Earlier this month I shared some frustrations about the shockingly bad performance by Americans on a basic financial literacy test, where the average score is a D-.

Whenever I strike up a conversation about financial literacy (which, as you’ve probably guessed, happens quite often), I rarely encounter much resistance.

I’d describe the typical reaction as “defeatist” — everyone acknowledges the sad reality, but there’s never much interest in discussing specific solutions.

I think that stems in part from a lack of understanding about the magnitude of the underlying problem. So, today, I’d like to bring some specifics — some dollars and cents — to the conversation.

The Chart…

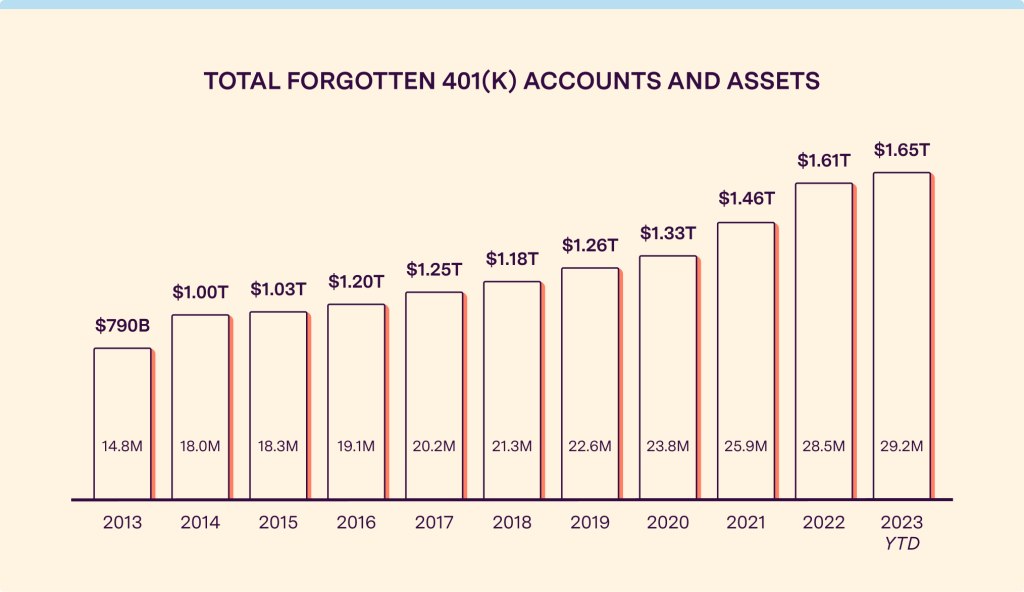

29.2 million. That’s the number of “forgotten” 401(k) accounts out there, according to Capitalize. Amazingly, these accounts have about $1.65 trillion in assets — about 25% of the total 401(k) assets held by Americans.

And that number is going in the wrong direction: up.

Source: Capitalize.

Let’s take a moment to think about what the chart above means.

This is hard-earned money that American workers (and their employers) have put away towards retirement — that they might never see again. My guess is that this happens when an employee switches jobs and is unaware of how their 401(k) works.

This is, of course, entirely avoidable. These are retirement accounts that are fully vested and owned by the employees, but that risk being lost forever due to a basic lack of understanding about how 401(k) accounts work.

Perhaps the saddest thing about this chart is that it reflects 29.2 million people who are doing the right thing: setting aside part of each paycheck for retirement.

Presumably, many of them are taking advantage of employer matches (essentially, claiming the free money offered to them).

But then they move on from a job, and forget about the mini nest egg they’d accumulated. You expect some things to be lost when changing jobs: some office supplies, maybe some files — but not a retirement account with more than $50,000 in it.

Next time you walk down the street or through the grocery store, think about the fact that nearly one in ten of the people you’re passing has simply lost track of a retirement account with an average of $56,500 in it.

Scratching The Surface

This is, of course, not the only example of investors inadvertently shooting themselves in the foot. There are plenty more examples of poor investing habits, including both self-induced errors and mistakes pushed on unaware investors by third parties who stand to profit.

So, here’s an opportunity for you to make someone’s day. There are a couple of tools that can help investors to track down “forgotten” 401(k) accounts, including the Capitalize 401(k) finder and the National Registry of Unclaimed Retirement Benefits.

They’re both free and easy to use.

Heck, maybe you have some unclaimed money out there. Statistically, the odds are that lots of folks getting this email do. And it’s highly likely that one of your family members or close friends has made this mistake.

If you do turn up some forgotten 401(k) assets for a friend or loved one, I’d love to hear about it!

Talk soon,

Michael Johnston

More Reading

- Want this in your inbox each week? Subscribe to the WealthChannel Newsletter

- Think investing is too complicated? WealthChannel Academy is the solution

- How much does Medicare actually cost? Watch the video

- Read past editions here.