To be more precise (and less alarming): they’re coming for the tax advantages of your 401(k).

Nobody’s going to raid your retirement accounts (at least as far as I know), but it’s very likely that the tax advantages of accounts like the 401(k) and the IRA are severely diminished over the next several years.

Bloomberg floated this as a “trial balloon” last week. Unfortunately, I think they’re right.

The Social Security Quagmire

Why would politicians take away one of the most effective and widely used retirement planning accounts out there?

It all comes down to Social Security — and the fact that this program will not exist in its current form a decade from now.

That’s not a political statement at all. It’s a mathematical one.

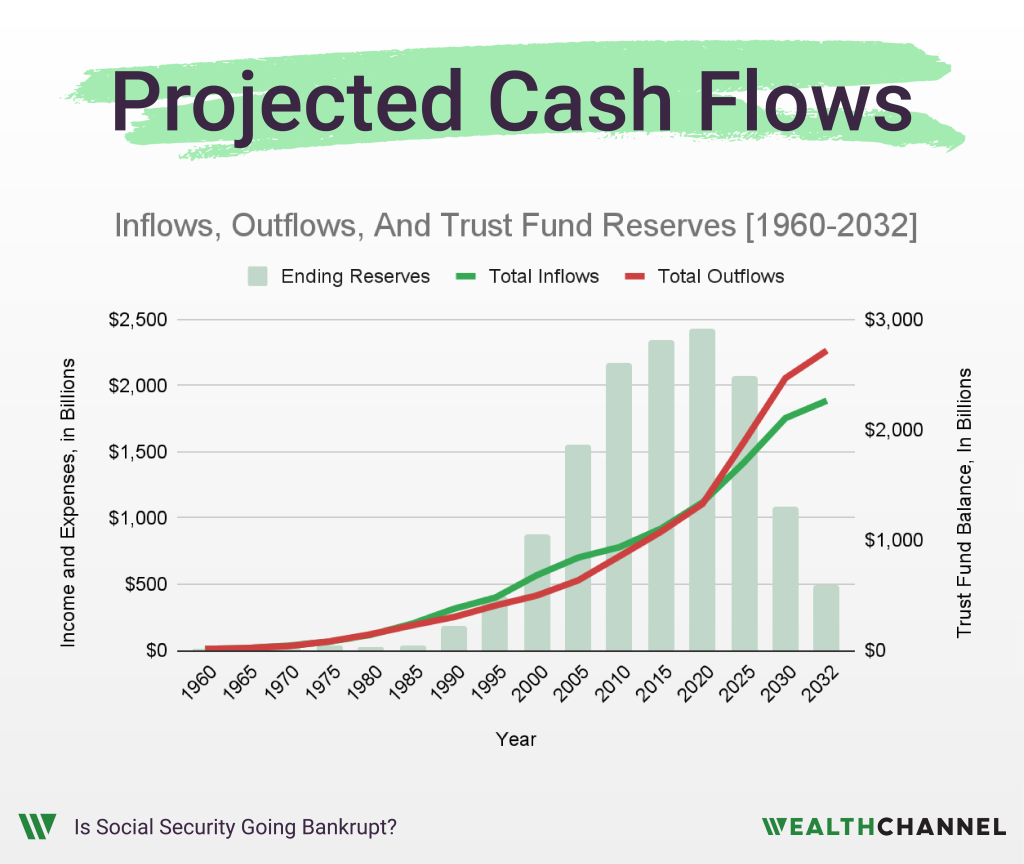

For the last several decades, Social Security took in more in tax receipts than it paid out in benefits. Those surpluses were socked away into a trust fund that — at one point — reached nearly $3 trillion.

But now the tables have turned. Benefits are rapidly outpacing collections, because Boomers are retiring, and plummeting birth rates mean that there aren’t enough new workers to replace them. And the “rainy day fund” that was built up over six decades is going to be depleted in the next eight or nine years.

Lots Of Bad Options

There are a lot of ways to “fix” this problem — all of which are terrible options.

Cutting benefits by 20% or so would do the trick, but that would imperil the wellbeing of tens of millions of retirees. And one thing retirees do better than just about any demographic is turn out on election day. So that isn’t a viable option.

Another “fix” is to increase the payroll tax from 12.4% to about 16%.

That’s unattractive politically as well; nobody wants to tell employers that their payroll costs are about to jump — but that their employees are going to be angry because they’re somehow taking home less pay each week (the Social Security tax is split between employees and employers).

The “Frankenstein” Solution

More likely, in my mind, is a fix that spreads the pain around and implements indirect tax hikes rather than (politically painful) direct ones.

Cost of living increases could get slashed (which would annoy retirees). The “full retirement age” could get pushed from 67 to 68 or even 70 (which would annoy those nearing retirement).

The formula for calculating benefits could get more “progressive,” and the cap on Social Security taxes could be lifted (which would annoy high earners).

And, of course, the government will look for incremental revenue from other sources to balance the scales. That could — and in my mind, likely will — include eliminating the tax advantage associated with IRAs and 401(k)s.

Now, you may be asking: “isn’t this just robbing Peter to pay Paul?”

You’re preaching to the choir. But, please, don’t kill the messenger.

More Reading

- Want this in your inbox each week? Subscribe to the WealthChannel Newsletter.

- While you can, check out our 401(k) and IRA tools.

- Dive into the math behind your Social Security benefit calculation in this week’s WealthChannel Academy.

- Read past editions here.