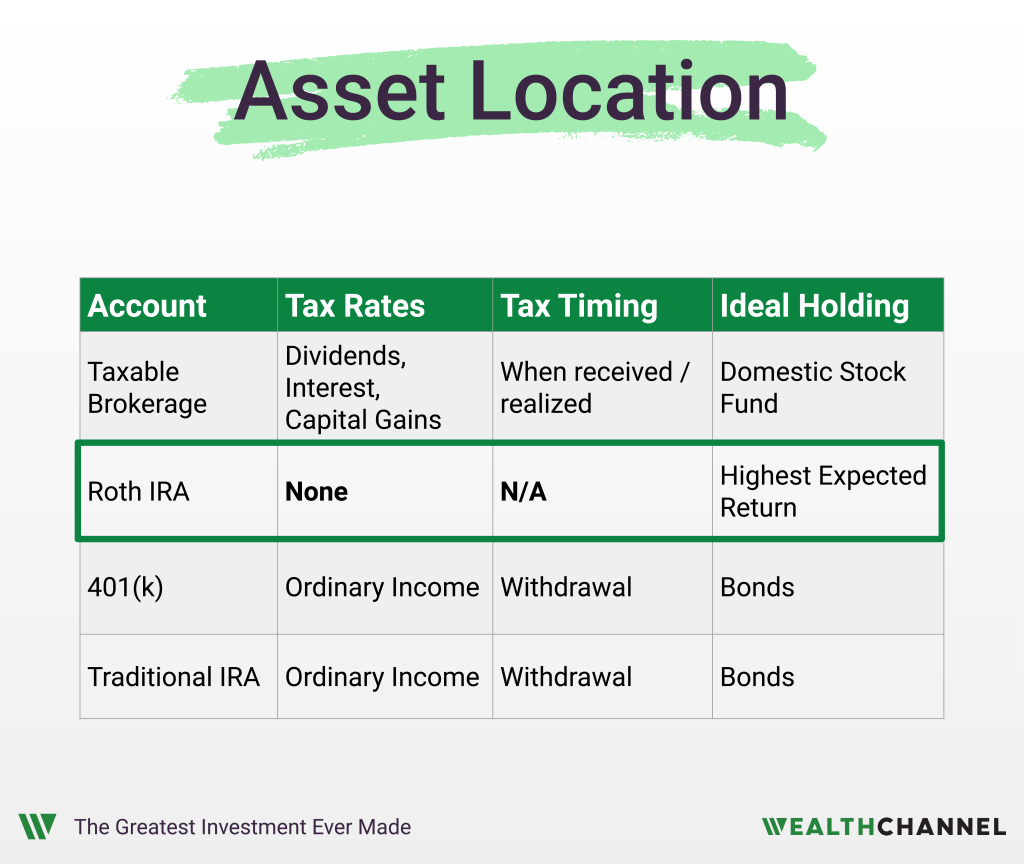

Asset location is an important concept for anyone looking to build wealth to understand. It essentially means matching up the characteristics of an asset class – like stocks or bonds – with the characteristics of the various accounts that you have access to – like a Roth IRA or a 401(k) or a taxable brokerage account.

Just like some flowers are better suited for sun or shade, some asset classes are better suited for certain account types.

For example, bonds don’t make much sense in a Roth IRA, because they aren’t likely to generate much capital appreciation. That essentially wastes one of the major tax advantages of the Roth IRA.

It’s also suboptimal to hold bonds in a taxable account, because the interest income they generate is taxed at the relatively high ordinary income rates.

Bonds do pair nicely with a tax-deferred account like a Traditional IRA or a 401(k), where the interest income is sheltered from taxes completely.

Similarly, you’ll ideally locate your best performing assets in a Roth IRA – like Peter Thiel did – where the capital gains they generate won’t be taxed at all.

For Peter Thiel, a smart asset location strategy saved hundreds of millions of dollars in taxes. Even if you come nowhere close to that dollar total, this little detail can still have a meaningful impact on your bottom line. So it’s worth getting right.

Bottom Line On Asset Location

Asset location can seem a little complicated, and it’s nota n inherently “sexy” topic. But it can have a big impact on bottom line returns, especially for investors with a long time horizon and high marginal tax rates.

How An Advisor Can Help

A good financial advisor can assist with optimizing the location of your assets; many of them use software to assist with this process, and ensure that your tax efficiency is maximized.

About WealthChannel Academy

This article is part of WealthChannel Academy, the ultimate guide to planning a worry-free retirement.

WealthChannel Academy has a simple premise: to build a $1 million portfolio and enjoy a worry-free retirement, you need to understand just 7 basic concepts. WealthChannel Academy is your guide to simple and effective retirement planning, without the hype.