One of the first steps in planning for a worry-free retirement is figuring out your “endgame” — what you’ll be spending money on after you stop working.

A big component of many retirement budgets is healthcare, so it’s important to be realistic about what your health insurance and out-of-pocket costs will be.

In this article:

Why It Matters

The first step is planning for a worry free retirement is figuring out your end game – what you’re trying to achieve. What does a worry free and satisfying retirement look like? What lifestyle are you able to live, without worrying about running out of money?

This is a fairly straightforward exercise, and I detailed exactly how to go through it in this guide. It involves estimating how much you’ll spend on your “Needs” like food and shelter as well as your “Wants” like entertainment and travel.

But there’s one part of this exercise that can trip people up, so I wanted to dive deeper into that right now. I’m talking about healthcare expenses in retirement.

| Essential Retirement Expenses (Needs) | Discretionary Retirement Expenses (Wants) |

|---|---|

| Housing (Mortgage / Rent, Property Taxes, Maintenance & Improvements) | Travel (Airfare, Hotel, Entertainment) |

| Utilities (Phone, Internet, Water, Electric/Gas, Trash) | Dining Out |

| Transportation (Gas, Car Insurance, Repairs) | Entertainment |

| Healthcare (Health Insurance, Medications, Dental, Vision) | Pet Care |

| Clothing | Charitable Contributions |

| Groceries | Gym Memberships |

Healthcare expenses work a little differently in retirement than they do during your working years. And it’s important to have a realistic expectation about this expense when building your overall retirement budget.

Medicare 101

Most Americans will receive their healthcare through Medicare in retirement. Medicare is federal health insurance for Americans over the age of 65 – and it’s also available to some younger people with certain disabilities.

Now, there are different parts of Medicare that cover different health care costs. These include:

| Medicare “Part” | What It Covers |

|---|---|

| Part A | Hospital stays and inpatient procedures |

| Part B | Doctor visits, some medical equipment, outpatient care |

| Part D | Prescription drugs |

Health Insurance Cost Structure

Now, for each of these “Parts” there unfortunately isn’t a single number. Much like the insurance many Americans have through their employer or a private insurer, there are three pieces to the formula for each part of Medicare:

Premium

First is the premium. This is presented as a dollar amount, and is the amount that you’ll pay each month, regardless of what you use.

Deductible

Second is the deductible. This is also presented as a dollar amount, usually on an annual basis. This is the amount that you pay before insurance kicks in. Once you’ve paid the deductible amount, your benefits take over.

So, let’s say a policy has a $1,000 annual deductible. That means that the first $1,000 in expenses each year will not be covered at all by insurance – it comes out of your pocket.

If you have a $1,000 medical expense, your insurance would not kick in. You’d have to cover the entire amount because it is less than your deductible.

But if you have another medical expense, your insurance would now kick in and cover a portion of the costs, because you’ve exceeded your deductible.

Co-Insurance And Co-Payments

Finally, there’s a co-payment or co-insurance. With a lot of insurance plans, you will still pay for a portion of costs even after you meet your deductible.

This can be either a dollar amount, in which case it is called a co-payment. You’ve probably experienced this at a doctor’s office, where you’ve been required to make a $20 co-payment after your visit.

Or it can be a percentage of total costs – in which case it’s referred to as “co-insurance.”

For example, you may have to pay 20% of total costs – after exceeding your deductible – with insurance paying the remaining 80%.

Example: Out-Of-Pocket Costs

This is a little complicated, so I’ll use a real world example here. Let’s say your health insurance has the following terms:

- A $100 monthly premium;

- A $1,000 deductible; and

- 20% co-insurance

Let’s say you incur $5,000 worth of medical expenses during the year. What would you have to pay?

First, you owe the premium each month: $100 x 12 = $1,200.

Next, you have to cover expenses up to the deductible. In this case, the first $1,000.

For the amount over the deductible, you would owe the co-insurance percentage. In this case, you owe 20% of the amount over the $1,000 deductible. 20% of $4,000 is $800.

So, you would have total out-of-pocket costs of $3,000: $1,200 for the premiums, $1,000 for the deductible, and $800 in co-insurance.

With Medicare, you will likely have multiple premiums, deductibles, and co-payment obligations. For example, you may have both a Part B and Part D premium.

Medicare Part A

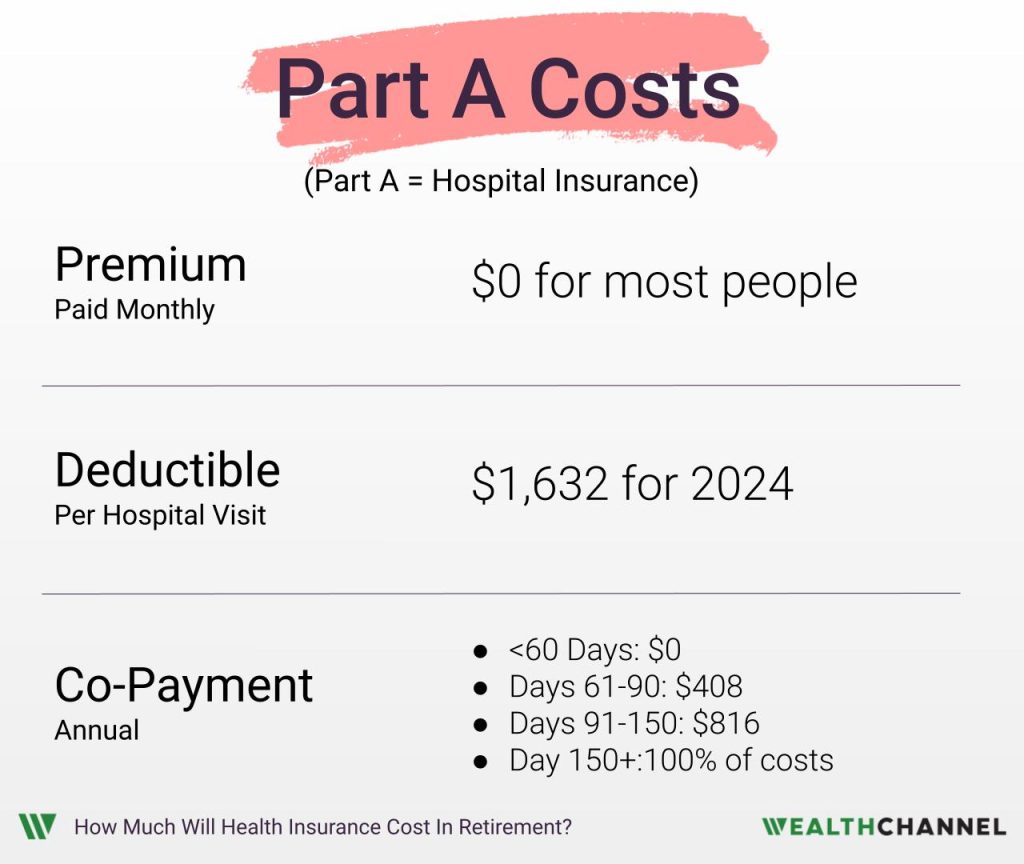

Below is a summary of the premium, deductible, and co-payments for Medicare Part A:

Premium Free Part A

For most people, there is no monthly premium for Part A, or hospital insurance. This is the case if you or your spouse paid Medicare taxes for at least 10 years.

You may have seen something called FICA on your paychecks. This stands for the Federal Insurance Contributions Act. The gist of it is that 6.2% of your gross wages go to fund Social Security and 1.45% of your wages go to cover Medicare. Your employer matches these percentages, for a total contribution of 12.4% for Social Security and 2.9% for Medicare.

So, essentially how this works is that you pay into Medicare while you’re working. And then when you retire, you get subsidized health care that includes “premium free” hospital insurance. If you’re not certain if you are eligible for “premium free” Part A coverage, you can ask your employer or log in to your Social Security account.

Part A Deductible

For 2024, the Part A deductible is $1,632 per hospital admission. That means that each time you’re admitted to the hospital, you’ll pay the first $1,632 before your insurance kicks in.

Part A Co-Payment

Part A has a co-payment: a fixed dollar amount that you’ll pay once you reach your deductible.

The amount of this co-payment depends on the length of your stay.

- If you’re in the hospital for less than 60 days, this amount is $0.

- For days 61-90 it is $408 a day.

- For days 91-150 it doubles to $816 each day.

- After 150 days in the hospital, you pay all costs.

Part A Example

So, let’s use an example. Let’s assume you’re eligible for premium free Part A. You have a hospital stay that lasts a week, and the retail price for your stay is $40,000.

What are your total out-of-pocket expenses?

Well, your premium is $0 – that’s easy!

Your per visit deductible is $1,632.

And because your stay was less than 60 days, your co-payment is $0. So your total cost would be $1,632.

Medicare Part B

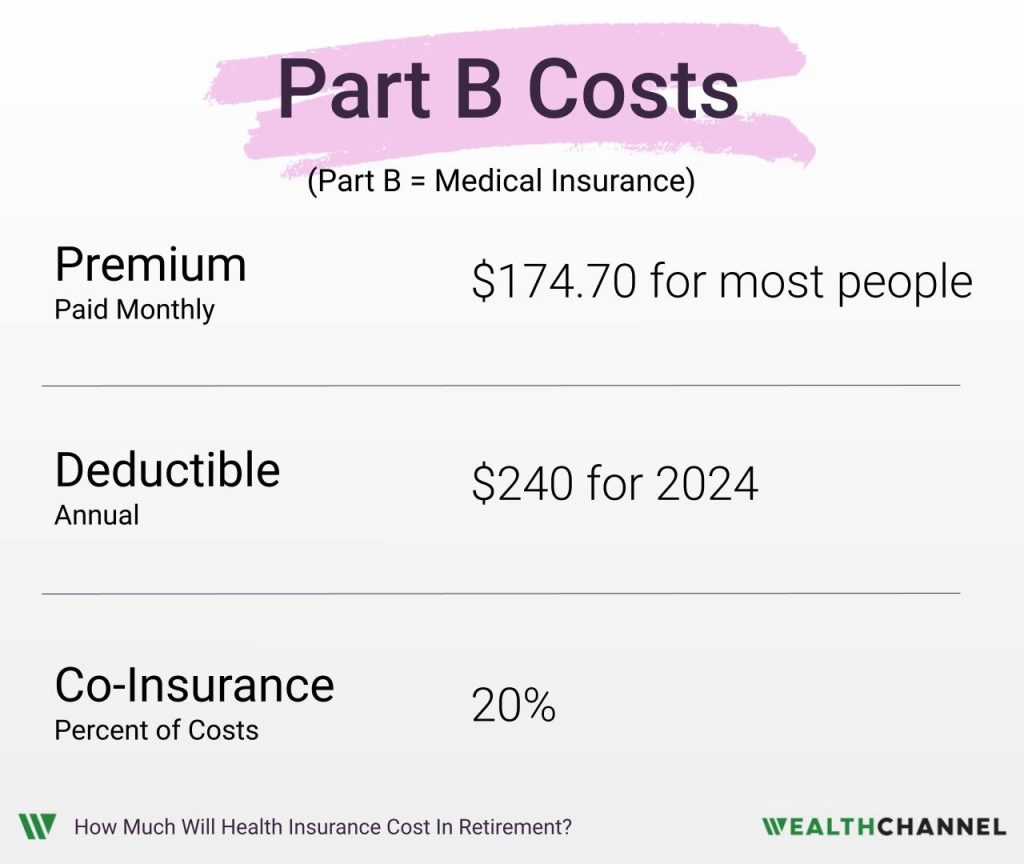

Let’s move on to Part B of Medicare, which is Medical Insurance. This covers things like doctors visits, some medical equipment, and outpatient care.

Below is a summary of Part B expenses for 2024:

Part B Premium

For 2024, Part B has a monthly premium of $174.70 or about $2,100 a year – for most people. But if your income is above a certain amount, you may pay more.

The way this works is, of course, a little complicated. For 2024, you have to look at your 2022 income. If you’re married and made more than $206,000 in 2022, you will pay a higher premium than the $174.70. This goes all the way up to $594 a month for couples making over $750,000.

| 2022 Income (Individual) | 2022 Income (Married, Joint Filing) | 2024 Monthly Part B Premium |

|---|---|---|

| $103,000 or less | $206,000 or less | $174.70 |

| $103,000 to $129,000 | $206,000 to $258,000 | $244.60 |

| $129,000 to $161,000 | $258,000 to $322,000 | $349.40 |

| $161,000 to $193,000 | $322,000 to $386,000 | $454.20 |

| $193,000 to $500,000 | $386,000 to $750,000 | $559.00 |

| $500,000 or above | $750,000 or above | $594.00 |

Part B Deductible

The annual deductible for Part B, or Medical Insurance, is $240. This amount is the same regardless of your income level.

Part B Co-Insurance

Part B generally has a 20% co-insurance requirement, meaning that you’ll pay 20% of any amount over your $240 deductible.

Part B Example

So, let’s do an example: let’s assume you made less than $206,000 in 2022, so you’re eligible for the $175 monthly premium. That’s about $2,096 annually.

Let’s assume your total bills for doctor visits came to $5,000. You’d pay the $240 deductible, and then 20% of the amount over that hurdle.

In this case, the 20% co-payment is $952. So your total Medical Insurance cost would be $2,096 + $240 + $952 = $3,288.

Impact Of Price Increases

One other note here: as with all the dollar amounts in this video, this monthly premium changes each year. In more years it goes up.

Over the last two decades, it’s gone up quite a bit. In 2002, the monthly premium was just $54. But it’s increased at an annual rate of about 5.5%, which is much, much higher than overall inflation.

A 5.5% increase might not sound like much, but compounded over a couple decades it results in a significant price increase. Between 2002 and 2024, the monthly Part B premium roughly tripled.

Medicare Part D

We’ve covered Part A – Hospital Insurance – and Part B – Medical Insurance. The third component is Part D, which covers prescription drugs.

Unlike Parts A and B, Part D is provided through private insurance companies that contract with the federal government.

And it gets a little difficult to estimate, because these plans will depend on the exact drugs you need.

But we can at least provide some ballpark estimates. Part D has a set of “Standard Parameters” and a requirement that insurers offer plans that have “actuarial equivalence” with these Standard Parameters.

Essentially, that means that any insurance plan providing prescription drug coverage would be expected to pay at least as much as a plan with the Standard Parameters.

Part D Premium

For 2024, the standard monthly premium is $34.70 a month, or about $416 a year. Similar to Part D, there is a surcharge here if you made more than $206,000 on your 2022 tax return. For couples that made more than $750,000, this can be an additional $81 a month:

| 2022 Income (Individual) | 2022 Income (Married, Joint Filing) | 2024 Monthly Part D Premium |

|---|---|---|

| $103,000 or less | $206,000 or less | Your premium |

| $103,000 to $129,000 | $206,000 to $258,000 | Your premium + $12.90 |

| $129,000 to $161,000 | $258,000 to $322,000 | Your premium + $33.30 |

| $161,000 to $193,000 | $322,000 to $386,000 | Your premium + $53.80 |

| $193,000 to $500,000 | $386,000 to $750,000 | Your premium + $74.20 |

| $500,000 or above | $750,000 or above | Your premium + $81.00 |

Part D Deductible

The standard deductible is $545 a year.

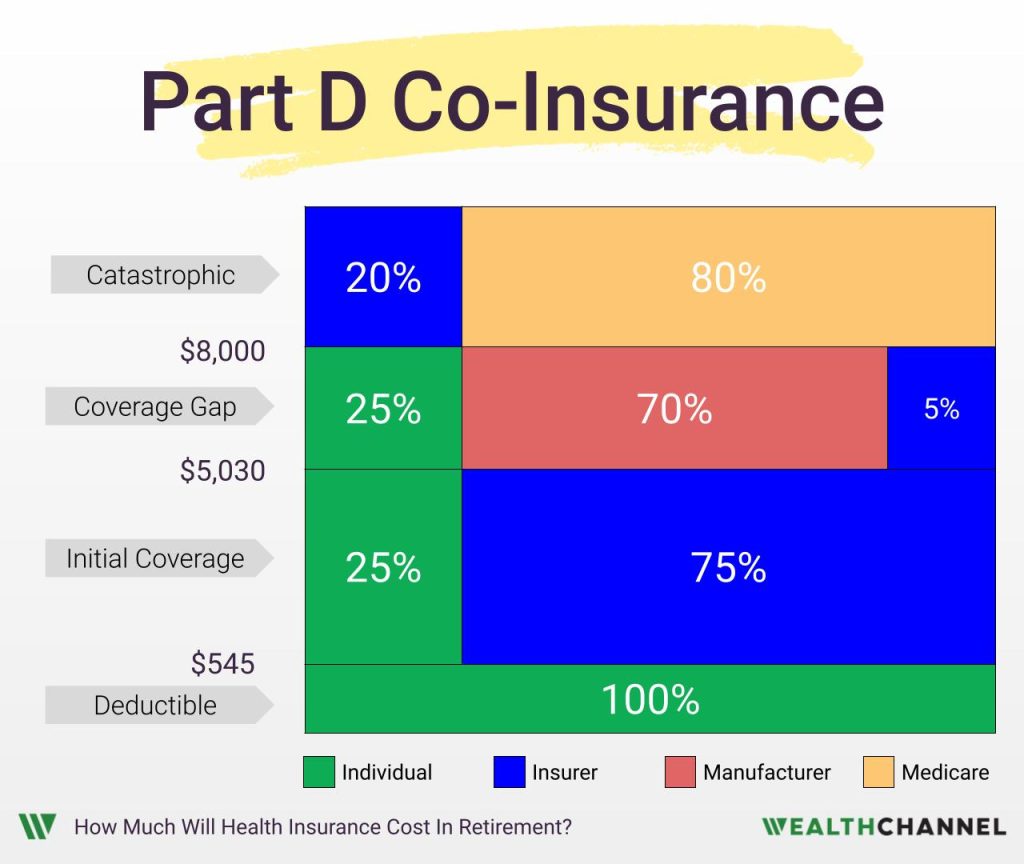

Part D Co-Insurance

Once you hit that deductible, there’s a 25% co-insurance until the retail price of your drugs hits $8,000. At that point, you don’t have to pay any more – it’s entirely covered by Medicare and your insurance provider.

This $8,000 threshold is sometimes called the “catastrophic coverage” limit.

The exact structure of Part D is pretty complex. There’s an intermediate phase – referred to as the “coverage gap” or the “donut hole” – where part of the burden shifts to the manufacturer for your brand name drugs – but not for generics:

If you really want to get into the details, there is a link below to some additional resources. But the upshot is this: when the total retail price of your drugs hits $8,000 you kick into what is called “catastrophic coverage” and have no further expenses. It’s all covered by your insurer and Medicare above that level.

Now, I want to point out that your out-of-pocket maximum isn’t actually $8,000 because you’re only paying a portion of that – 25% in the example used above. So your maximum out-of-pocket for drugs is effectively about $3,300 PLUS the monthly premiums you pay.

Part D Example

So let’s do an example for Part D Standard Benefits, assuming that the retail price of your drugs is $5,000 a year.

Your premiums would be $416 a year.

You’d have to pay the first $545 in costs, since that’s the amount of your deductible.

Then you’d owe the 25% coinsurance on the remaining $4,455; that’s another $1,114.

In this example, your total costs are about $2,075.

Now, again, Part D is a little bit different in that there isn’t a single plan; rather, there are a number of different plans offered by private insurers. And the prices can vary quite a bit depending on which drugs you need.

The plan you end up with might, for example, have a higher monthly premium than $35 and a lower deductible than $545.

But there are a couple “guarantees.” Your deductible won’t be higher than $545 and you won’t have to pay once total out-of-pocket costs reach $8,000.

There’s a link resources section below to a marketplace where you can plug in your exact information and get a better idea of your individualized costs.

Total Medicare Costs (2024)

So, let’s add this up, starting with the premiums. Your Part A premium, assuming you’re eligible, is $0. For Part B it’s about $175 a month or $2,100 a year assuming you don’t make too much money.

And then for the Part D Standard Benefit, it’s going $35 a month or $415 a year. That adds up to about $2,500 in annual premiums.

| Part | Premium |

|---|---|

| Part A (Hospital Insurance) | $01 |

| Part B (Medical Insurance) | $174.10 Monthly | $2,086.40 Annually2 |

| Part D (Prescription Drug Insurance) | $34.70 Monthly | $416.40 Annually2, 3 |

| Total | $208.80 Monthly | $2,502.80 Annually |

2 For high earners, premiums may be higher.

3 Rate for the “Standard Benefit”

Again, that’s only part of the equation. Your deductible for Part A will be $1,632 per visit. For Part B it’s $240 a year and for the Part D Standard Benefit, it’s $545.

If you had one hospital visit – and had to pay the $1,632 deductible – that would add up to a little more than $2,400.

| Part | Deductible |

|---|---|

| Part A (Hospital Insurance) | $1,632 Per Visit |

| Part B (Medical Insurance) | $240 Annually |

| Part D (Prescription Drug Insurance) | $545 Annually1 |

Finally, we can summarize your co-insurance or co-pays.

Remember that for Part A it’s going to vary depending on the number of days you’re in the hospital. For Part B it will generally be 20% of costs. And for the Part D Standard Benefit it will be 25% up until the total retail cost of your drugs hits $8,000. Then it drops to 0%, meaning that you don’t pay anything else and your out-of-pocket payments for the year are capped at approximately $3,300 plus your monthly premiums.

Important Caveats

Now, there are a few things I want to note here.

Number 1 – and I’m going to sound like a broken record here – but all of these dollar amounts are for 2024. If you’re trying to project retirement healthcare expenses decades down the road, you should plan for prices to increase between now and then.

Number 2 is that I’ve been covering what is called Original Medicare. You might have noticed that I covered Parts A, B, and D but left out Part C. Part C is known as Medicare Advantage, and is insurance offered by private insurers that can enhance or extend the coverage offered by Original Medicare.

For example, many Part C plans will also provide vision and dental coverage. They will often also include Part D benefits.

Finally, this isn’t meant to be a super detailed guide. The goal here is to give you a reasonably good estimate of your retirement healthcare expenses. Because that’s the first step to a worry-free retirement – determining what you’re going to be spending.

If you would like to get more information about Medicare, there are a couple links to some great resources below.

Bottom Line On Medicare Expenses

An important part of retirement planning is wrapping your head around what your outflows will be in retirement; you need to first determine that before you can determine how much money you’ll need to enjoy a worry-free retirement.

Healthcare can be a big part of your expense structure in retirement, so it’s important to be able to estimate how much the various pieces of Medicare will cost you.

How An Advisor Can Help

Some investors will be comfortable estimating their anticipated healthcare expenses on their own, while others may prefer to receive some assistance from a fiduciary financial advisor.

An advisor may be able to assist with:

- Setting up and funding tax-advantaged accounts to efficiently pay for retirement expenses;

- Avoiding penalties that can be triggered by late Medicare enrollment;

- Planning for health insurance expenses prior to Medicare eligibility; or

- Being prepared for “extreme” scenarios, such as hyperinflation… or living to be 120.

About WealthChannel Academy

This article is part of WealthChannel Academy, the ultimate guide to planning a worry-free retirement.

WealthChannel Academy has a simple premise: to build a $1 million portfolio and enjoy a worry-free retirement, you need to understand just 7 basic concepts. WealthChannel Academy is your guide to simple and effective retirement planning, without the hype.

Additional Resources

- Medicare Eligibility Tool

- Social Security Account

- Phases Of Part D

- Find Medicare Part D Plans

- YouTube Channels For Additional Medicare Topics: