Estimated reading time: 10 minutes

One of the most important financial decisions that many Americans will make is when to start receiving Social Security benefits.

It’s important to understand the risks and benefits with the various options in order to make the optimal decision for your situation.

In this article:

Why It Matters

For the vast majority of Americans, Social Security represents a significant portion of the income they will receive in retirement. But the amount that you receive each month can vary — potentially by thousands of dollars — depending on the start date you select for your benefits.

Side Note: I’m not going to get political here. This guide is all about how Social Security actually works, and not how I think it should work.

The Big Picture

In the last guide, I walked through the math behind your Social Security benefit calculation – showing you how the Social Security Administration determines what it will pay you when you reach “full retirement age” – which is 67 for most people.

But you actually have the option to start receiving benefits early – as much as five years early. For each month you bump up your start date, however, your benefit gets reduced. If you move it forward a full five years – and start receiving benefits when you’re 62 – you’ll only get 70% of your “full” benefit.

On the other hand, you can delay receiving Social Security by as much as three years – waiting until you are 70. For each year that you delay, your benefit is increased by 8%. So if you delay the full 3 years until you’re 70, your benefit would be increased by 24% – that’s 8% a year times three years – compared to what you would receive if you started at the “full retirement age” of 67.

| Timing | Age | % of “Full Benefit” |

|---|---|---|

| Five Years Early | 62 | 70% |

| Four Years Early | 63 | 75% |

| Three Years Early | 64 | 80% |

| Two Years Early | 65 | 87% |

| One Year Early | 66 | 93% |

| Full Retirement Age | 67 | 100% |

| One Year Late | 68 | 108% |

| Two Years Late | 69 | 116% |

| Three Years Late | 70 | 124% |

Optimal Scenario Analysis

So, the question of course is… which option should you take?

So, here’s how I think about this: I want to get an apples-to-apples comparison, and pick the option that has the highest expected value.

So I’m going to pretend that I am 62 years old – the youngest age at which I can elect to start receiving benefits. And let’s assume my estimated full monthly benefit is $3,000 a month or $36,000 a year.

Three Scenarios

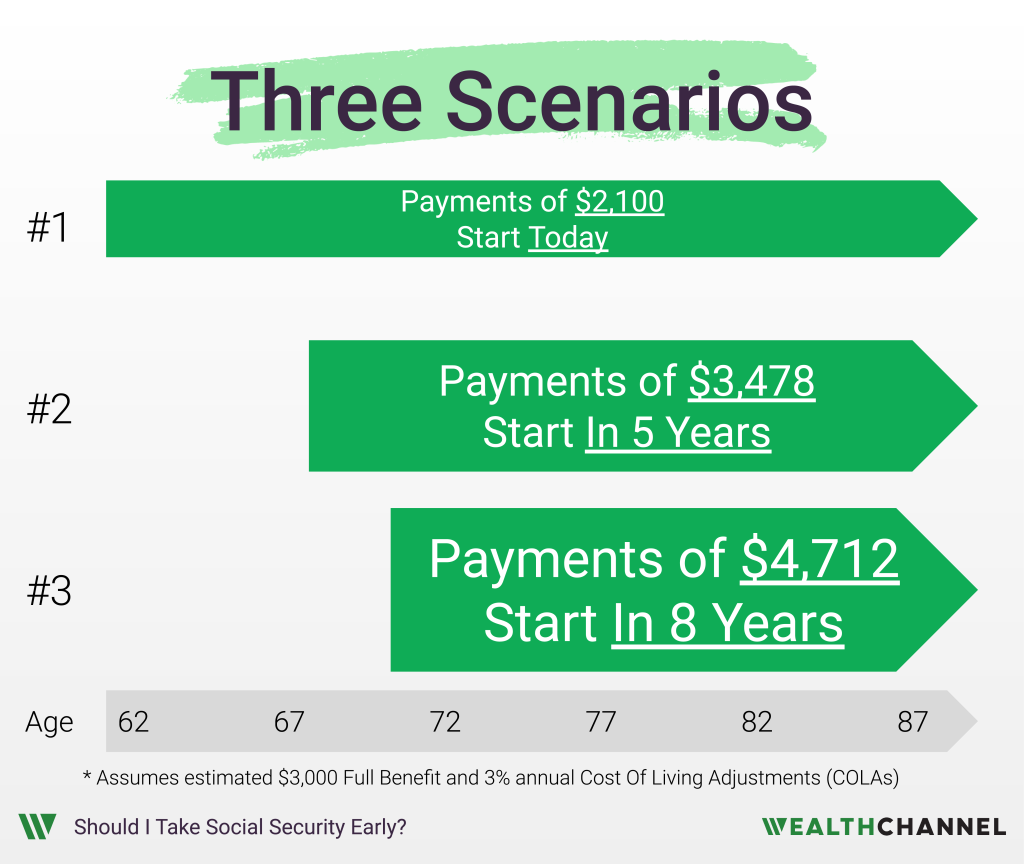

I get to choose from different series of cash flows in the future. There are actually dozens of different options – you can pick any month between age 62 and 70 – but I’m going to simplify things a bit and focus on three scenarios.

The first option starts right now – at age 62 – but the monthly amount is the smallest. Remember, because I am starting early I get just 70% of that $3,000 figure, which comes out to $2,100 a month.

The second option starts in five years at my Full Retirement Age of 67, and has a higher monthly payout.

Now I want to point out a very important detail here. You are eligible for cost-of-living benefit increases starting at age 62, even if you don’t start receiving benefits then. These cost-of-living benefits start accruing, and are applied to your monthly benefit when you start receiving distributions.1

So, in this second scenario – when you start receiving at your Full Retirement Age of 67 – you’d adjust that $3,000 a month figure for five years of cost of living increases.

If we assume 3% annual increases for five years, your benefit would grow to about $3,480 a month or $41,700 a year.

The third option starts in eight years – when you turn 70 – and has the highest monthly payout yet: eight years of COLAs plus a 24% increase for deferring becomes $4,712 a month or about $56,500 a year.

You can see all the numbers behind the calculations in this guide in a Google Spreadsheet here.

So, which one should you take?

This is ultimately just a math equation, but it comes down to a couple of variables that you need to make assumptions about.

The Variables

The first variable / assumption is a little bit morbid: how long are you going to live?

In general, the longer you expect to live, the more attractive Scenario #3 will be. That’s because you get a late start – you get nothing for the first eight years – but then you make up that ground each year through higher benefit payments.

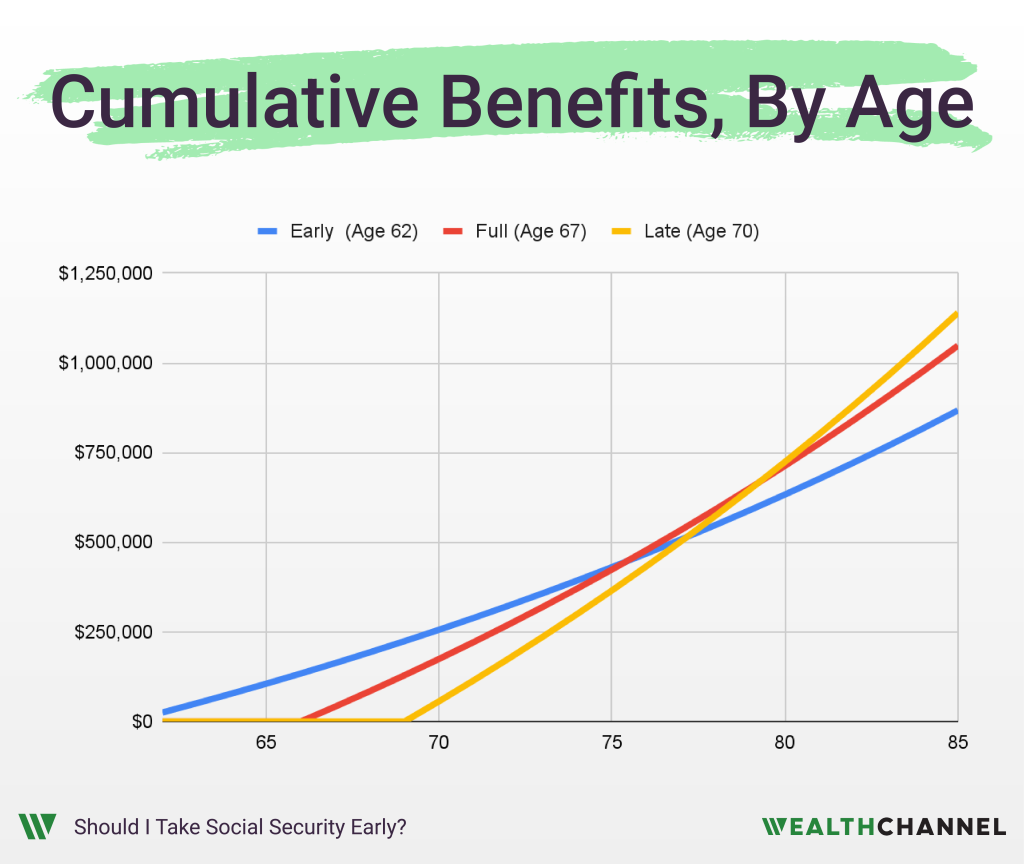

So if you were to graph the cumulative payments you receive under these scenarios, it would look something like this. Scenario #1 has the early lead, but the others gain ground on it each year and eventually overtake it. The longer you live, the better Scenario #3 looks.

If you die at age 66 – again, sorry to be morbid – you’ll obviously have received the most cash if you opted for the earliest possible start to your benefits. In Scenarios #2 and #3, you wouldn’t have yet received anything.

A quick note here: I’m assuming that your benefit payments stop when you die. In reality, that’s not always the case; you may be able to pass on all or part of your benefits. For example, when a spouse passes away the general rule of thumb is that the largest benefit payment remains and the smallest ceases. But, there are a ton of caveats and edge cases here. So for this analysis, I’m making the simplifying assumption that these payments stop when you die.

So, we can actually calculate the breakeven point in this example. Age 76 is where your cumulative benefits under Scenarios #1 and #2 cross. And age 80 is where the crossover happens between Scenarios #2 and #3.

But there’s another factor to consider here: the Time Value of Money or the Discount Rate that should be applied to future cash flows.

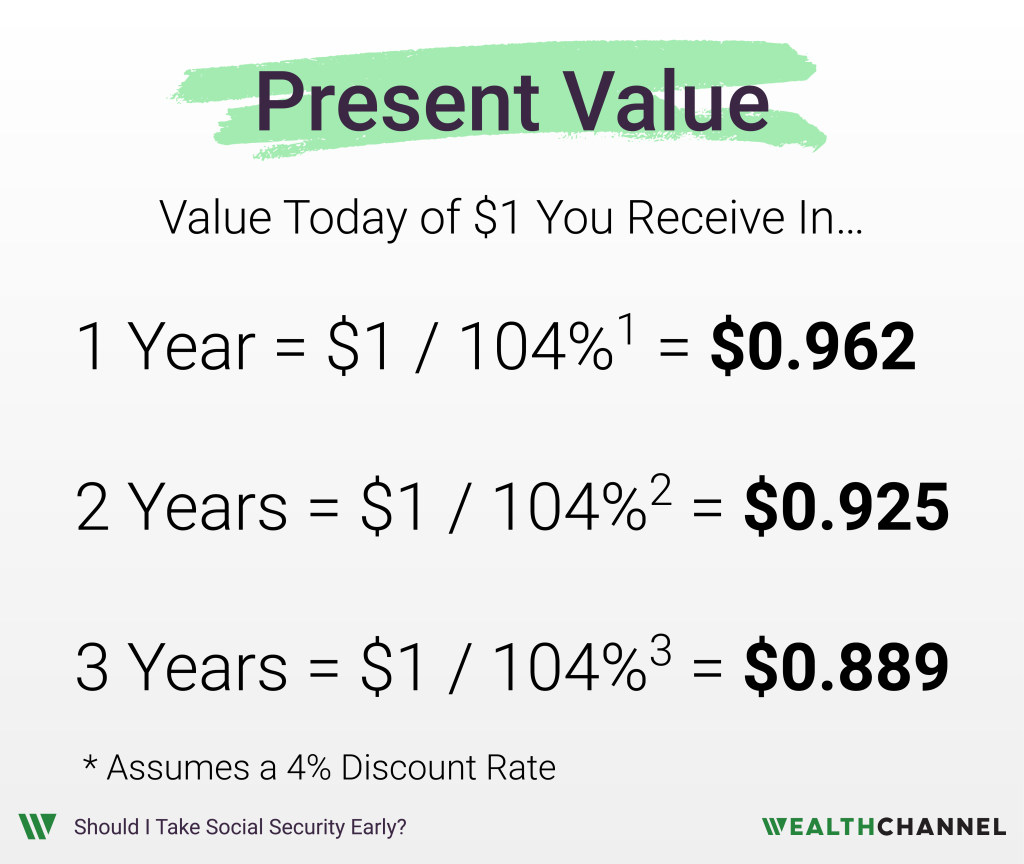

All else being equal, a dollar today is worth more than a dollar a year from now. This is the time value of money and it is a foundational principle of investing.

So if I were to use a discount rate of 4%, that would mean that $1 one year from now would be worth about 96 cents to me today. A dollar two years from now would be worth about 92 cents to me today. And so on.

Now, how much should you discount future cash flows?

That’s a great question, and the answer to it will impact your decision making here. In general, the higher your discount rate, the less valuable future dollars are to you. And the less valuable future dollars are to you, the more you will prefer Scenario #1 – starting to receive benefits at age 62.

And the opposite is true as well. The lower your discount rate, the more valuable future dollars are to you and the more you will prefer Scenario #2 – starting at your Full Retirement Age of 67 – or Scenario #3 – waiting until age 70.

The discount rate you apply to future cash flows should be based on risk. In this case, these benefit payments are not particularly risky. They are backed by the U.S. government, and there is very little risk that you wouldn’t receive those payments.

So it would be appropriate to use a discount rate roughly equivalent to the yield on U.S. government bonds. I’m going to pick a 4% discount rate for this example.

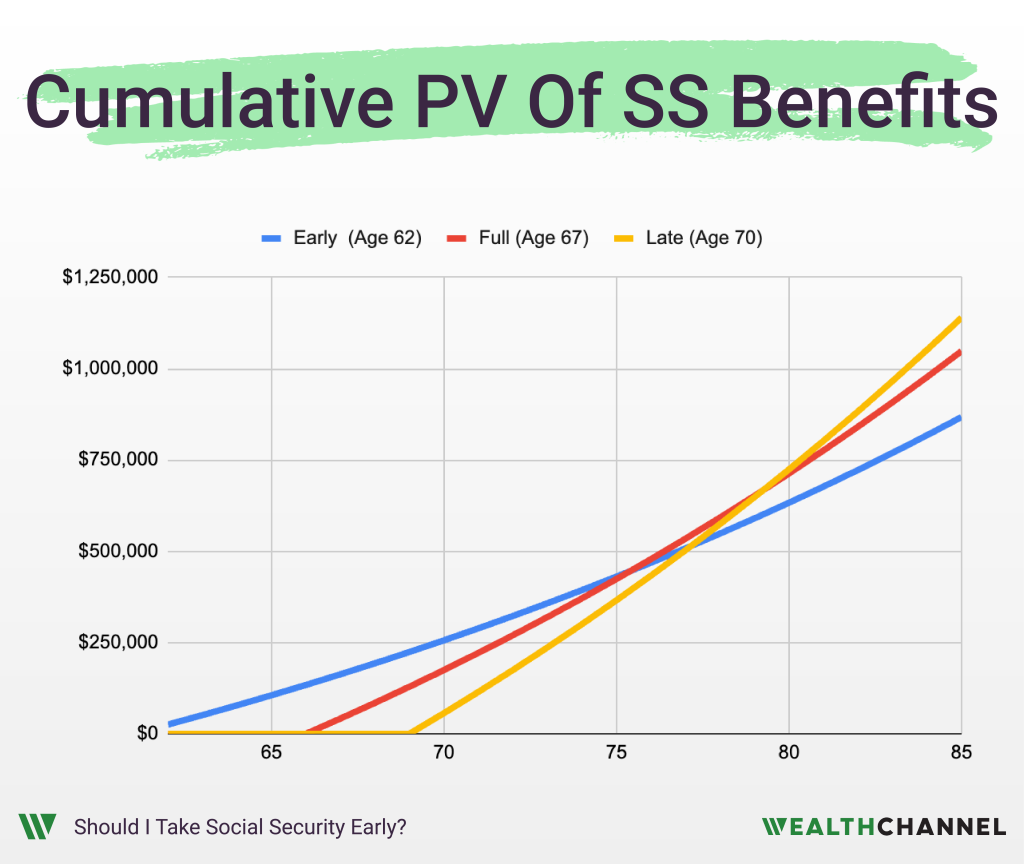

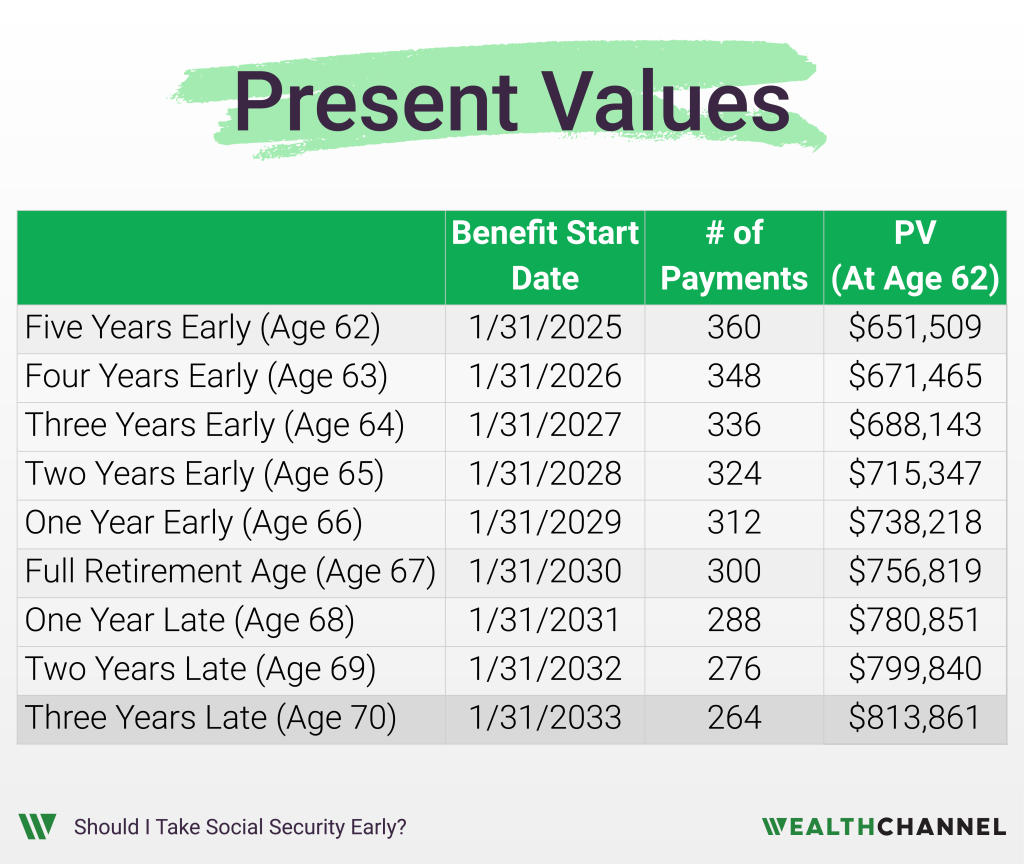

So we can then calculate the present value of expected future cash flows under all of these scenarios. And I’m showing that in this chart.

In this example, the breakeven point between Scenario #1 – starting at age 62 – and Scenario #2 – starting at your Full Retirement Date of 67 – is about age 79. In other words, if you live to be 79 or older, you’re better off waiting.

And then the breakeven point between Scenario #2 – Full Retirement Age of 67 – and Scenario #3 – delaying until age 70 – is about age 83. In other words, if you live to 83 or later you’ll be better off delaying your benefits.

A quick note: this is one example, and it is dependent on the assumptions that I’ve been making. If you have different assumptions, you might get different results. If you want to see the source data and enter in your own assumptions, here’s the Google Sheet I used to do these calculations.

OK, so let’s roll up everything we’ve been talking about. Here are the assumptions I’m using:

- Estimated Full Benefit of $3,000 a month or $36,000 a year;

- Your Full Retirement Date – your 67th birthday – is January 2030;

- That means you could start receiving benefits as early as January 2025 or as late as January 2033;

- I’m going to assume that you’ll live until January 2055 – that’s 25 years beyond your 67th birthday, or a ripe old age of 92;

- That means in Scenario #1 you’d get 360 monthly benefit payments. In Scenario #2 you’d get 300 and in #3 you’d get 264;

- Let’s assume your benefit increases at a rate of 3% a year and we’re going to discount all future cash flows at a rate of 4%.

We can come up with a Present Value of your expected cash flows in each scenario. And here’s what we come up with:

Now these are apples-to-apples numbers – the present value of all future expected payments. So the highest number is the better option.

So, in this scenario, we’d be much better off waiting to receive your benefits until age 70.

Now I’m going to sound like a broken record here, but this is just one scenario and it is sensitive to the assumptions that we use. The Google Sheet I used to come up with these numbers is below. It’s also linked here; download it, play around with it, and enter in your own assumptions.

Bottom Line On Social Security Timing

OK, so what is the key takeaway here?

Well, in most scenarios, you’re going to be better off delaying Social Security assuming that you’re going to live into at least your late 70s or 80s. That decision – delaying the start to your benefits – also reduces what I call “longevity risk” – it reduces the risk that you will run out of money if you live to a very old age.

I hope that’s been helpful. In the next episode, I’m going to talk about the risk that Social Security goes away. I’ll be separating the fact from fiction and explaining what you actually need to know.

How An Advisor Can Help

When it comes to determining your optimal Social Security strategy, a good financial advisor can help in a number of ways:

- Determining the tradeoffs associated with the age at which you start receiving benefits;

- Assessing the impact of taxes on your Social Security receipts;

- Preparing for a scenario where Congress cuts Social Security benefits; and

- Determining if you’ll be able to pass on your Social Security benefits after you die.

Notes

- Details here: https://www.ssa.gov/pubs/EN-05-10070.pdf ↩︎

About WealthChannel Academy

This article is part of WealthChannel Academy, the ultimate guide to planning a worry-free retirement.

WealthChannel Academy has a simple premise: to build a $1 million portfolio and enjoy a worry-free retirement, you need to understand just 7 basic concepts. WealthChannel Academy is your guide to simple and effective retirement planning, without the hype.