Estimated reading time: 9 minutes

When I explain this concept, people often have an “aha moment” where a few things suddenly snap into place.

Once this happens, they feel way more confident in their ability to build towards a worry-free retirement.

In this article:

Why It Matters

In planning for retirement, it’s important to start at the end. In order to work towards a retirement goal, you need to understand what that goal looks like.

Having clarity of what you are trying to accomplish dramatically increases your chances of success.

The Big Picture

Let’s start at a high level…

I like to break life down into three phases:

| Phase | Also Known As | Your Financial Goal(s) |

|---|---|---|

| Pre-Earning | School | Prepare yourself to earn and accumulate |

| Earning | Accumulation | Earn and save (accumulate) |

| Retirement | De-Accumulation | Enjoy yourself 😎 |

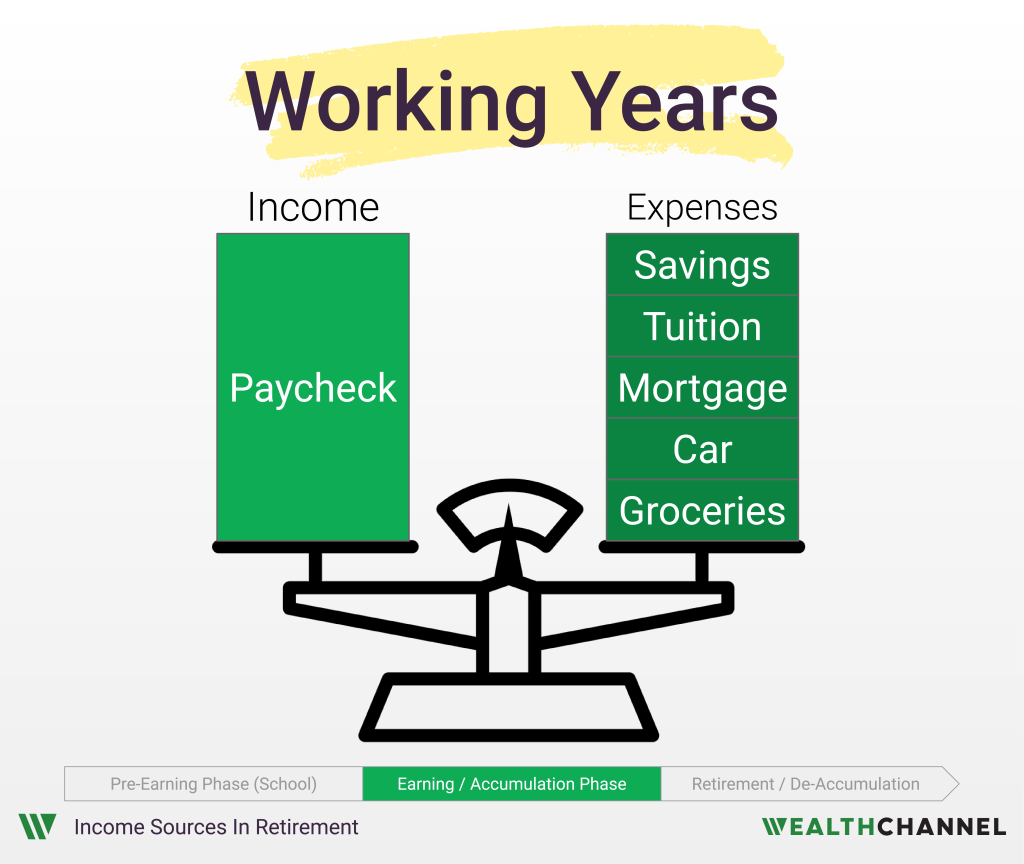

During your working years, or your Accumulation Phase, you have income: money coming in the door in the form of your paycheck.

And you have expenses: money going out the door, for things like mortgage, groceries, clothes – and hopefully setting aside some money each month into savings.

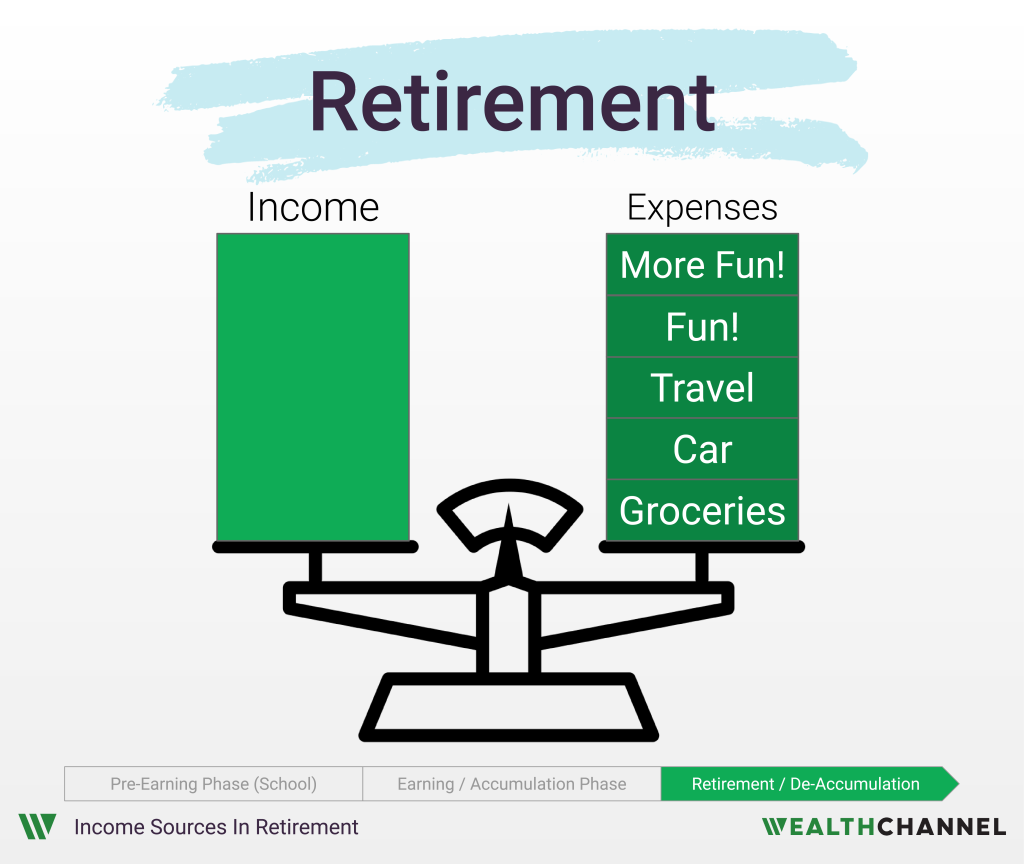

Once you retire, your high level situation… actually stays the same. You’ll still have expenses, though they may be different than they were while working. For one, you won’t be saving for retirement anymore.

And some other expenses may disappear too: you might not spend on commuting expenses or work clothes, for example.

For many people, retirement may coincide with no longer having dependents. In other words, you may no longer need to pay for your kids. Retirement might also coincide with paying off your mortgage, if you’re fortunate.

But you may add some new expenses; you may want to travel more than you did while working, for example. Or you may want to go out to dinner more frequently.

Depending on your ideal retirement lifestyle, you may see your expenses go up or down. If your ideal retirement involves playing pickleball, solving the crossword, and volunteering, you’ll probably have lower expected retirement expenses than someone who wants to travel the world.

Regardless of whether your spending goes up or down, you’ll need to pay for these expenses.

But you won’t have a paycheck. So, essentially, retirement planning is planning for how to replace that paycheck.

Social Security: Fact And Fiction

Social Security is a piece of the puzzle. But it’s not designed to be a complete replacement.

It gets a little bit complex, but in general Social Security is designed to replace about 35% of your income.

Here’s how that happens — at a very high level.

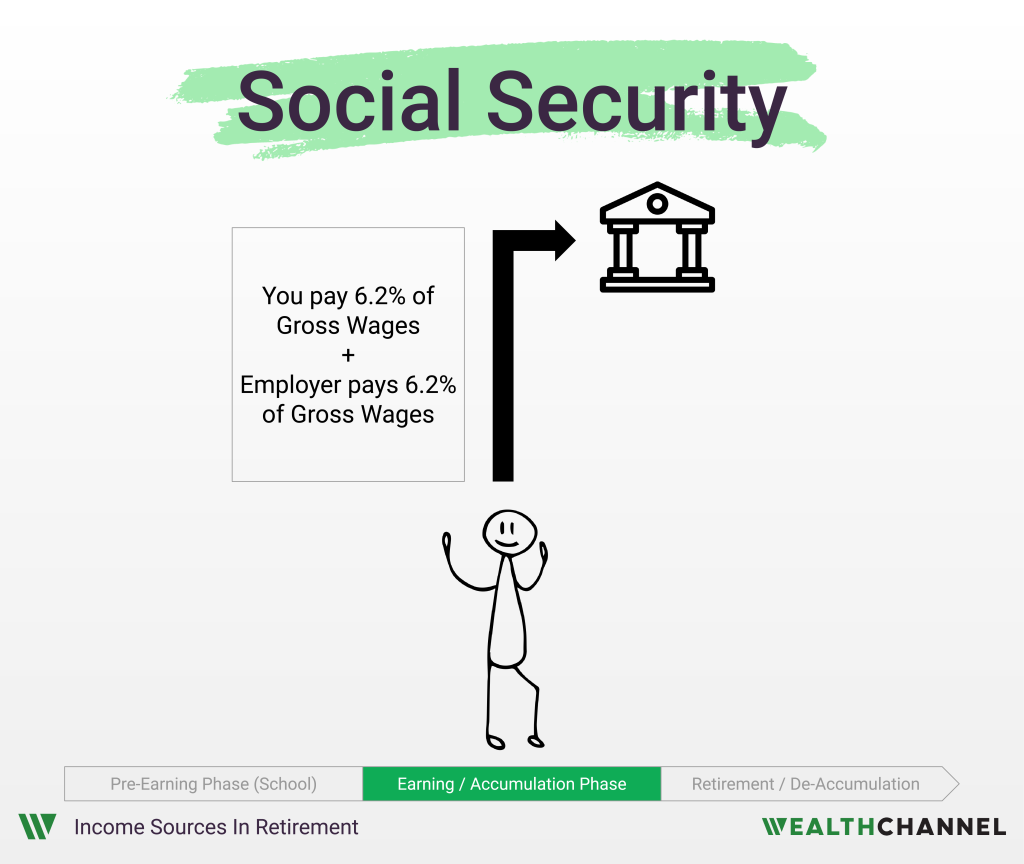

While you’re working, you contribute 6.2% of your gross wages to fund Social Security. You may have seen a line called “FICA” as a deduction on your paystubs.

Your employer matches that contribution (or, if you’re self employed, you match that amount).

Once you hit age 65, the flow of money reverses. You start to receive money from social security.

What you can expect to receive in Social Security depends on how much you paid in, which depends on how much you made. Again, your total contributions – including your employer’s contributions – are about 12.4% of your gross wages.

The benefits calculation is progressive – similar to our tax system – which means that people who made less will have a higher percentage of their salary covered by Social Security in retirement.

If your average salary during your working years was $75,000, adjusted for inflation, Social Security would be about $32,000 annually. That means it would replace about 43% of your income.

If you made twice that – $150,000 annually – Social Security would be about $45,000. That’s a bigger dollar amount, but only about 30% of your income.

| Average Salary | Annual Social Security Benefit | % Of Average Salary |

|---|---|---|

| $50,000 | ~$24,200 | ~48% |

| $75,000 | ~$32,300 | ~43% |

| $100,000 | ~$37,600 | ~38% |

| $125,000 | ~$41,400 | ~33% |

| $150,000 | ~$45,100 | ~30% |

Future guides in this series are going to dive a bit deeper into Social Security, including a more detailed explanation of the benefits calculation, whether there’s a risk of Social Security going away, and a way that you can increase your benefits by waiting a bit longer.

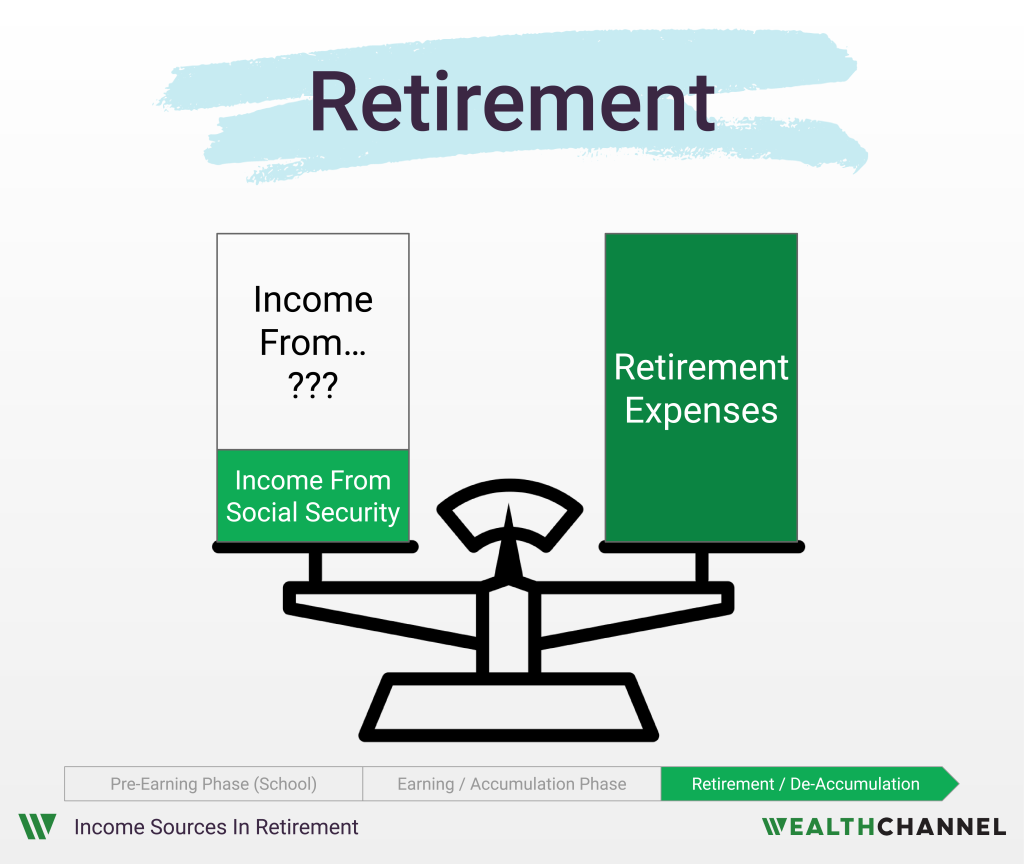

Regardless of the exact percentage, Social Security is one piece of the puzzle. Let’s say that it’s going to account for 35% – again, that percentage might be higher or lower, depending on how long you worked and how much you paid into the system.

So… where will the rest come from?

There are two possible sources.

Some Americans will have a Defined Benefit Pension from their employer. Essentially, a Defined Benefit Pension means that your employer will send you a check each month, even after you stop working.

Unlike Social Security, there’s not a uniform formula for calculating pension benefits – every employer does it a little bit differently. Again, future videos are going to dive into this in a bit more detail, but let’s use an example.

Your employer may structure a pension to provide 2% of your final salary for every year you worked there.

Let’s say you worked for 20 years, and your final salary was $100,000. In this case your pension benefit would be $40,000 annually: 20 years times 2% per year, times your final salary of $100,000.

Again, this is just one example of a hypothetical Defined Benefit pension. Each employer will offer their own version1.

Bad News…

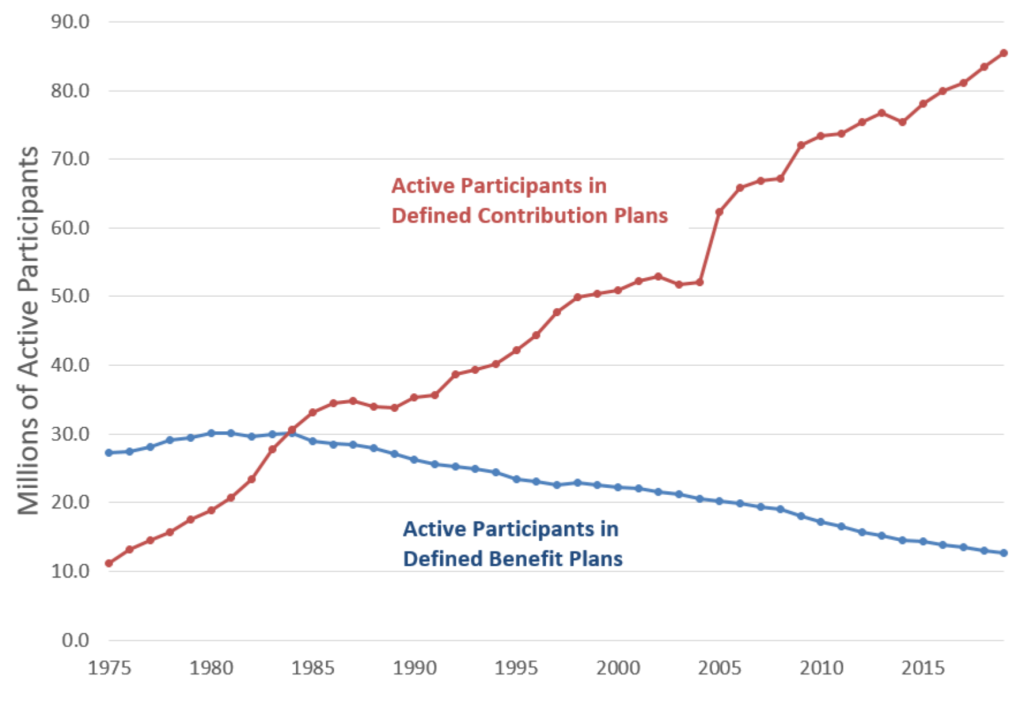

Now, unfortunately, you probably don’t have a Defined Benefit Pension from your employer. These used to be fairly standard, but employers have shifted away from them over the last several decades. Many government employees – including cops, firefighters, teachers, and others2 – still have Defined Benefit Pensions, but most private sector companies have shifted towards so-called Defined Contribution plans instead.

Source: Congressional Research Service

OK, so if Social Security is designed to replace about 35% of your salary and your employer doesn’t offer a pension plan, then how do you replace the rest of your paycheck and cover your anticipated expenses in retirement?

The short answer is: you set aside money during your working years, invest it into assets like stocks and bonds, and accumulate a “nest egg” or retirement portfolio that is going to generate income in retirement.

Now, you’re not entirely on your own here. Your nest egg is not going to be just the sum of the money that you set aside.

In many cases, your employer will also make contributions to your retirement savings. This is typically called a “Defined Contribution” plan, which is the tool that has gradually replaced “Defined Benefit” pension plans.

But, more importantly, your investments are going to grow. The stocks that you buy will pay dividends and the bonds that you buy will pay interest. And you’ll use that money to buy more stocks and more bonds, and it will begin to snowball.

Compound [returns are] the eighth wonder of the world. He who understands it, earns it … he who doesn’t … pays it.

Albert Einstein

As Albert Einstein realized, this is a beautiful thing. It means that you put your money to work, and it grows without any input required from you. It grows while you sleep. And, in many cases, this ends up being the source of most of your nest egg.

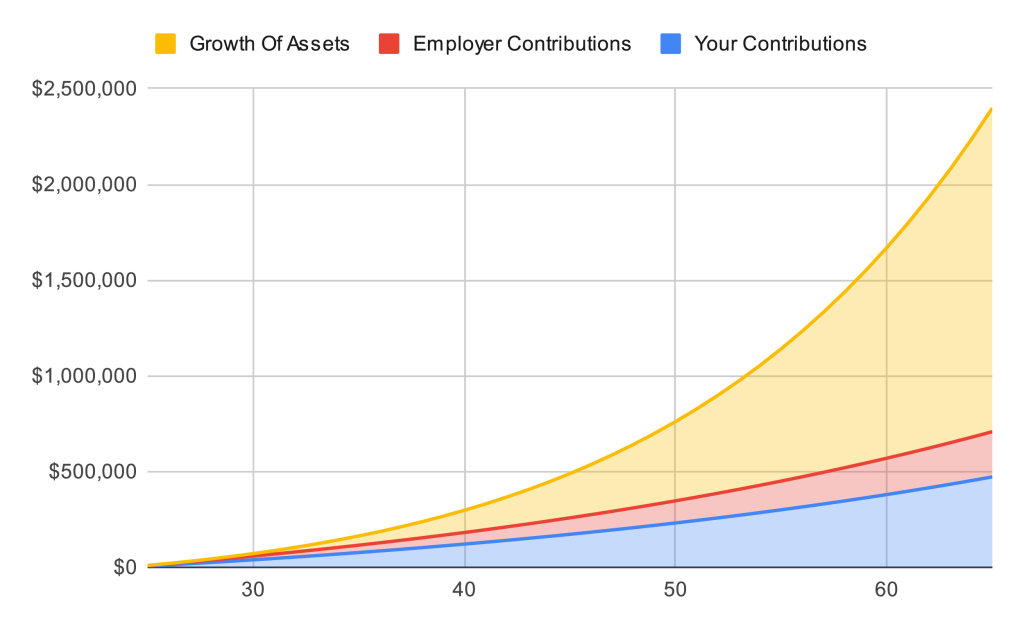

The chart below assumes:

- You start saving $500 a month when you’re 25;

- Your employer contributes $250 a month;

- Your contributions increase 3% a year; and

- You invest those savings in a portfolio that returns a very modest 6% a year.

By the time you’re 65, the “nest egg” has grown to about $2.4 million. You’ve saved about $472k of that, and your employer has contributed about $236k. And the rest – about $1.7 million – has come as a return on this investment.

So, that’s the longer answer: it’s up to you to save and invest in order to accumulate a retirement account3 that is big enough to provide income to replace your paycheck in retirement.

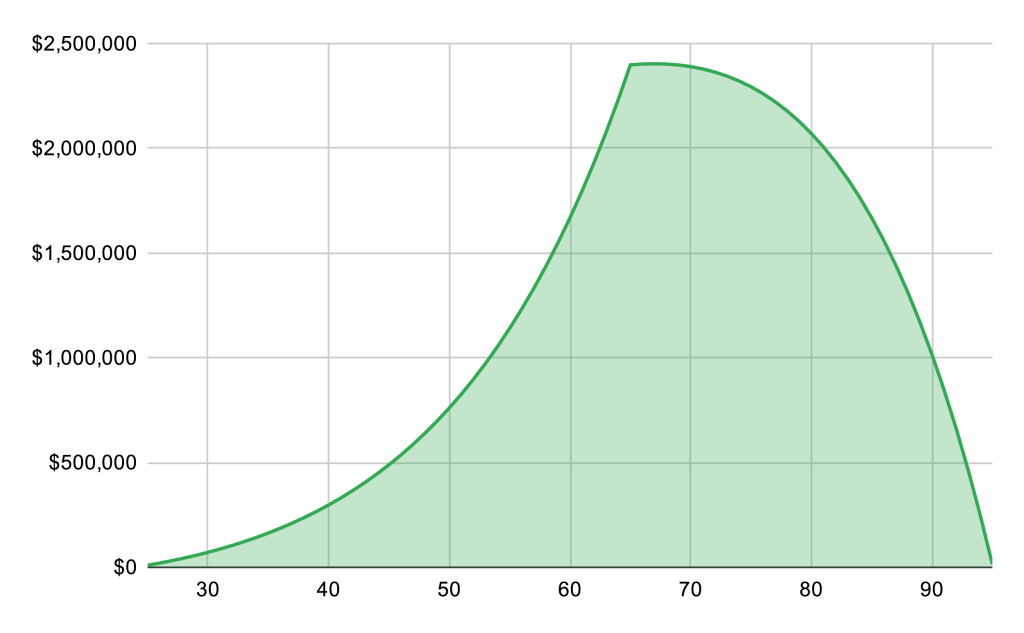

When you retire, you go from “Accumulation Mode” to “De-Accumulation Mode” and start drawing down from this account. And this is what replaces the rest of your paycheck in retirement.

Bottom Line On Retirement Income

The chart above illustrates what you are essentially attempting to accomplish with retirement planning. You need to accumulate a retirement account that is big enough to fund the difference between your Social Security income and your expected expenses.

When you retire, you stop accumulating assets in your retirement accounts, and begin the process of “de-accumulation,” or withdrawing from these accounts to fund your living expenses.

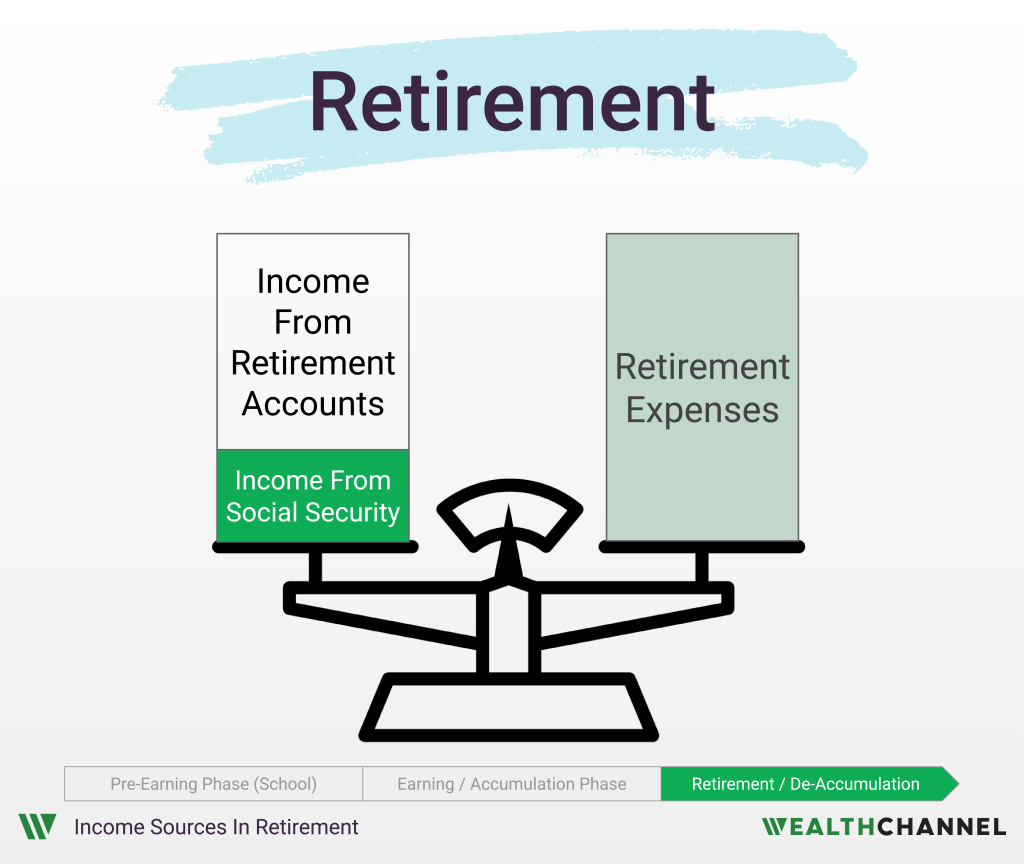

To come back to our scale analogy, here’s what the “balance” between income and expenses will look like for most people in retirement:

So the first thing you need to do is to figure out the right side of the scale: your expenses.

The previous episodes of WealthChannel Academy have covered those, including:

Once you figure out that side of the scale, you can turn to the income side of the scale.

You’ll want to figure out what Social Security will be paying you. Once you know that, you can calculate the gap between that amount and your expenses – and you’ll know what you need to bring to the table. That’s how much income you’ll need your retirement portfolio to provide during retirement.

Once you have a handle on that, you can determine how much you need to save to be confident that your portfolio will be generating enough income for you in retirement.

How An Advisor Can Help

When it comes to retirement planning, a financial advisor can help navigate the various complexities associated with this exercise, including:

- Estimating the amount and timing of Social Security and pension payments;

- Modeling various assumptions for the “de-accumulation” phase;

- Determining whether you’re on track with your “accumulation” objectives; or

- Providing guidance during turbulent market environments.

Notes

- For example, some pension plans will use an average of your three highest years salary. There can also be significant variation around cost of living increases, and benefits to your spouse if you pass away. ↩︎

- Including, in many cases, college football coaches. ↩︎

- You may have more than one account. For example, many Americans will have a 401(k), an IRA – perhaps multiple IRAs, including a Roth IRA. ↩︎

About WealthChannel Academy

This article is part of WealthChannel Academy, the ultimate guide to planning a worry-free retirement.

WealthChannel Academy has a simple premise: to build a $1 million portfolio and enjoy a worry-free retirement, you need to understand just 7 basic concepts. WealthChannel Academy is your guide to simple and effective retirement planning, without the hype.